It is a phase from the 0xResearch e-newsletter. To learn full editions, subscribe.

Obol launches its native OBOL token as we speak.

Token holders will be capable to stake OBOL for a liquid staking token, which can be utilized for governance within the Obol Collective, as DeFi collateral, or for voting in retroactive funding rounds (RAF).

“After years of constructing dependable, distributed validator expertise that eliminates single factors of failure, we’re now placing governance within the palms of the group,” mentioned Obol Affiliation CEO Thomas Heremans.

“The OBOL Token represents extra than simply governance — it’s the coordination mechanism for a complete ecosystem of operators who’re revolutionizing how Ethereum secures its infrastructure.”

What’s Obol?

Obol is a middleware tech supplier for Ethereum community staking. The corporate permits “distributed validators” (DV), which permit a number of unbiased nodes to collectively function one validator by sharing its duties and personal keys.

This solves a longstanding drawback confronted by all proof-of-stake networks.

Ethereum validators stake a couple of collective ~34 million ETH ($64.7 billion) as we speak. Massive establishments particularly could management tons of of tens of millions of {dollars} as one operator entity. These operators could also be internet hosting validators throughout the identical {hardware} servers or in concentrated geographic jurisdictions, exposing them to technological disruption or regulatory dangers.

Due to distributed validator expertise enabled by corporations like Obol and SSV, a number of nodes (two of three, 4 of seven, seven of ten) globally can now collectively run one Ethereum validator.

Subsequently, one node taking place causes no disruption to the validator, decreasing its publicity to those concentrated dangers.

This helps validators keep away from slashing and reduces dangers of single factors of failure, thereby bettering validator uptime and total community resilience.

At present, 800+ distinctive node operators, from main staking companies to solo residence stakers, run Obol-powered validators. $975 million value of ETH from Lido, EtherFi, StakeWise, Swell, Bitcoin Suisse and extra are secured by Obol’s distributed validator clusters throughout Ethereum as we speak.

Due to Obol, Lido has elevated its operators from 36 to over 200, in response to its press launch.

EtherFi, the biggest restaking protocol with $5.4 billion TVL, was capable of broaden its operators from ~10 to just about 100 as we speak. About 258,784 ETH ($499 million) from EtherFi is staked on Obol DVs as we speak. A further 40 on testnet are set to maneuver to mainnet quickly.

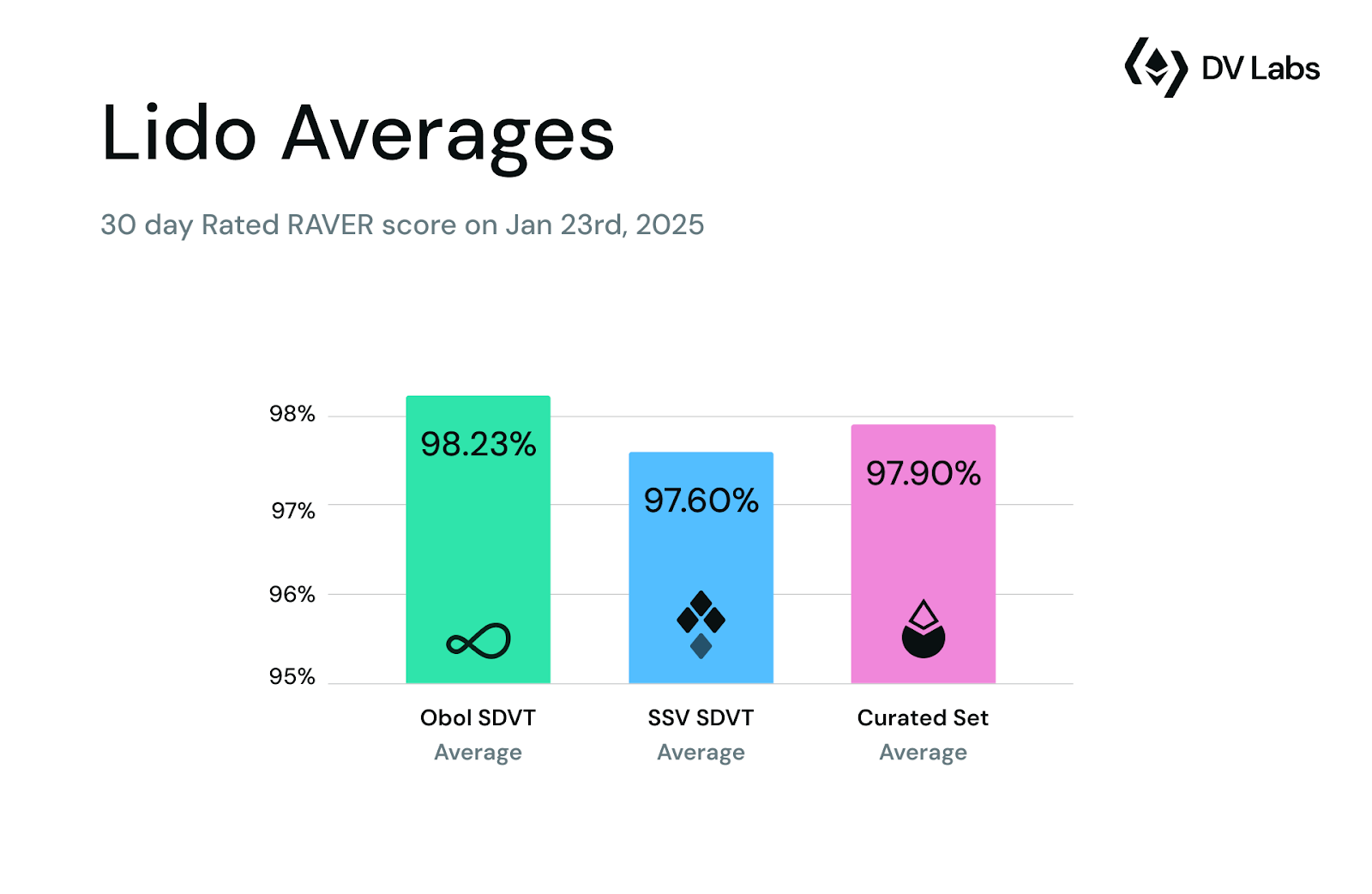

In line with DV Labs, the 30-day common RAVER rating in January 2025 for Obol DVT was 98.23%, outperforming SSV SDVT and a curated Lido set. The RAVER rating is a metric used to measure validator effectiveness throughout proposal and attestation success in Ethereum staking.

Supply: DV Labs

The Pectra community improve, which went reside yesterday, included EIP-7251. This elevated the utmost validator stake to 2048 ETH from its earlier cap of 32 ETH. That favors establishments, who can consolidate 1000’s of validators.

“EIP-7251 represents a long-awaited leap ahead in validator effectivity,” Heremans instructed Blockworks.

“By enabling validator consolidations, it addresses one of many largest operational burdens confronted by giant stakers and establishments,” Heremans mentioned. He forecasts “as much as 80% reductions in operational and infrastructure prices.”