Blockchain networks are bleeding informal customers, with 4 out of 5 low-engagement accounts going inactive inside three months, a Flipside examine reveals.

A current examine reveals a tough fact about blockchain ecosystems: most customers lose curiosity rapidly. Knowledge from Flipside, which analyzed consumer conduct throughout networks resembling Solana, Ethereum, Arbitrum, and Avalanche, reveals that consumer retention is extraordinarily low. The vast majority of customers disappear inside months until they have been already extremely lively from the beginning.

Flipside took a tough have a look at how wallets behave over time. They sorted customers into three classes: low-value (scores 0-3), medium-value (4-7), and high-value (8+), primarily based on how a lot exercise they’d had on-chain earlier than. Then, they checked every group each month for half a 12 months, monitoring what number of have been nonetheless lively.

The retention cliff

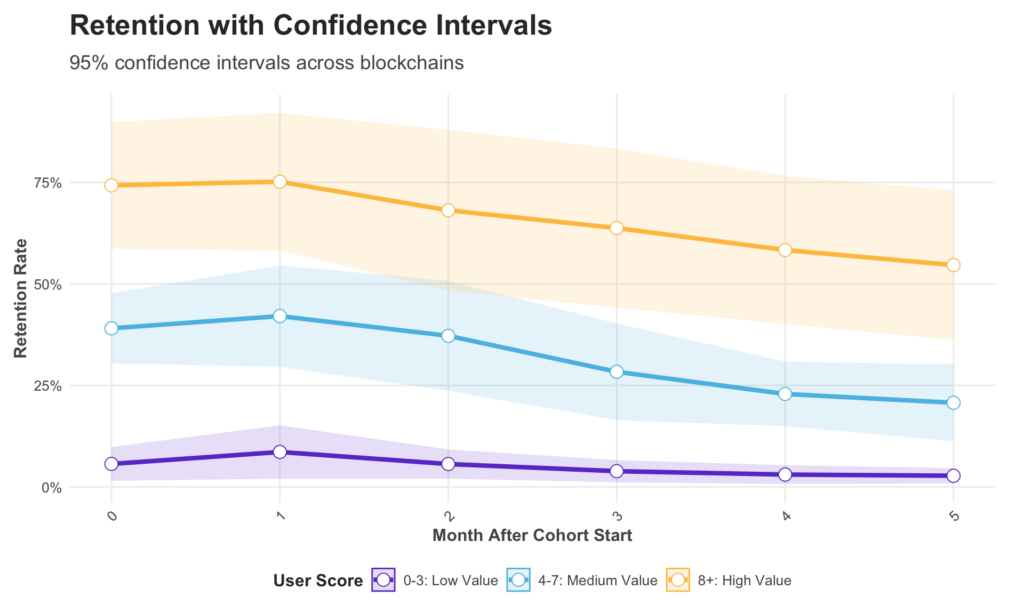

The info reveals a transparent sample: the primary month is brutal. Low-value customers — wallets with little or no earlier exercise — dropped off nearly instantly. Per the report, constantly present the “lowest retention, falling under 5% after 6 months.” In plain phrases: 95 out of each 100 of those wallets are gone in half a 12 months.

