September witnessed a wave of listings throughout main crypto exchanges. From Coinbase within the US to exchanges in South Korea, new itemizing bulletins have been made nearly day-after-day. On this context, some altcoins recorded sturdy accumulation indicators after going reside.

These indicators seem in two key areas: a decline in alternate reserves and an increase in reserves held by prime wallets. This development is very notable through the sharp market correction within the ultimate week of September.

1. Avantis (AVNT)

Avantis (AVNT), the utility and governance token of the perps DEX Avantis, was listed concurrently on Binance, Upbit, and Bithumb in September. This gave AVNT ample liquidity, with each day buying and selling quantity persistently exceeding $1 billion.

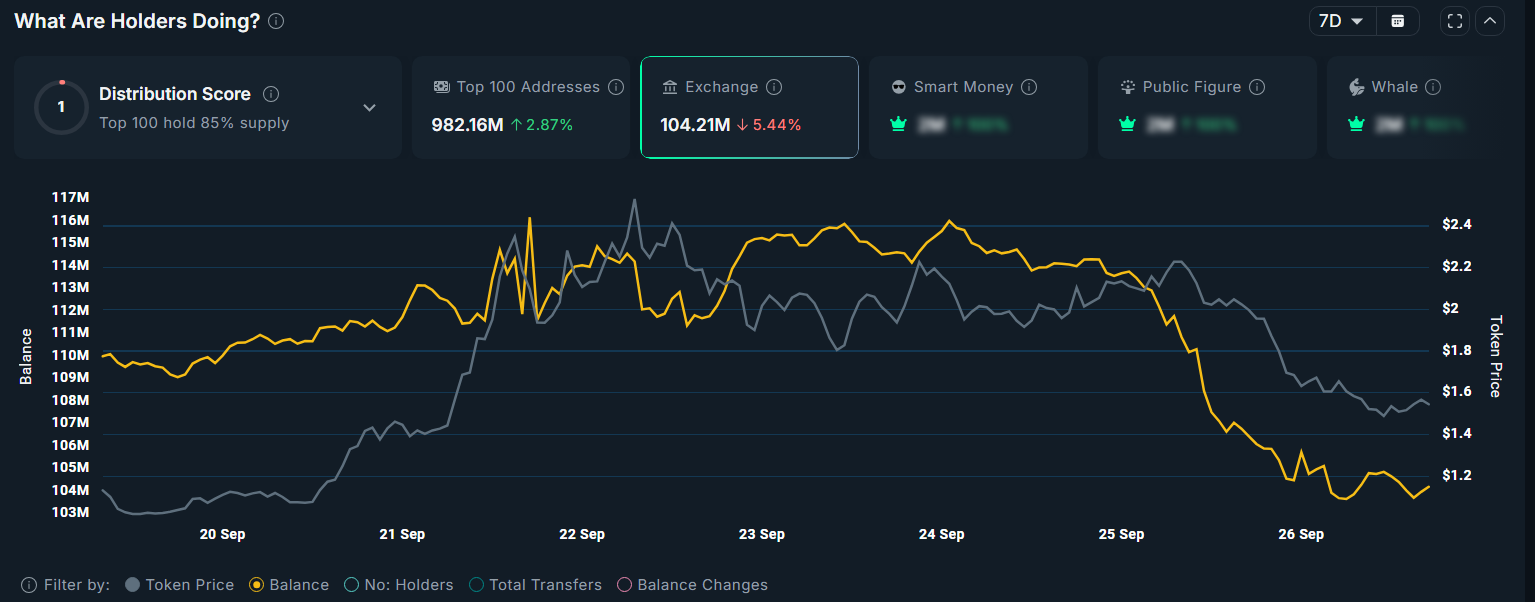

AVNT Exchanges Reserve. Supply: Nansen.

Nansen knowledge exhibits that AVNT’s alternate reserves fell greater than 5.4% within the final week of September, dropping from over 106 million to just about 104 million. On the similar time, the reserves of the highest 100 wallets rose by 2.87%.

For a lot of merchants, AVNT’s worth drop in late September seemed like a chance to purchase and accumulate.

Avantis at the moment advantages from heightened investor curiosity in perps DEX tokens, which surged all through September. Buyers typically search out newly launched tokens throughout rising traits, hoping to maximise earnings.

“Not too long ago, just a few pals round me made a number of million by means of Binance’s new tokens AVNT and ASTER. Why is the wealth impact so sturdy? On one hand, HYPE’s sturdy efficiency available in the market has raised everybody’s expectations. In any case, folks like to rank opponents in the identical sector as 1, 2, 3. In the meantime, the on-chain derivatives market remains to be in its early stage,” one dealer on X stated.

