Ethereum (ETH), the second-largest cryptocurrency by market cap, is below intense stress as recent bearish headlines ripple by way of the crypto world. A serious institutional sell-off reportedly triggered by new U.S. regulatory threats—paired with stagnating Ethereum ETF progress—has sparked panic throughout exchanges. Whales are unloading, retail is backing out, and analysts at the moment are daring to ask: might Ethereum value really crash to $600?

With ETH value at present hovering round $1,810, all eyes are on whether or not the help zone will give approach. To evaluate the actual danger, we turned to the charts—each each day and hourly—and the alerts are sobering.

Ethereum Worth Prediction: Is the Day by day Chart Flashing a Breakdown Warning?

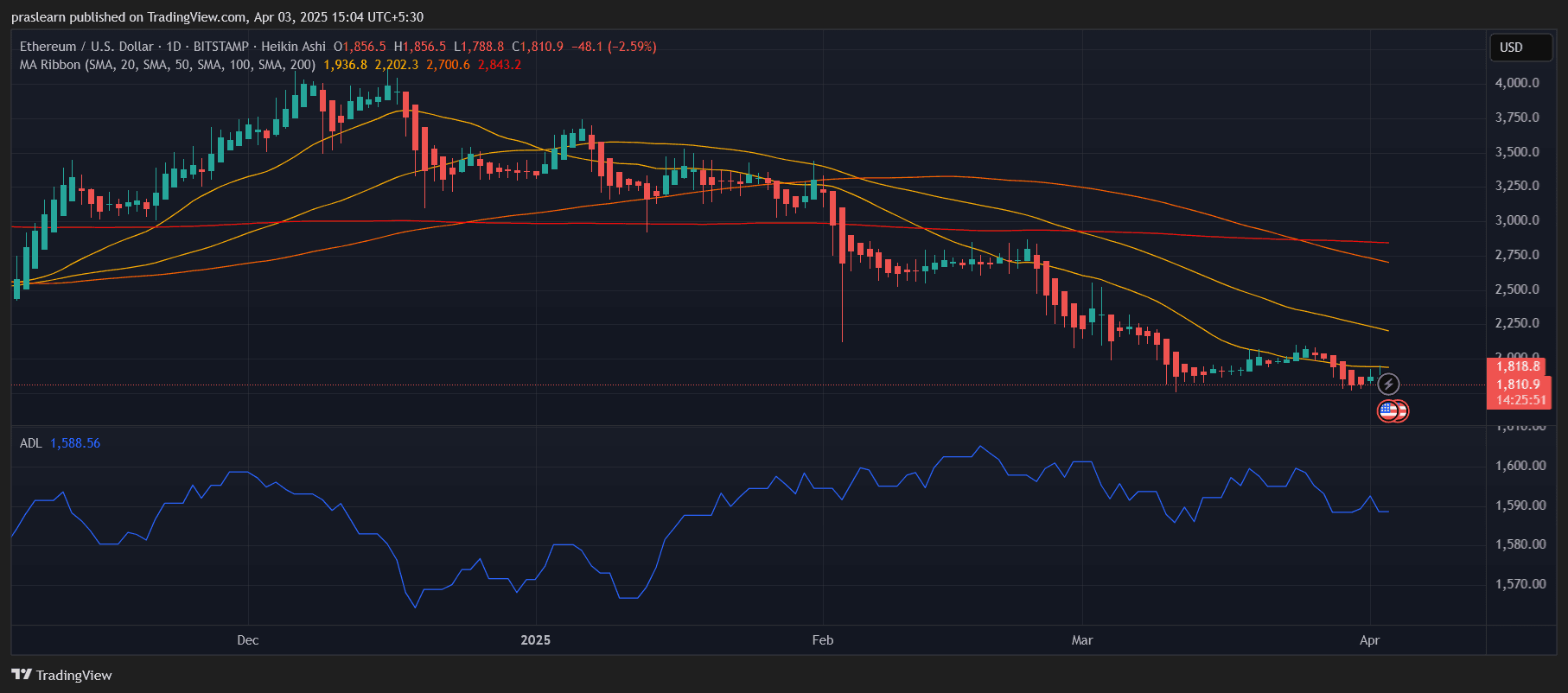

ETH/USD Day by day Chart: TradingView

The each day Ethereum chart paints a stark image. ETH value has been in a well-defined downtrend since mid-March, with constant decrease highs and decrease lows. The Heikin Ashi candles present growing bearish momentum over the previous week. Extra worryingly, the worth is buying and selling nicely beneath all main shifting averages—the 20, 50, 100, and 200-day SMAs.

