Ethereum is at the moment buying and selling round crucial value ranges because the market shifts into a brand new part. The momentum that propelled ETH increased earlier this 12 months has began to fade, with the asset now getting into a consolidation interval. Whereas some altcoins have managed to publish modest positive factors and Bitcoin continues to commerce sideways, Ethereum’s value motion displays a cooling pattern as merchants watch for readability on the following decisive transfer.

Regardless of this pause in momentum, institutional demand for ETH stays sturdy. Recent information reveals that enormous gamers proceed to build up Ethereum, even amid volatility and broader market uncertainty. This persistent influx of institutional capital highlights confidence in Ethereum’s long-term position because the main good contract platform, with its deep DeFi, NFT, and layer-2 ecosystems persevering with to draw adoption.

Nonetheless, Ethereum’s short-term path is closely influenced by macroeconomic forces. Weakening US labor information and uncertainty surrounding the Federal Reserve’s rate of interest coverage proceed to form threat sentiment throughout monetary markets. Whereas the Fed’s eventual pivot to price cuts would assist liquidity and threat property, the timing stays unclear, preserving volatility elevated. For Ethereum, this mixture of sturdy institutional demand and unsure macro headwinds defines the tense equilibrium that at the moment grips the market.

Establishments Sign Confidence In Ethereum

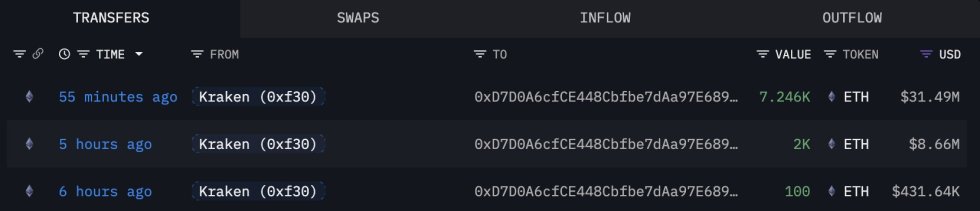

In accordance with information from Lookonchain, 4 newly created wallets withdrew a mixed 78,229 ETH—value roughly $342 million—from Kraken in simply the previous 10 hours. Such large-scale withdrawals are usually interpreted as indicators of long-term holding intentions, since establishments and whales typically transfer funds off exchanges for custody or strategic allocation.

This exercise marks a major shift in comparison with the primary half of the 12 months, when Ethereum and the broader altcoin market had been below heavy stress. Again then, aggressive corrections swept by the sector, wiping out speculative positive factors and forcing many short-term contributors out of their positions. Sentiment was dominated by warning, and ETH struggled to take care of momentum as liquidity drained from altcoins.

The panorama immediately seems to be very totally different. Ethereum has not solely recovered from these drawdowns however has additionally surged to new all-time highs, reaffirming its dominance within the good contract area. Altcoins, too, are benefiting from renewed confidence, with capital rotation supporting recent rallies throughout the market.

Institutional flows like these spotlight a deeper conviction that Ethereum stays a cornerstone of the crypto ecosystem. As ETH consolidates at increased ranges, continued accumulation by massive gamers means that the muse for additional upside stays sturdy, even amid lingering macro uncertainty.

ETH Holds Tight Vary

Ethereum is at the moment buying and selling at $4,436, exhibiting indicators of power after consolidating in a good vary close to $4,300 for a number of days. The 4-hour chart signifies ETH is trying to push increased, testing overhead resistance ranges as bulls attempt to regain momentum. The 50 SMA at $4,338 and the 100 SMA at $4,388 have acted as short-term assist, with value now buying and selling simply above them—an encouraging signal for consumers.

The subsequent key resistance is the 200 SMA at $4,416, which ETH is at the moment urgent in opposition to. A transparent breakout and consolidation above this degree might open the door for a retest of $4,600, with the potential to increase towards $4,800 if momentum builds.

On the draw back, assist stays well-defined. The $4,300 zone has held a number of occasions, and with the 50 and 100 SMAs aligned there, it gives a strong cushion for bulls. A breakdown under this space might invite renewed promoting stress, dragging ETH again towards $4,200 and even $4,100.

Ethereum seems to be within the early phases of a possible restoration. Holding above the $4,400 area and breaking previous the 200 SMA would strengthen the bullish outlook, whereas failure right here might imply extra consolidation earlier than any decisive transfer.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.