Technique (previously MicroStrategy), the enterprise intelligence agency and the most important public holder of Bitcoin (BTC), has recorded a brand new all-time excessive (ATH) in quarterly quick curiosity.

Analysts stay cut up on what this implies for the worth of MSTR. Some consider the ATH in brief curiosity might be a precursor to a brief squeeze. In the meantime, others argue that it could mirror market makers hedging their positions in derivatives.

MSTR Inventory Brief Curiosity Hits Report Excessive

For context, quick curiosity refers back to the whole variety of shares of a inventory that buyers have borrowed and bought in anticipation that the inventory worth will decline. An increase in brief curiosity usually alerts rising pessimism about an organization’s prospects.

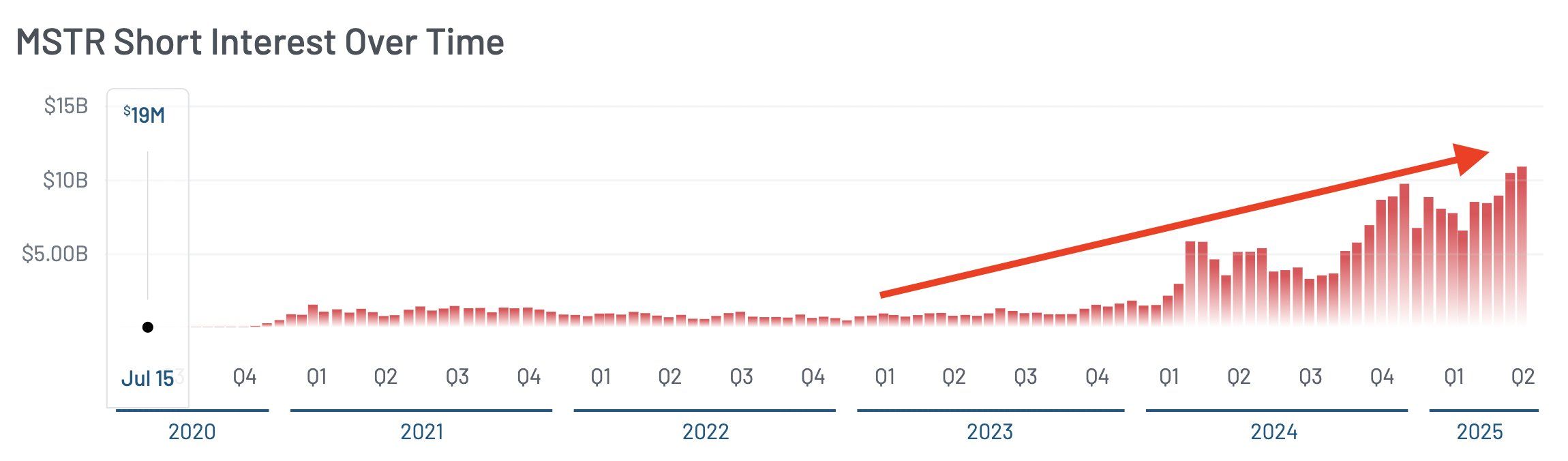

In the meantime, an ATH in brief curiosity signifies a very excessive bearish sentiment. A market watcher, Luke Mikic, just lately shared a chart on X (previously Twitter), revealing that MSTR’s quick curiosity hit an ATH in Q2 2025.

MSTR Brief Curiosity Peak. Supply: X/ LukeMikic

Nevertheless, Mikic predicted this might set off a “big quick squeeze.” A brief squeeze occurs when a closely shorted inventory unexpectedly rises in worth.

As the worth climbs, short-sellers are compelled to purchase again the inventory to cowl their positions. This creates a suggestions loop and pushes the inventory worth even increased.

Curiously, one other analyst identified that MSTR is forming a Cup and Deal with sample. This can be a bullish continuation sample in technical evaluation. It usually alerts that the inventory is getting ready for an upward transfer.

“MSTR a bit extra endurance is required right here…. The cup & deal with b/o WILL come….. and when it begins, it ought to go quick and livid….. Key ranges to observe: 393, 404, 416, 432, 455, 481,” the submit learn.

MSTR Inventory Value Prediction. Supply: X/InvestXOS

Thus, if the worth does get away, it may act because the catalyst for a brief squeeze. This, in flip, may push MSTR increased.

Nevertheless, the narrative of an impending MSTR quick squeeze confronted skepticism from one other person.

“That is simply market makers hedging in opposition to their spinoff positions… aka choices… we’re close to a zone with a cluster of excessive focus for delta heading. MSTR has the most important choices market, to assume market makers don’t play a job in its worth motion could be naive,” Peter O wrote.

Peter defined that because the inventory worth approaches key strike costs, just like the $390 stage for Technique, market makers modify their positions to remain “delta impartial” (which means they intention to keep away from publicity to cost fluctuations).

This course of includes aggressive hedging, which might create shopping for or promoting stress on the inventory. Peter additional emphasizes the significance of understanding choices movement and gamma publicity—ideas that designate how market makers’ actions affect the inventory’s worth dynamics.

His extra technical perspective means that the actions in Technique’s inventory should not solely a results of quick curiosity however are considerably influenced by complicated choices methods.

In the meantime, buying and selling methods may be influencing the excessive quick curiosity in MSTR inventory. Jim Chanos, an funding supervisor and founding father of Kynikos Associates, has been following a Bitcoin/MSTR buying and selling technique. In line with CNBC, Chanos buys Bitcoin whereas shorting MicroStrategy’s inventory.

“We’re promoting MicroStrategy inventory and shopping for Bitcoin and mainly shopping for one thing for $1 promoting it for 2 and a half {dollars},” Chanos stated.

The rationale behind this technique is that MSTR inventory usually trades at a premium relative to the worth of its Bitcoin holdings. If this hole narrows, Chanos believes it may current a worthwhile alternative.

Now, whether or not the MSTR inventory worth will rise or not stays to be seen. As of the newest knowledge from Google Finance, the inventory closed at $387.1, down 1.04%.

MSTR Inventory Efficiency. Supply: Google Finance

In after-hours buying and selling, it dropped additional to $385.0, reflecting a 0.55% decline.