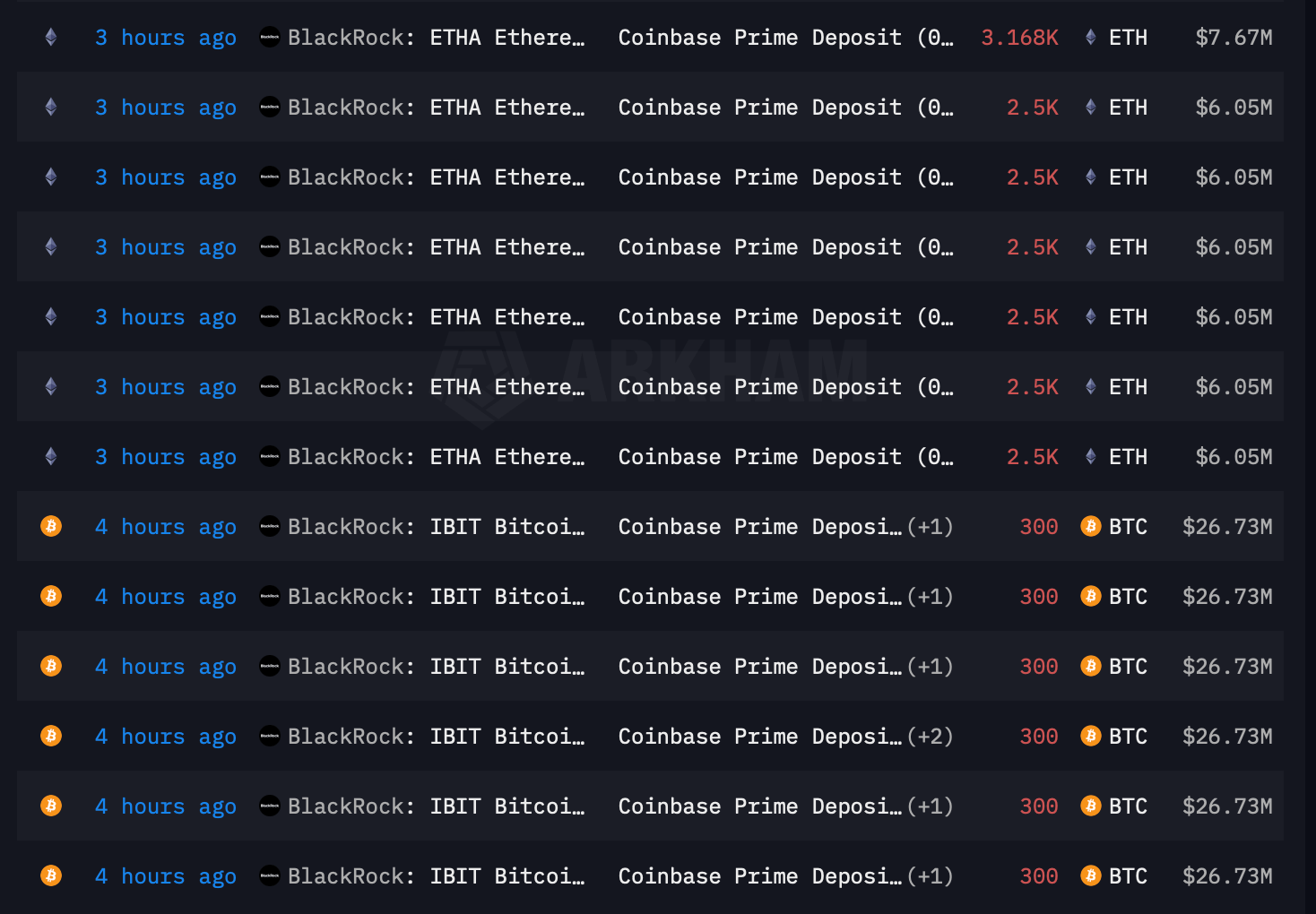

Blackrock has transferred about 18,168 ether and 1,800 bitcoin, price round $44 million and $160 million, to the centralized crypto platform Coinbase.

Blackrock’s Digital Asset Technique and Rebalancing within the Highlight

Onchain observers famous that the transfers occurred inside a brief window, indicating that the monetary large Blackrock is actively transferring its digital asset holdings. In complete, the estimated mixed worth stands round $204 million, signaling a robust presence within the cryptocurrency sector.

After all, Blackrock has not issued a proper assertion on its intentions, leaving analysts to invest on whether or not it goals to redistribute, promote, rebalance, or merely custody these belongings. The belongings are seemingly tied to its two spot crypto exchange-traded funds (ETFs) Market observers additionally observe that market circumstances and institutional participation might form the agency’s subsequent strikes.

Blackrock’s IBIT and ETHA funds transferring cash to Coinbase Prime, in accordance with information collected from Arkham Intelligence.

Merchants and crypto fans have flooded social media with theories on the transaction’s significance. Some view it as routine portfolio balancing, whereas others consider it might foreshadow a bigger market shift as conventional finance deepens its involvement in digital belongings.

The ETH and BTC shifts have been a topical dialogue on X alongside the broader crypto market rout that ensued following Trump’s tariff threats. Though it has issued no formal bulletins, and is probably going disinclined to take action, Blackrock is presumably recalibrating the holdings of its two managed spot crypto ETFs.