2. Popcat (POPCAT)

Popcat (POPCAT), a meme token on Solana, was first listed on Binance Alpha in April. In September, Bithumb additionally listed the token, elevating expectations that it might quickly safe a spot itemizing on Binance.

Regardless of itemizing information, the token hit a brand new low since April, dropping to $0.21 after a decline of greater than 30% in September.

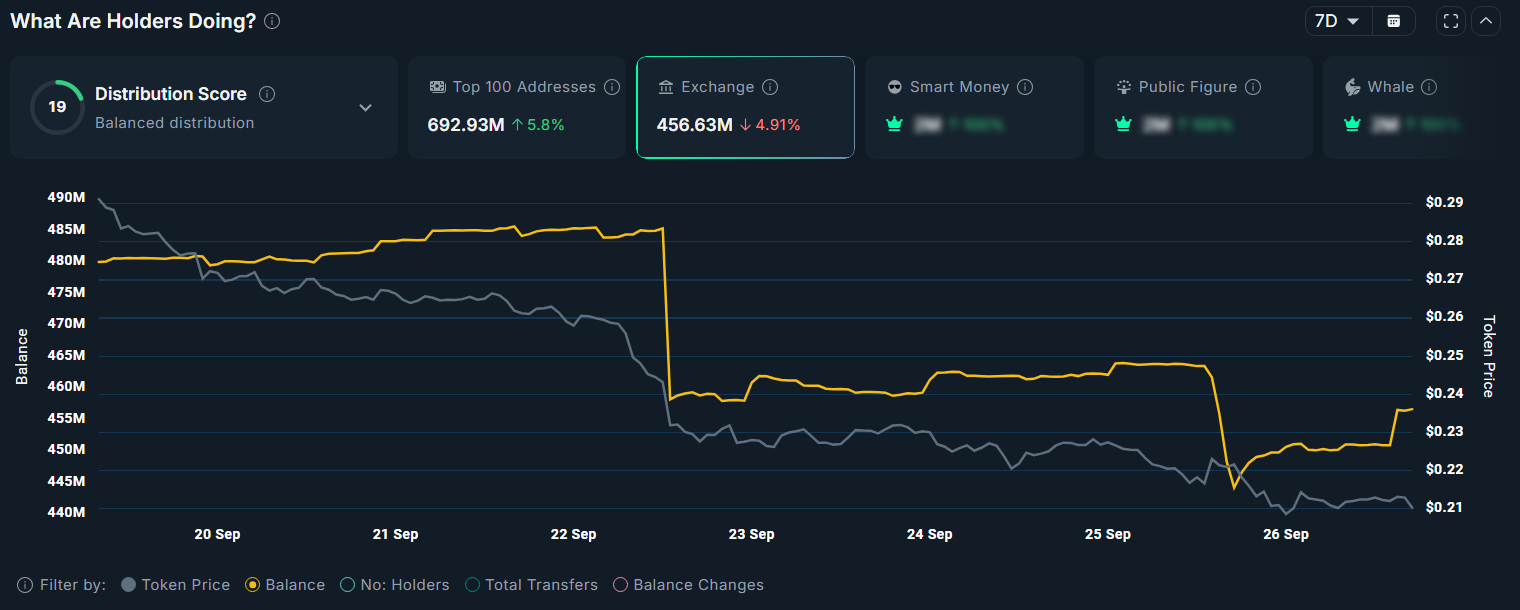

POPCAT Exchanges Reserve. Supply: Nansen.

Even with the downturn, knowledge exhibits POPCAT’s alternate reserves fell 4.9% final week, from over 485 million to simply above 456 million. In the meantime, prime whale wallets elevated their holdings by 5.8% over the identical interval. This implies accumulation as traders purchased the dip.

“21 cent popcat is a max alternative zone. Right now, one of many largest Korean exchanges listed it. It’s a absolutely community-owned token with no central entity. No one paid for Bithumb. The alternate actually stated, ‘This can be a good token.’ It gathered and was then listed. Count on any such habits to proceed,” investor Alfie stated.

Different traders seen that Binance wallets despatched 16 million POPCAT to a completely new handle. That handle later interacted with main exchanges Bithumb and Bybit, suggesting rising buying and selling exercise.

This raised hopes that the token may quickly see massive transactions fueling upward momentum.

