Primarily based on the newest information, tokenized U.S. Treasury bonds proceed their upward trajectory, notching a 6% acquire since Could 2, 2025.

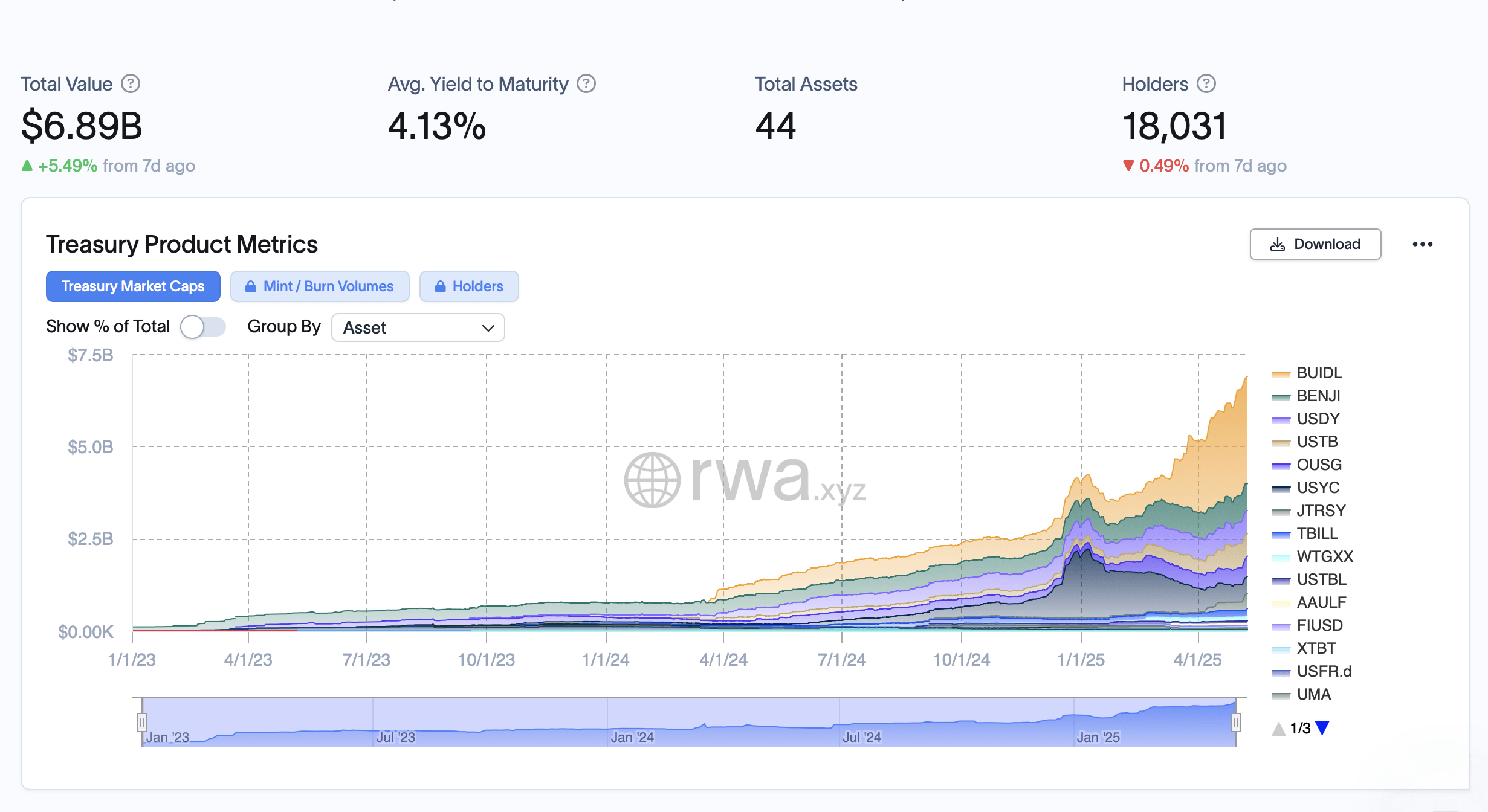

Tokenized Treasuries—$6.89B and Climbing

Final Friday, Could 2, the cumulative value of tokenized Treasuries hit $6.5 billion—a historic milestone. In only one week, this determine grew by 6%, increasing to $6.89 billion and attracting roughly $390 million in new capital.

Since Jan. 1, 2025, the tokenized Treasury bond sector has grown by 71%, rising from $4.03 billion to its present $6.89 billion valuation. Blackrock’s USD Institutional Digital Liquidity Fund (BUIDL) noticed an infusion of $36 million since Could 2, lifting its complete from $2.871 billion to $2.907 billion.

Over the previous week, Franklin Templeton’s Onchain U.S. Authorities Cash Fund (BENJI) added $10.61 million, rising from $716.84 million to $727.45 million. In the meantime, Ondo’s USDY fund outpaced each high contenders, increasing by $48.53 million from $581.20 million to the present $629.73 million.

Though Superstate’s Brief Length U.S. Authorities Securities Fund (USTB) skilled a lower, different funds—together with OUSG, USYC, JTRSY, TBILL, WTGXX, and USTBL—registered beneficial properties over the previous week, in accordance with rwa.xyz metrics. The earlier week of knowledge reveals USTB’s complete worth declined from $651.51 million to $607.43 million.

Persistent inflows into tokenized Treasuries spotlight a widening consolation with blockchain rails amongst asset managers and their shoppers, signaling that digital wrappers round authorities debt are now not experimental curiosities however in the present day’s actuality. If yields stay enticing and settlement benefits keep evident, onchain funds could shift from area of interest allocations to probably the most outstanding treasury operations.