It seems that Bitcoin (BTC) is knocking on the door of a monster brief squeeze.

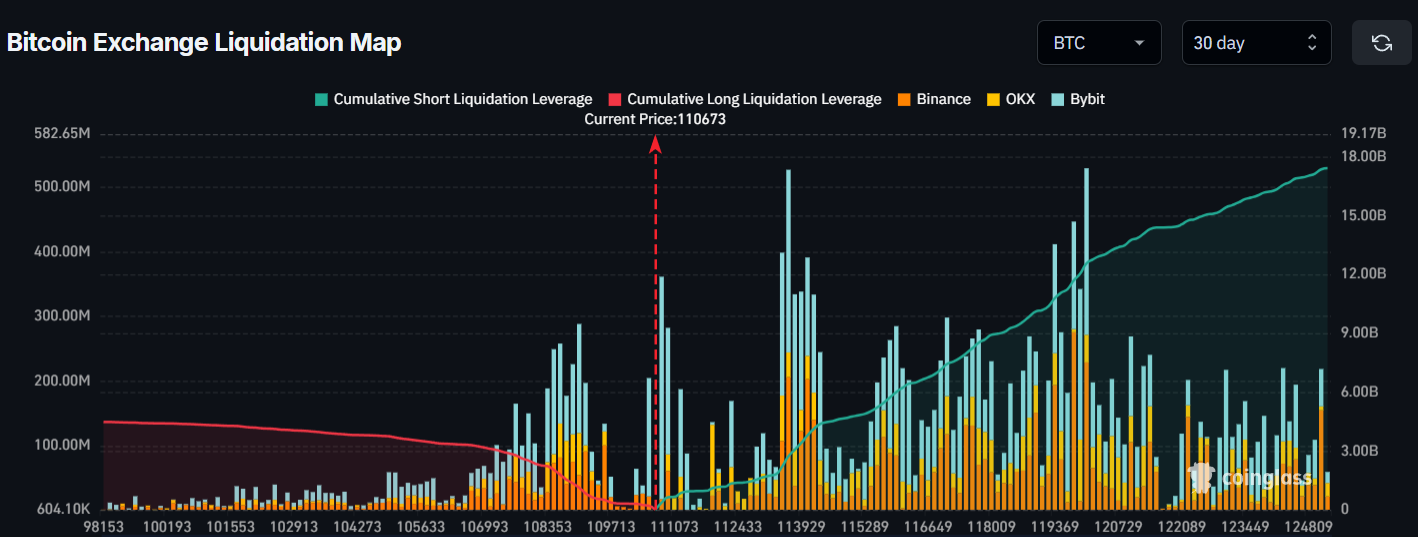

Based on the Bitcoin heatmap, if the asset surges previous $125,000, we may see $17 billion briefly positions liquidated on main exchanges like Binance, Bybit, and OKX, based mostly on Coinglass knowledge retrieved by Finbold on August 29.

On the chart beneath, the rising inexperienced curve on the correct alerts brief liquidation leverage, rising steadily and suggesting mounting strain.

Any transfer additional upward from round $113,000 dangers triggering a cascade of compelled liquidations, trapping late sellers, and propelling the worth greater.

Will Bitcoin rebound?

The world’s largest cryptocurrency slipped at present, buying and selling at $110,673 on the time of writing, and merchants expect additional draw back after failing to carry key assist.

Analyst Michaël van de Poppe famous on Thursday, August 28, that liquidity ranges within the $110,000–$108,000 vary could possibly be examined subsequent if promoting strain continues. The day after, Bitcoin certainly dropped to ranges at round $110,000.

Nonetheless, the analyst additional implied that the correction could be adopted by a rebound:

“If Bitcoin can’t maintain above $112K, we’ll in all probability face a really ugly correction throughout the board. Most likely the ultimate one after which we’re up just for the approaching interval.”

#Bitcoin could not maintain $112K and we proceed to fall.

I believe we’ll be seeing some decrease numbers, which can reset $ETH again to impartial and would supply a large alternative for the markets. pic.twitter.com/iaabrm9J4D

— Michaël van de Poppe (@CryptoMichNL) August 29, 2025

It’s nonetheless exhausting to inform what the close to future holds, however the subsequent few days are shaping as much as be crucial for BTC as buyers at the moment are awaiting the discharge of the Private Consumption Expenditures (PCE) index, the Federal Reserve’s most popular inflation gauge.

The information may closely affect Bitcoin within the following weeks, particularly because of fears that President Donald Trump would possibly push the central financial institution to handle U.S. debt extra aggressively.

Featured picture through Shutterstock