GRVT co-founder Hong Yea left behind a rising govt profession at Goldman Sachs to launch a hybrid crypto change because the market collapsed.

4 months after the mainnet, it has processed over $5 billion in quantity. Yea tells BeInCrypto how his Wall Avenue roots helped engineer a decentralized buying and selling powerhouse.

A Leap of Conviction in a Market on Fireplace

When Hong Yea left a decade-long profession at Goldman Sachs, the place he had risen to govt director, crypto markets have been in freefall. It was late 2022, and FTX had simply collapsed.

Confidence in centralized platforms had evaporated. However for Yea, the implosion was not a deterrent—it was validation.

“FTX crystallized our thesis. Centralized counterparties are single factors of systemic failure. We noticed that coming—and constructed GRVT to be the other,” Yea instructed BeInCrypto in an interview.

That conviction can be examined. Whereas former colleagues moved towards managing director promotions and fatter bonuses, Yea constructed a next-gen change from scratch. One that may fuse institutional-grade velocity and compliance with the decentralization ethos of Web3.

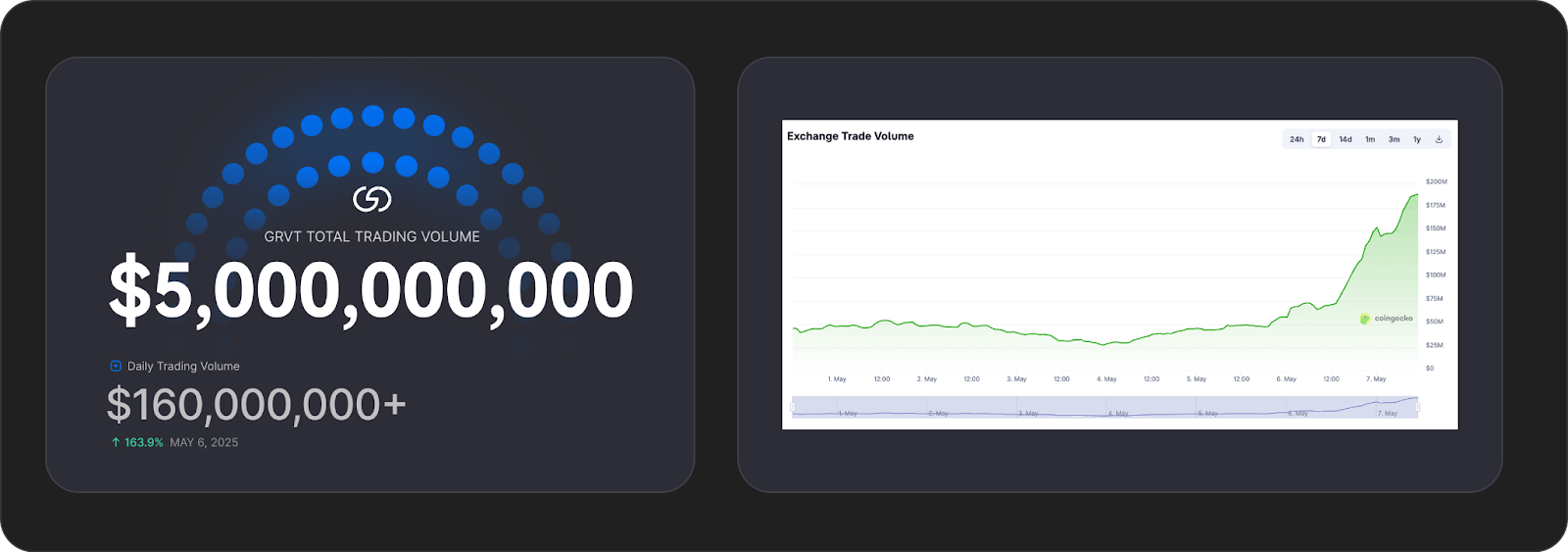

In the present day, simply 4 months after its public mainnet launch, GRVT has processed over $5 billion in buying and selling quantity.

GRVT $5 billion buying and selling quantity milestone, 4 months post-mainnet

It is the primary licensed decentralized change (DEX) underneath Bermuda’s Class M framework and one of many few platforms bridging Wall Avenue’s rigor with blockchain’s permissionless infrastructure.

Why a Goldman Exec Wager on Blockchain

For Yea, the pivot was not sudden. A dealer by coaching, he spent years inside Goldman watching promising monetary merchandise die behind walled gardens.

“I noticed good instruments and techniques that by no means reached past institutional silos. On the similar time, DeFi lacked the danger controls, efficiency, and compliance wanted to scale. I spotted: if we might mix each worlds, we might unlock finance for everybody,” he explains.