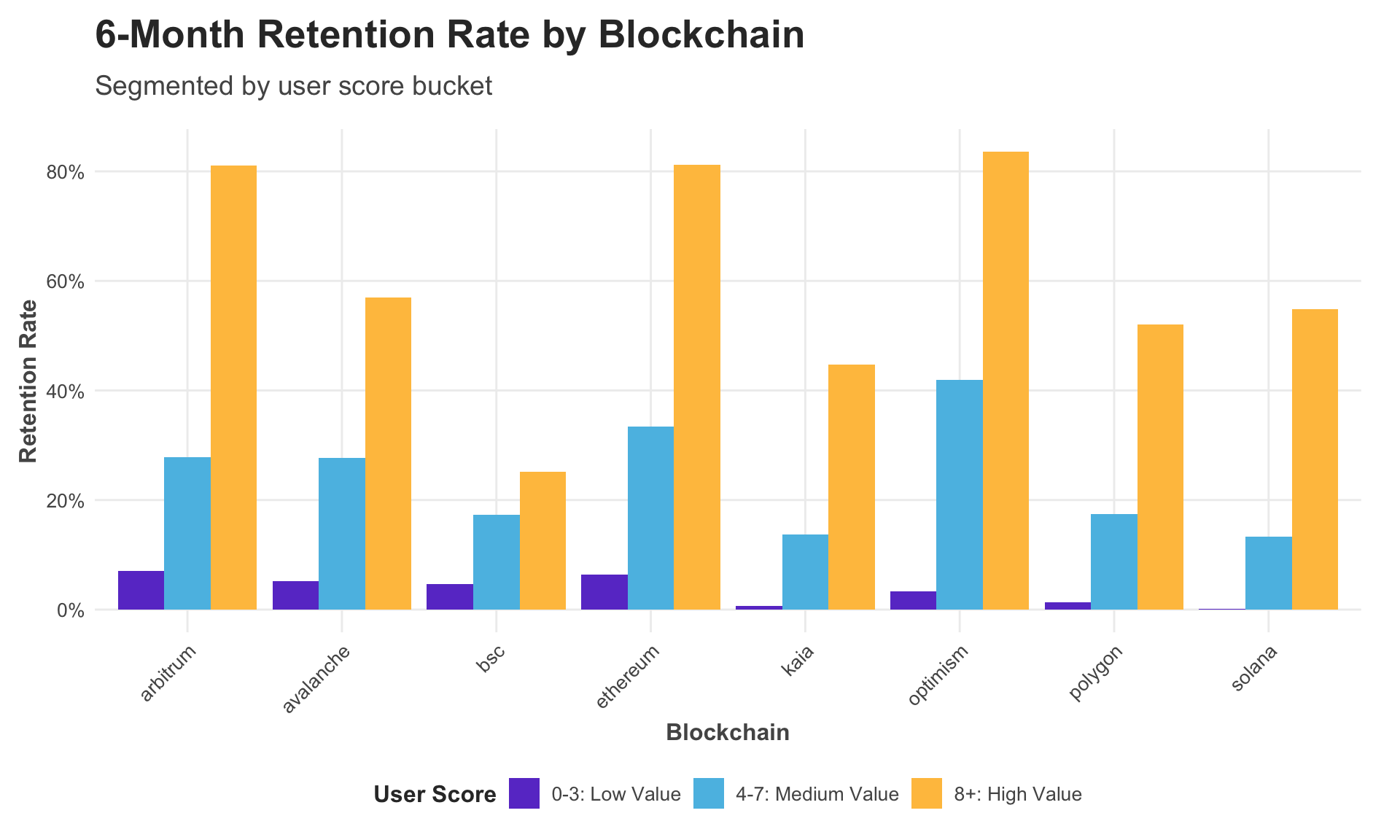

The 6-month retention charges throughout blockchains, segmented by rating bucket | Supply: Flipside

Medium-value customers — common however not energy customers — fare higher however nonetheless drop sharply early on earlier than stabilizingm whereas high-value customers decline slowly, dropping simply 5-8% of their numbers every month.

Some blockchains maintain onto customers higher than others. As an example, Ethereum and Avalanche have the strongest retention for high-value addresses, conserving 35-38% lively after six months. Solana, regardless of its dimension, lags behind, although particulars behind this hole stay unclear. Newer chains are inclined to have the steepest drop-offs, suggesting that early development numbers is likely to be deceptive.

The metric entice

The report factors out a standard drawback in crypto: chains chase huge consumer numbers, however most of these “customers” don’t final. Many are simply passing by way of: airdrop hunters, speculators, or bots. The info makes it clear, actual, sustained exercise comes from a small fraction of addresses.

“If we zoom in on the retention charts, you possibly can see it extraordinarily clearly: solely a handful of addresses are contributing any sustained exercise or liquidity quantity throughout the foremost chains studied.”

Flipside

You may also like: ‘AI will speed up blockchain adoption:’ Interview with Pantera Capital’s Cosmo Jiang

This creates a dilemma: as blockchains need to present speedy adoption, they give attention to inflating consumer counts. But when most of these customers disappear, the expansion isn’t actual. The report argues that protocols could be higher off concentrating on high-quality customers from the beginning, even when meaning slower headline development.

Retention curves throughout all analyzed blockchains | Supply: Flipside

Flipside’s analysis recommends that blockchain networks shift their focus away from low-value customers. Incentives for one-time actions might increase short-term metrics, however they fail to construct long-term engagement.

“It’s a tough tablet to swallow, however the protocols that embrace this actuality will outperform those who waste their incentives on addresses that received’t undertake them. The info clearly signifies that specializing in high quality consumer acquisition and retention — quite than inflating handle counts — represents probably the most sustainable path to ecosystem development.”

Flipside

The report means that blockchain builders might need to take into account placing extra thought into designing tokenomics and reward methods that encourage longer-term participation. Whereas short-term incentives might help drive preliminary exercise, they usually don’t result in significant engagement over time.

In line with the information, it appears more practical to create mechanisms that reward constant involvement, which may assist construct a extra steady and lively consumer base. Prioritizing sustained interplay, quite than one-off actions, may provide a greater path towards long-term development.

Learn extra: Easy methods to construct a 1B TPS blockchain with out decentralization, safety, or disgrace | Opinion