This can be a phase from the Provide Shock e-newsletter. To learn full editions, subscribe.

We’re nonetheless early in the case of crypto, that a lot is obvious.

Some are simply sooner than others. That goes for buyers, customers and, if we’re being beneficiant, blockchain networks themselves.

Immediately’s e-newsletter remembers one of the costly bets in Bitcoin historical past, a minimum of solely counting bets made outdoors of buying and selling and funding contexts.

Seven years in the past, Bitcoiner Jimmy Tune and Ethereum co-founder Joe Lubin made their well-known gambit on whether or not Ethereum apps would acquire a certain quantity of traction over the subsequent half-decade (with an finish date of Might 2023).

All issues thought-about, Lubin would’ve misplaced. Has something modified within the final two years?

On This Day

The guess went like this:

If a handful of Ethereum apps had an quantity of lively customers on par with a mildly well-liked iPhone app, then Tune must pay $500,000 ETH to Lubin.

In any other case, Lubin would wish to pay an equal quantity of bitcoin to Tune.

For Lubin to win, a minimum of 5 Ethereum “dapps” would wish to succeed in 10,000 each day lively customers and a minimum of 100,000 lively customers per calendar month, for a minimum of six calendar months in anybody 12-month stretch.

No person actually makes use of the time period “dapp” anymore, although, so we’ll simply name them apps. The true kicker was that the prize cash was meant to be pegged to the costs of ETH and BTC on the time of the guess, in Might 2018.

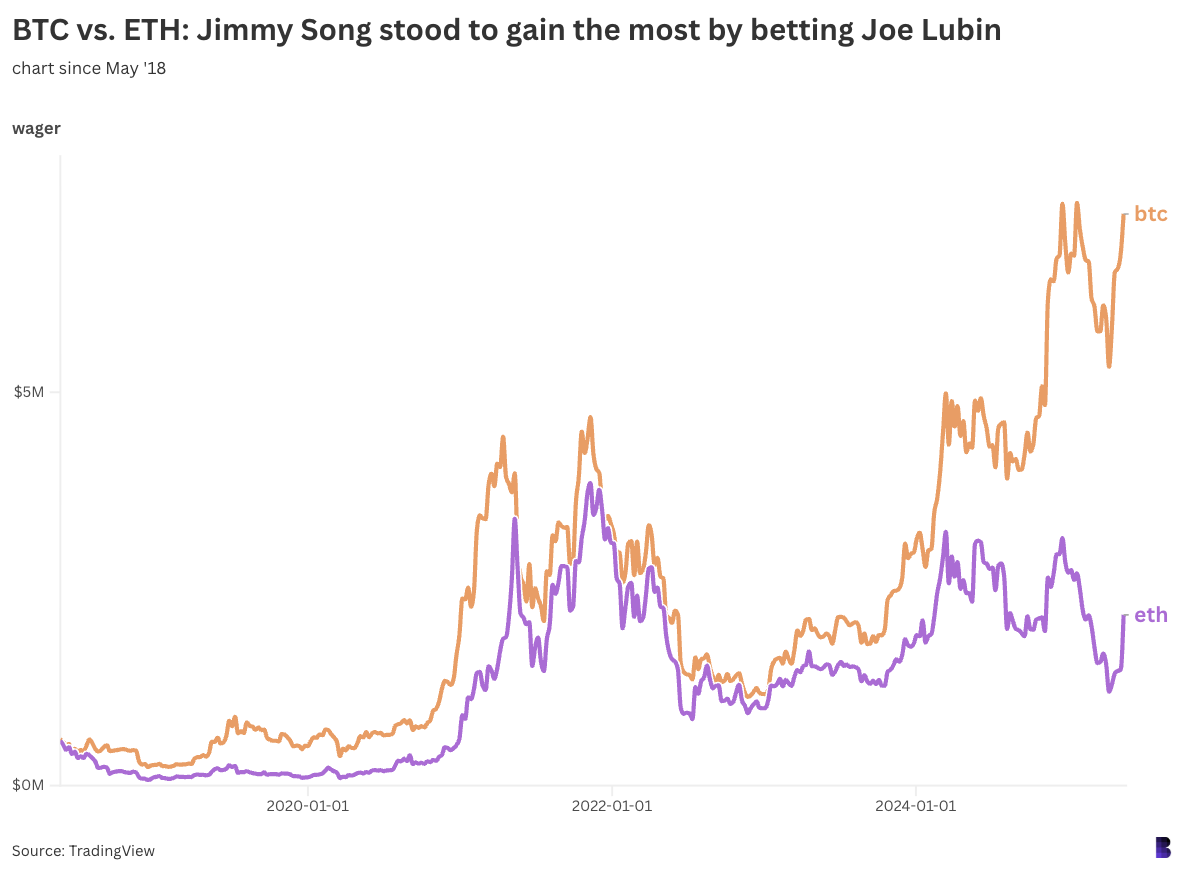

So, Tune would’ve needed to put up 810.8 ETH, price greater than $2.1 million proper now, whereas Lubin needed to pledge 69.74 BTC, or $7.25 million in right this moment’s cash.

Granted, there’s no actual technique to decide what number of lively customers any blockchain app actually has, Ethereum or in any other case, on account of how unreliable the lively addresses metric is.

As Blockworks Analysis places it, lively deal with counts aren’t a measure of consumer progress, so the guess was actually doomed from the beginning.

These traces plot the worth of each bets over the previous seven years. BTC in orange, ETH in purple.

Nonetheless, let’s droop the disbelief to see how the guess would’ve performed out had Tune and Lubin really adopted by, arbitrator and all.

We already know that Lubin would’ve in all probability misplaced. CoinDesk discovered there have been certainly 5 purposes on Ethereum that had the required degree of utilization on the time: Circle, OpenSea, Tether, Uniswap and wrapped ETH.

Are Circle, Tether and wrapped ETH actually “dapps”? Not likely, so it was secure to say that Tune was the winner, which might’ve put Lubin hundreds of thousands of {dollars} within the gap.

Then once more, the guess was by no means formally on to start with. Unhappy!

As for whether or not Tune would’ve gained if the guess spanned seven years as a substitute of 5: not likely. Uniswap nonetheless meets the minimal threshold, however apps like Banana Gun, 1inch and MetaMask aren’t but sustaining above the ten,000 lively deal with minimal to qualify, per Artemis information.

To not point out, Ethereum layer-2s akin to Base, Optimism and Arbitrum weren’t round in 2018, so maybe the guess would look completely different if it have been made right this moment.

In any case, Tune’s authentic thesis was that if a preferred app have been to exist on Ethereum, then finally, an analogous app on a extra centralized platform (“cheaper, quicker, extra scalable, extra maintainable and upgradable”) would come alongside and steal these customers.

Seven years later, these threats nonetheless exist, even when the pie that’s up for grabs is far bigger.