- Over $380 million in Ethereum has flowed out of exchanges prior to now week.

- Massive ETH holders have elevated their positions, reversing a long-term downtrend in pockets focus.

- On-chain knowledge suggests rising investor confidence regardless of subdued buying and selling volumes and ongoing market warning.

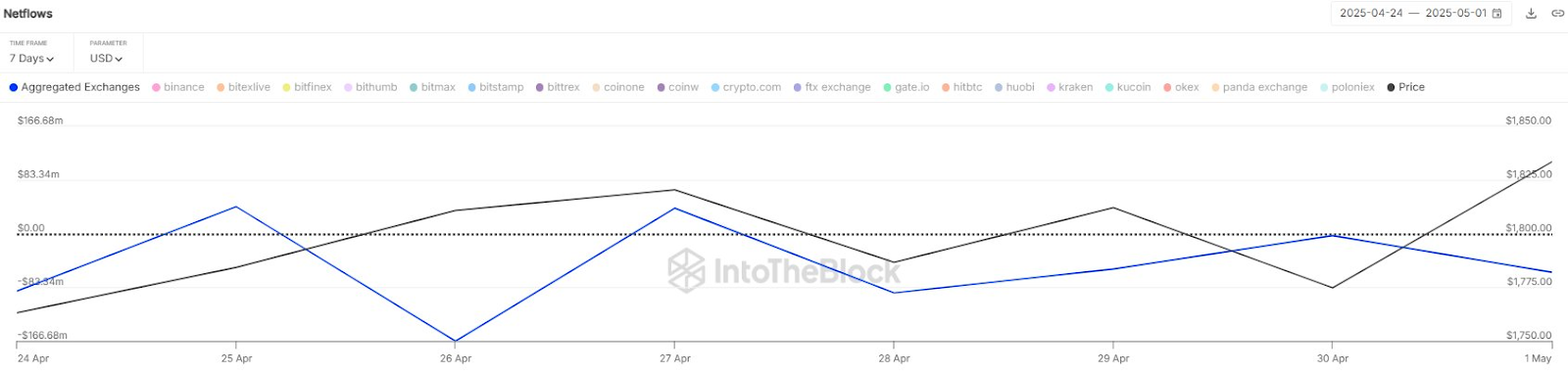

Ethereum (ETH) continues to circulate out of centralized exchanges at a major price. Over the previous seven days alone, internet outflows surpassed $380 million, in line with blockchain analytics agency IntoTheBlock.

This discount in exchange-held ETH displays rising investor accumulation into self-custody and will level to a tightening provide narrative that has traditionally preceded worth rallies.

ETH Accumulation Persists Regardless of Value Volatility

Information exhibits Ethereum’s internet flows from exchanges had been constantly damaging between April 24 and Could 1, with a very massive outflow recorded on April 26. This habits means that traders took benefit of short-term worth dips to purchase and withdraw ETH into self-custody.

Regardless of worth fluctuations through the week, ETH ended the interval on a optimistic observe, climbing again above $1,840. Analysts interpret sustained trade outflows as a bullish signal as lowered provide on exchanges lowers the chance of promote strain and will create the circumstances for a breakout if demand will increase.

