Steven Pu, co-founder of layer-1 blockchain Taraxa, launched a report on Feb. 24 highlighting a major hole between claimed and precise blockchain efficiency.

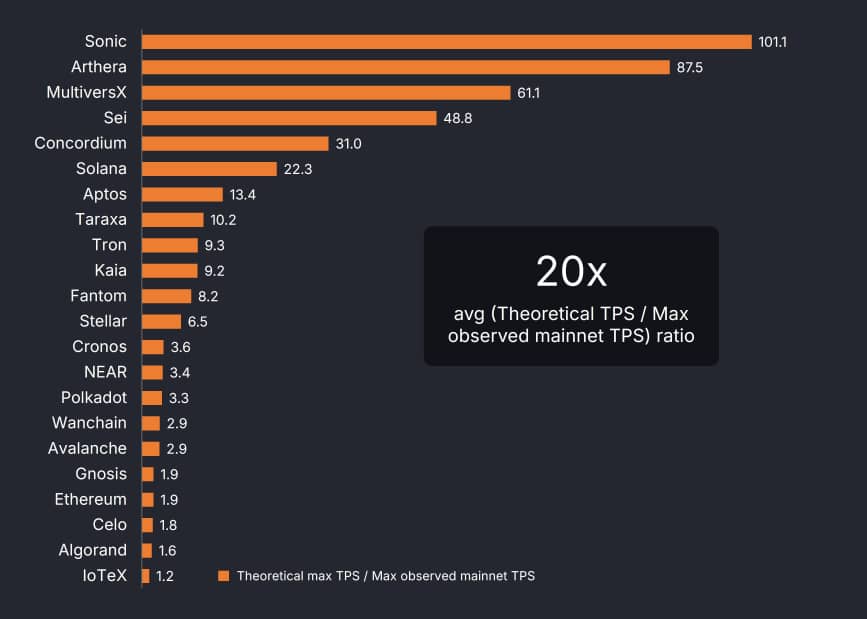

Analyzing 22 networks utilizing knowledge from Chainspect, the research discovered that theoretical transactions per second (TPS) are overstated by a mean of 20 occasions in comparison with real-world outcomes. In keeping with the findings, this discrepancy stems from lab-based metrics that fail to carry up on reside mainnets.

The report introduces a brand new metric: TPS per greenback spent on a validator node (TPS/$), aiming to measure cost-efficiency fairly than simply uncooked velocity. Throughout the 22 chains, theoretical TPS averaged 20 occasions larger than noticed mainnet efficiency, with solely 4 networks attaining double-digit TPS/$ ratios.

Pu argues this reveals many blockchains require pricey {hardware} for modest transaction charges, difficult claims of scalability and decentralization.

“We should always all follow clear, verifiable, on-chain efficiency metrics,” per the research.

Supply: Chainspect

You may additionally like: Base’s TPS declare could also be inflated by counting failed transactions

Blockchain scalability questioned

Pu’s findings counsel the trade’s deal with excessive TPS misleads stakeholders. Bitcoin (BTC) and Ethereum (ETH), for instance, prioritize safety over velocity, whereas newer chains tout huge numbers that hardly ever materialize. The TPS/$ metric might shift how builders assess networks for sensible use instances like funds or provide chain monitoring. The report states that,

Max noticed mainnet TPS for included networks, throughout a 100-block window (tx/s)

It’s price noting that Chainspect particularly excludes transactions that will unfairly inflate this Max TPS metric, comparable to voting transactions

Taraxa pushes for transparency

Taraxa, a proof-of-stake layer-1 centered on audit logging, frames this as a wake-up name. Pu, a Stanford-educated entrepreneur, urges reliance on verifiable mainnet knowledge over whitepaper hype.

This comes because the crypto house grapples with adoption hurdles. Inflated statistics might distort funding and growth selections, notably in decentralized finance and provide chain use instances that demand dependable efficiency. Pu means that cost-efficiency metrics like TPS/$ might redefine how blockchain sustainability is evaluated, shifting focus towards networks that ship sensible worth fairly than simply excessive theoretical speeds.

You may additionally like: What’s layer-1 blockchain? Blockchain layers defined