The MA ribbon is clearly fanned out in bearish formation, with the 20 SMA (~$1,936) sitting far above the present value, indicating sustained promoting stress. ETH’s repeated rejections close to the 20-day shifting common present that bulls are utterly overpowered at this degree.

The Accumulation/Distribution Line (ADL) at ~1,588 continues to say no, signaling that cash is flowing out of ETH quite than into it. This provides additional affirmation that the broader market is de-risking Ethereum quite than making ready for a bounce.

The ultimate each day help zone seems to be close to $1,750. If this cracks, the subsequent psychological help could be round $1,500, with the actual panic zone mendacity close to $600, final seen in the course of the 2022 bear cycle. The chart at present gives no bullish reversal indicators.

Does the Hourly Chart Trace at a Brief-Time period Rebound or Extra Draw back?

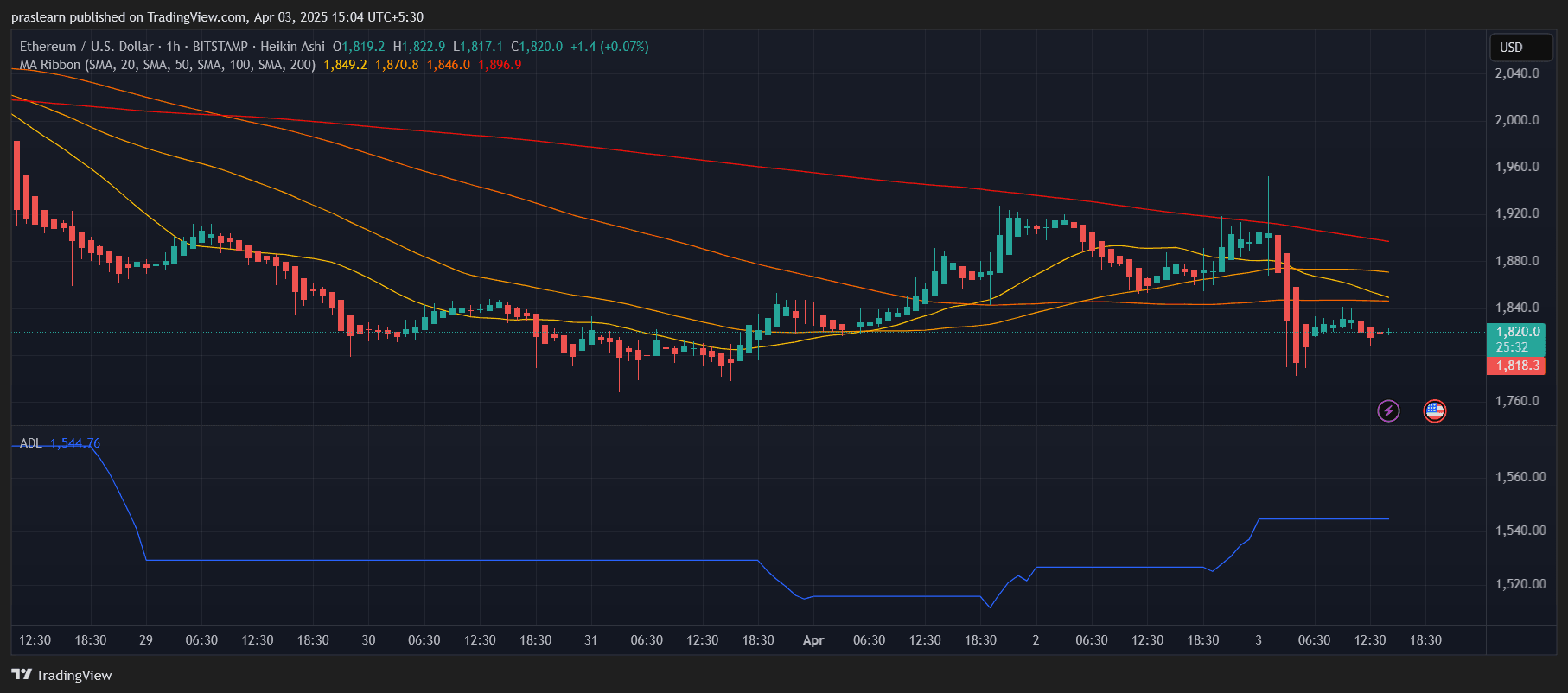

ETH/USD Hourly Chart- TradingView

Zooming into the hourly chart, Ethereum tried a modest bounce above $1,870, however it was brutally rejected from the descending resistance trendline—seen simply beneath the 200-hour SMA (~$1,896). The MA ribbon additionally clearly aligns in bearish formation, and the current value dip pushed ETH again beneath all short-term shifting averages.

Whereas there was a momentary uptick in bullish momentum, the current crimson Heikin Ashi candles present that sellers are nonetheless aggressively defending $1,850 and above. The hourly ADL round 1,544 suggests short-term accumulation makes an attempt failed to achieve traction, which once more weakens the bull case.

Until ETH value breaks and holds above the 200 SMA on the hourly chart, there’s no bullish construction to belief. The shortcoming to carry even short-term positive factors underscores a deeper exhaustion amongst consumers.

What Are the Key Indicators Saying?

- Transferring Averages (Day by day + Hourly): All stacked in bearish alignment. ETH value is buying and selling beneath each key SMA, displaying clear downward pattern continuation.

- Heikin Ashi Candles: Predominantly crimson, particularly on the each day chart, indicating no let-up in bearish stress.

- Accumulation/Distribution Line (ADL): Constantly falling, signaling cash outflows and institutional exit.

