Bitcoin simply ended the week with its strongest shut in historical past, settling above $106,000 after a weekend rally, as proven on Binance’s BTC/USDT chart.

The digital asset pushed as excessive as $107,000 on Sunday, narrowing the hole to its January all-time excessive of $109,500 to only 2%.

After testing greater ranges, Bitcoin eased to round $104,500 at press time. Nonetheless, analysts view the pullback as wholesome consolidation amid rising institutional flows and tightening market provide, suggesting continued upward momentum within the close to time period.

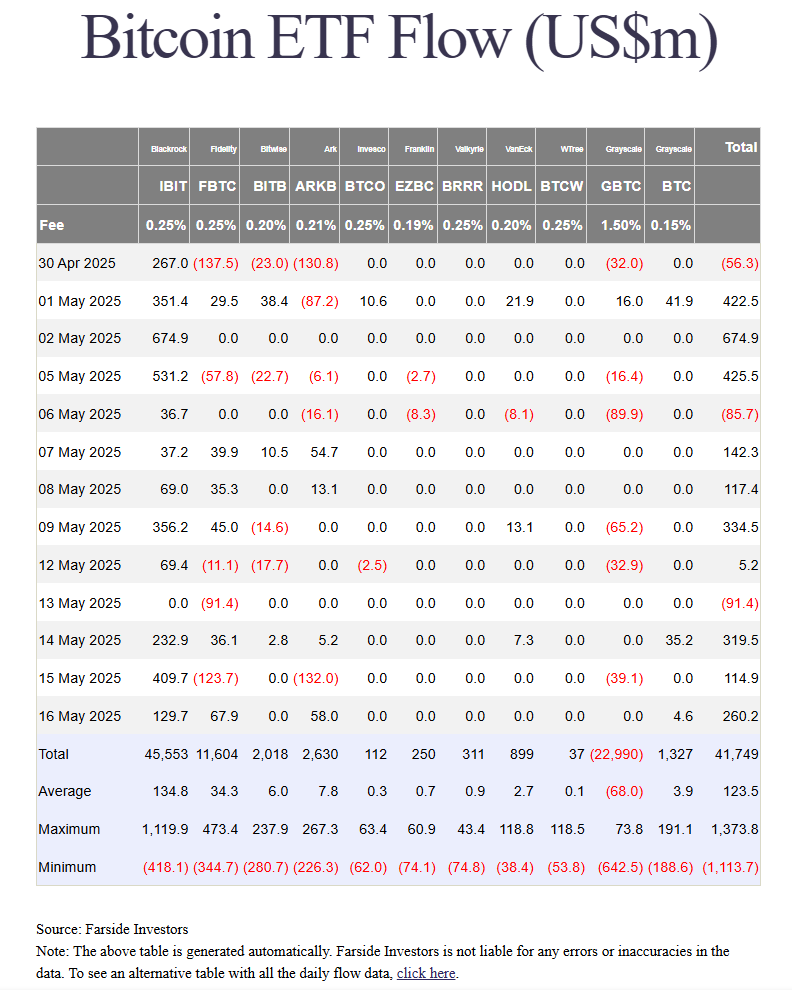

Investor urge for food for Bitcoin funding merchandise stays strong. US-listed spot Bitcoin ETFs recorded web inflows of $608 million, constructing on sturdy momentum from the earlier week, per Farside Traders.

BlackRock’s iShares Bitcoin Belief topped the leaderboard, pulling in additional than $840 million, greater than the mixed web inflows of the remainder of the market.

“This isn’t a melt-up—it’s a structurally supported transfer,” stated analysts at Bitfinex in a touch upon Bitcoin’s latest breakout. “So long as ETF and institutional flows persist and macro stays secure, dips are more likely to be transient and acquired aggressively. The trail of least resistance stays greater.”

Company demand for Bitcoin additionally stays sturdy and regular. On Monday, Technique, the biggest company holder of BTC, introduced the acquisition of a further 13,390 BTC for about $1.3 billion, bringing its complete holdings to 568,840 BTC.

The corporate’s aggressive accumulation technique continues to set the tempo for institutional adoption.

A rising variety of new and current corporations have both adopted Bitcoin or introduced plans to carry it as a strategic reserve asset, lots of whom are anticipated to proceed buying BTC within the months forward.

In the meantime, the worldwide race amongst nations to ascertain sovereign Bitcoin reserves can also be anticipated to speed up, additional tightening provide within the years forward.

In keeping with Matt Hougan, Chief Funding Officer at Bitwise, demand is now significantly outpacing provide. With miners projected to provide simply 165,000 BTC this yr, public corporations and ETFs have already acquired greater than that.

Hougan sees this structural imbalance as a key driver that would propel Bitcoin past $100,000, with $200,000 as the following main goal.