The spark got here at a 2022 crypto convention in Barcelona. Yea noticed clearly that blockchain was not simply speculative—it was a superior substrate for finance.

“It’s like a better web. Not only for knowledge, however for logic. Immutable, programmable, international. That’s what finance wants,” he articulates.

The Hybrid Benefit: CEX Velocity Meets DEX Trustlessness

Within the interview, Hong Yea introduced GRVT as a purpose-built hybrid, not a conventional DEX or a centralized change with a Web3 gloss.

The platform, he mentioned, separates matching and threat logic off-chain from settlement and custody on-chain. With this, customers get the velocity of centralized venues with out ceding management of their belongings.

“Each commerce is executed with sub-millisecond latency, however settled on-chain through sensible contracts that by no means contact person funds. It’s trustless execution at institutional speeds,” Hong Yea remarked.

Customers signal trades cryptographically utilizing SecureKey know-how, which mixes multi-party computation (MPC) with biometrics for optimum security. On the similar time, onboarding looks like Web2—e mail, password, 2FA.

Behind the scenes, GRVT’s zero-knowledge chain ensures privateness whereas holding settlements clear. Crucially, the platform permits customers to immediately rehypothecate margin throughout markets—an edge even legacy prime brokerages not often provide.

GRVT’s “CeDeFi” structure combines off-chain order matching and threat administration with on-chain self-custodial settlement utilizing a personal zk-powered Validium chain. It eliminates intermediaries, avoids on-chain custody charges, and permits customers to keep up sole management of their belongings.

“Trades execute in sub-millisecond latency however clear trustlessly in customers’ personal wallets,” Yea mentioned.

This design instantly targets the weaknesses of each CEXs and DEXs:

- CEXs provide comfort and velocity however pressure customers to relinquish custody, introducing counterparty threat.

- DEXs present transparency and management however undergo from latency and fragmented liquidity.

GRVT bridges that divide. Customers signal trades with biometrics through a SecureKey whereas all belongings stay of their wallets.

“We mix Web2 login flows with cryptographic controls and one-click commerce signing,” Yea defined. “It’s the velocity of Binance with the self-custody of Uniswap—minus the trade-offs.”

$5 Billion in 120 Days With Regulation As The Blueprint

In keeping with Hong Yea, GRVT’s explosive progress was engineered by way of uncooked efficiency, ecosystem incentives, and early partnerships. Its matching engine operates with latency underneath 10 milliseconds, outpacing Ethereum-based DEXs, Solana (SOL), and even newer Layer 2 options.

Nonetheless, it’s not nearly velocity. GRVT rewards market makers, group contributors, and liquidity suppliers, and creates a balanced, multi-stakeholder system.

Reportedly, greater than 40 establishments, together with CoinRoutes and high prime brokers, now commerce on GRVT, injecting deep liquidity from day one.

Furthermore, in a post-FTX enjoying discipline, the timing is opportune. Retail customers demand transparency; establishments demand compliance. GRVT meets each calls for with out compromise.

“We’re not a distinct segment. We’re a bridge. Retail needs security, establishments need entry. We provide a platform the place each can commerce on equal footing,” Yea added.

Whereas most DEXs try and dodge regulation, GRVT leaned in. It turned the world’s first licensed DEX underneath Bermuda’s Digital Asset framework.

“We deal with compliance as code. Our chain enforces KYC and commerce surveillance on the protocol stage. That’s not simply coverage—it’s unbreakable,” Yea emphasised.

Reportedly, GRVT is now in energetic discussions with regulators throughout Asia, Europe, and North America, working towards multi-jurisdictional licensing for a globally compliant rollout. Yea believes this regulatory adoption is just not a constraint however a essential enabler.

“Guidelines aren’t the enemy—they’re the gateway to institutional belief,” he said.

In the meantime, GRVT’s imaginative and prescient doesn’t finish with crypto buying and selling. Yea sees a future the place tokenized real-world belongings (RWAs), together with equities, funds, and institutional methods, commerce peer-to-peer (P2P) on a decentralized, composable platform.

Wall Avenue Is Watching

Whereas some in conventional finance (TradFi) stay skeptical of crypto, the institutional tide is popping. The window is reopening with MiCA (Markets in Crypto Property) in Europe, Hong Kong’s digital asset push, and a softening US regulatory tone.

“Wall Avenue is warming up. Nonetheless, this time, they may come to not dominate, however to combine,” Yea concluded.

Constructing long-term belief on a blockchain could look like a leap for a dealer who as soon as priced threat in microseconds. Nonetheless, for Hong Yea, it was a calculated commerce—and to date, it’s paying off.