- Quantity (implied): Although in a roundabout way proven, the constant value suppression beneath shifting averages implies low shopping for curiosity even at discounted costs.

These indicators collectively level towards a continuation of the bearish pattern, except sturdy catalyst information or whale help flips the sentiment.

May Ethereum Worth Actually Crash to $600?

It’s a surprising chance, however not off the desk. Whereas $600 could sound excessive, it is rooted in technical historical past—Ethereum value hovered close to that zone in the course of the brutal 2022 bear market. If ETH breaks beneath the $1,750 and $1,500 zones with excessive quantity, a capitulation occasion may very well be triggered.

Given the current geopolitical and financial shake-up, the potential for Ethereum value crashing to $600 is now not simply fear-mongering it’s a situation that’s beginning to acquire credibility. President Donald Trump’s announcement of sweeping tariffs has despatched shockwaves by way of monetary markets, triggering a sell-off throughout each conventional and digital belongings. Bitcoin, which briefly climbed above $88,000, swiftly reversed and fell again to the $82,000 vary, displaying how delicate the market is to political developments. Ethereum, being carefully tied to Bitcoin’s value actions, is now in a weak place.

If Bitcoin continues to fall below stress from Trump’s tariff-driven financial instability, Ethereum value might comply with swimsuit and break by way of key help ranges. A steep drop to $600, although excessive, may very well be triggered by panic promoting and a broader lack of investor confidence—particularly if macro uncertainty continues to escalate.

On the flip facet, ETH remains to be the bedrock of DeFi, NFTs, and the vast majority of blockchain dApps. A $600 value would probably appeal to aggressive institutional re-accumulation, however that wouldn’t occur with out large fear-driven promoting first.

Ethereum Worth Prediction: Breakdown Earlier than Breakout?

Based mostly on each charts and on-chain alerts, ETH value is teetering on the sting of a significant help collapse. Until ETH can reclaim and shut above the $2,000 degree quickly, the pattern stays decisively bearish. The $1,750 help zone is the final line of protection. If it breaks, Ethereum might begin sliding towards the $1,500 vary quick—and from there, a capitulation wick to $600 is not simply doom-talk—it turns into a statistical likelihood.