3. Troll (TROLL)

This week, Coinbase introduced the itemizing of TROLL, giving the meme token entry to U.S. traders and increasing liquidity. After the itemizing, CoinMarketCap reported that Coinbase accounted for greater than 24% of TROLL’s each day buying and selling quantity.

TROLL can also be included within the Binance Alpha program. Coinbase’s itemizing has fueled investor hopes that Binance might quickly add TROLL to its spot listings.

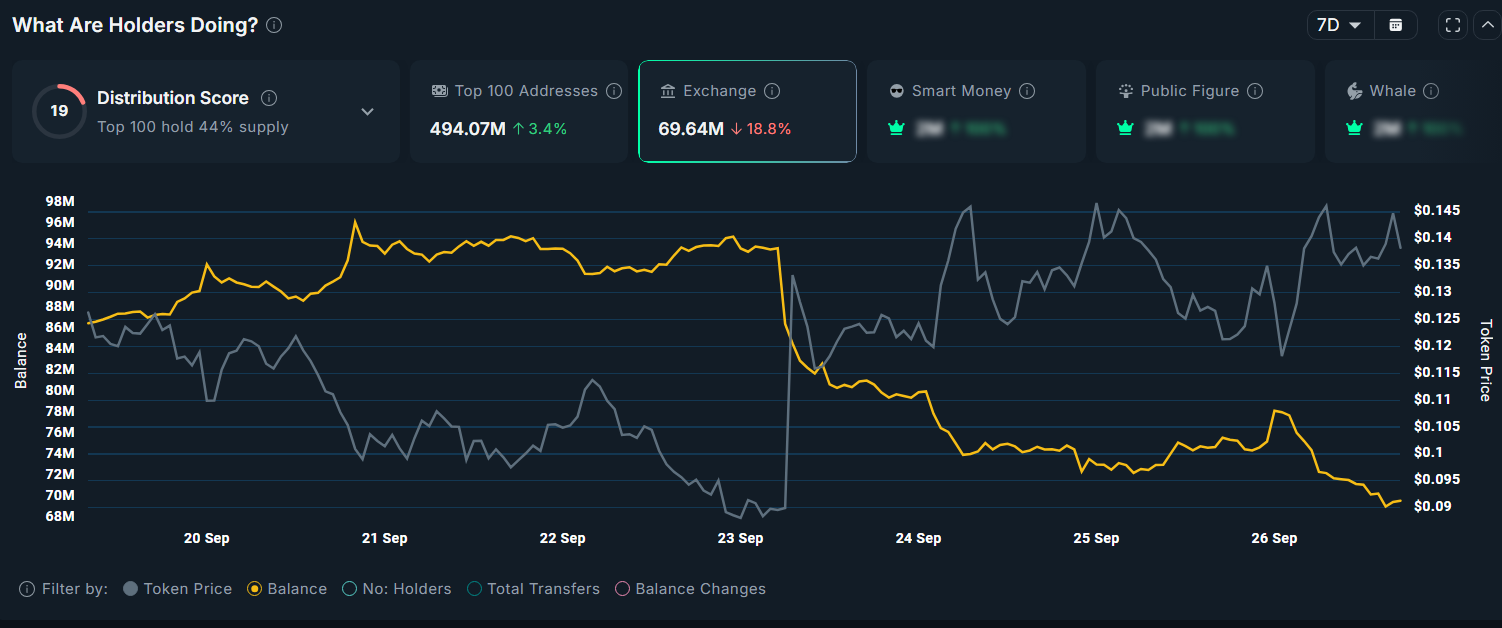

TROLL Exchanges Reserve. Supply: Nansen.

Within the brief time period, Nansen knowledge exhibits TROLL’s alternate reserves dropped 18.8% this week, whereas prime whale wallets elevated their holdings by 3.4%. On-chain actions level to energetic accumulation as traders look forward to the following catalyst.

Group engagement knowledge additionally highlights rising consideration to TROLL. Stalkchain reported that previously 30 days, the $TROLL neighborhood created about 304,000 posts on X.

Within the final 30 days, the $TROLL neighborhood has made round 304K posts on X

That may be a sturdy indicator of neighborhood exercise and a focus. pic.twitter.com/GTY2idv5wJ

— Stalkchain (@StalkHQ) September 26, 2025

As a meme token, consideration is important. The rising highlight on TROLL suggests a probably optimistic state of affairs.

These three altcoins spotlight a transparent development in late September: traders are gravitating towards newly listed tokens and positioning themselves in rising narratives similar to perps DEX.

The put up 3 Newly Listed Altcoins Merchants Are Shopping for Throughout Market Correction appeared first on BeInCrypto.