Bitcoin ETFs reversed their two-day shedding run with $241 million in inflows, led by Blackrock’s IBIT. Ether ETFs, nonetheless, continued their outflow streak, shedding $79 million throughout 5 funds.

Bitcoin ETFs Bounce Again as Ether ETFs Mark Third Day of Outflows

After two straight classes of redemptions, bitcoin exchange-traded funds (ETFs) lastly flipped the script midweek. Recent demand lifted the asset class again into inexperienced territory, at the same time as ether ETFs remained caught in a string of outflows.

Bitcoin ETFs recorded $241 million in web inflows, halting the outflow streak. Blackrock’s IBIT carried the majority of the momentum with $128.90 million, adopted by Ark 21Shares’ ARKB at $37.72 million and Constancy’s FBTC at $29.70 million.

Bitwise’s BITB contributed $24.69 million, whereas Grayscale’s Bitcoin Mini Belief added $13.56 million and Vaneck’s HODL chipped in $6.42 million. No outflows have been seen, underscoring the power of the rebound. Complete worth traded reached $2.58 billion, with web property climbing to $149.74 billion.

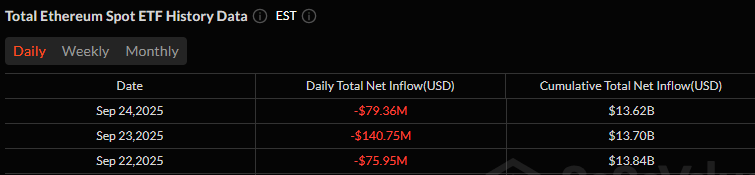

Crimson week to this point for ether ETFs. Will the ultimate two days be completely different? Supply: Sosovalue

Ether ETFs, alternatively, prolonged their losses into a 3rd consecutive session with $79.36 million in outflows. Constancy’s FETH led the purple tide at $33.26 million, whereas Blackrock’s ETHA adopted intently with $26.47 million. Grayscale’s ETHE misplaced $8.91 million, Bitwise’s ETHW slipped $4.48 million, and 21Shares’ TETH rounded off with $6.24 million in exits. Complete worth traded stood at $971.79 million, with web property holding at $27.42 billion.

The sharp divergence underscores a break up in investor sentiment, with bitcoin ETFs regaining traction simply as ether ETFs wrestle to seek out regular floor. The subsequent few days may show decisive in figuring out whether or not bitcoin’s rebound good points momentum or ether stays weighed down by persistent promoting stress.