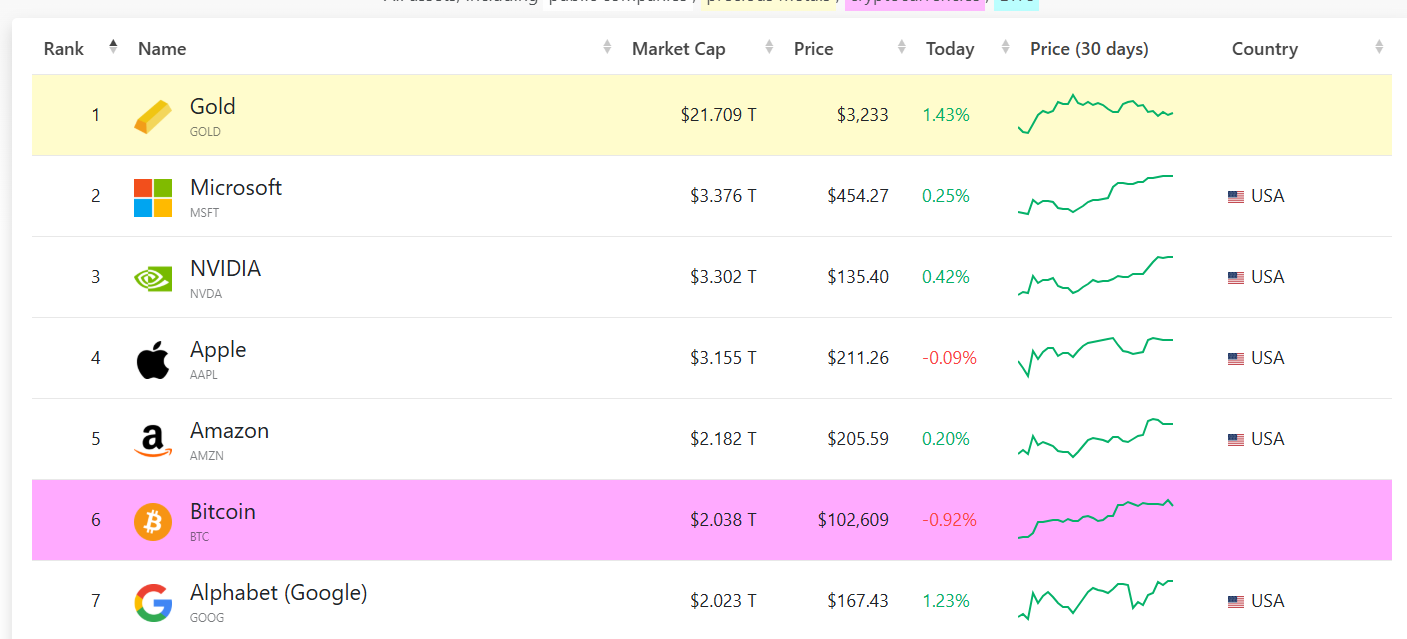

Bitcoin’s (BTC) highest weekly shut in historical past, above $106,000, got here with extra perks, because the digital forex overtook Alphabet (NASDAQ: GOOGL) to assert the sixth-largest asset by market capitalization globally.

Bitcoin commanded a market cap of $2.038 trillion at press time, edging out Alphabet’s $2.02 trillion.

On the prime of the worldwide asset rankings, gold stays the chief with a market cap of $21.70 trillion, adopted by expertise giants Microsoft ($3.37 trillion), Nvidia ($3.30 trillion), Apple ($3.155 trillion), and Amazon ($2.182 trillion).

Previously 24 hours, Bitcoin’s market cap peaked at $2.11 trillion at one level when the worth traded at $106,847 earlier than briefly retracing to settle at $103,146 as of press time, a 0.7% loss during the last 24 hours.

Drivers of Bitcoin’s worth rally

Though there was no fast set off for the Bitcoin rally that just about examined $107,000, a number of components might have pushed the worth larger.

As an example, traders appear to be tapping into the asset as a possible secure haven in response to Moody’s downgrade of the U.S. sovereign credit standing, alongside easing commerce tensions.

On the similar time, Bitcoin has additionally seen elevated capital inflows into exchange-traded funds. Information reveals that U.S.-listed spot Bitcoin ETFs recorded internet inflows of $608 million over the previous week.

Alternatively, Google additionally had a powerful week, with the inventory rallying over 5% to shut at $167.43 within the final buying and selling session.

Bitcoin and Google structural variations

The 2 property, nevertheless, function in numerous classes. Alphabet, a expertise large, is backed by tangible firm property, together with its huge portfolio of companies like Google Search, YouTube, and cloud computing.

In distinction, Bitcoin is a decentralized forex that exists solely within the digital realm and trades 24/7 on world exchanges.

This structural distinction might have given Bitcoin an edge, as its surge previous Alphabet occurred over the weekend, when conventional inventory markets have been closed.

Bitcoin’s means to commerce across the clock allowed it to capitalize on weekend market momentum, whereas Alphabet’s inventory remained static till markets reopened on Monday.

Nevertheless, given the unstable nature of cryptocurrencies, Bitcoin’s lead over Google could also be short-lived, as digital property entered Monday going through notable capital outflows.