On-Chain Information Reveals Whale Accumulation, Regular Exercise

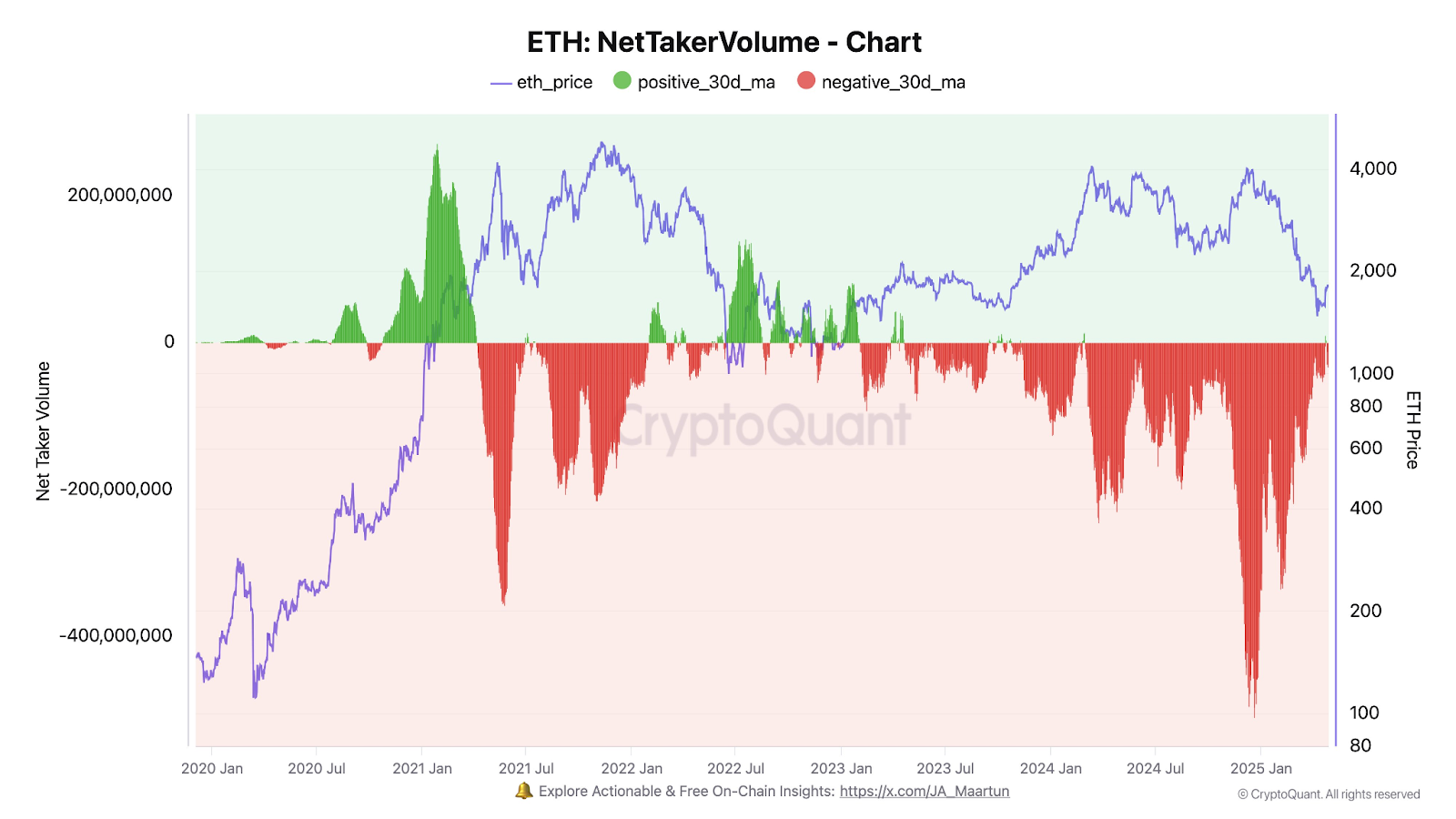

This outflow pattern helps the broader narrative that Ethereum could possibly be establishing for a serious rebound after massively underperforming Bitcoin this cycle. Current knowledge from CryptoQuant exhibits that the distribution of Ethereum provide by pockets dimension signifies that the biggest holders are both sustaining their positions or persevering with to build up.

CryptoQuant analyst Darkost highlighted that wallets holding greater than 100,000 ETH have grown by roughly 3% since August 2024. He sees this as an indication of “good cash” positioning. He famous that since 2020, the proportion of ETH held by massive wallets had step by step decreased, however that pattern now seems to be reversing.

Extra Bullish On-Chain Information Pointing to a Probably Rally for Ethereum

Darkost additionally famous that the variety of energetic addresses has remained regular regardless of ETH’s worth decline. He noticed appreciable promoting strain within the derivatives market, although this can be easing. Notably, Web Taker Quantity turned optimistic on April 23 and 24, which might sign the start of a bottoming course of if the pattern continues.

Darkost confused that these metrics run counter to the “Ethereum is lifeless” narrative. Basically, regardless of ETH presently buying and selling about 62% beneath its 2021 all-time excessive, on-chain knowledge factors to enduring power and strategic accumulation.

The right way to Strategy ETH

Darkost concluded that whereas some encouraging long-term alerts exist, on-chain knowledge nonetheless displays a lingering sense of pessimism round ETH. He additionally famous that open curiosity has dropped considerably and that buying and selling volumes stay subdued, each of which underscore the cautious market sentiment.

In his view, essentially the most prudent method proper now could also be to attend for a transparent invalidation of the bearish pattern or, at most, to have interaction in a light-weight dollar-cost averaging (DCA) technique.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be answerable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.