Berachain has skilled a dramatic shift, with over $1.1 billion in internet outflows and a complete worth locked (TVL) plunge of greater than 70%, elevating critical questions in regards to the protocol’s future and consumer confidence.

Latest on-chain analytics place Berachain squarely within the crypto highlight, although for troubling causes. Initially celebrated for its momentum in the course of the testnet part, the platform now reveals fast decline, with each information and consumer sentiment reflecting a lack of confidence.

Outflows Attain $1.2 Billion as TVL Drops Over 70%

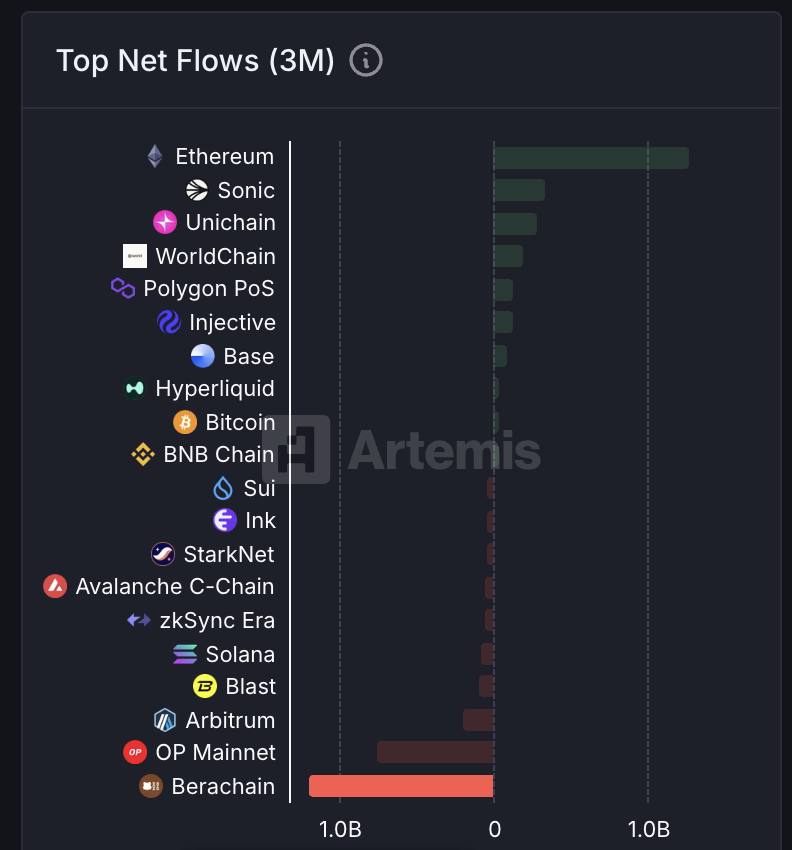

Information from Artemis highlights the size of capital leaving Berachain. Inside three months, the platform recorded $1.69 billion in inflows, but noticed $2.89 billion depart, leading to internet outflows of over $1.2 billion. This positions Berachain because the main chain by internet outflow in the course of the interval.

Berachain is the Main Chain by Web Outflows. Supply: Artemis

As these metrics deteriorate, the Berachain neighborhood’s outlook has notably worsened. Many have began questioning whether or not the platform’s early promise can stand up to ongoing outflows and falling morale.

“Berachain is rapidly turning into a ghost chain. With over $1.1 billion in internet outflows over the previous 3 months and a token value down 82% from ATHs. There was a lot life throughout Testnet and now all of the ‘energy customers’ are gone farming the subsequent airdrop,” crypto analyst Rick stated.

This extensively shared put up displays a pointy change in neighborhood temper. The preliminary pleasure from the testnet part has light, with key individuals transferring to competing tasks.

Criticism now consists of each advertising ways and the platform’s broader viability. Finally, the dialog inside the neighborhood has shifted decisively from optimism to skepticism.

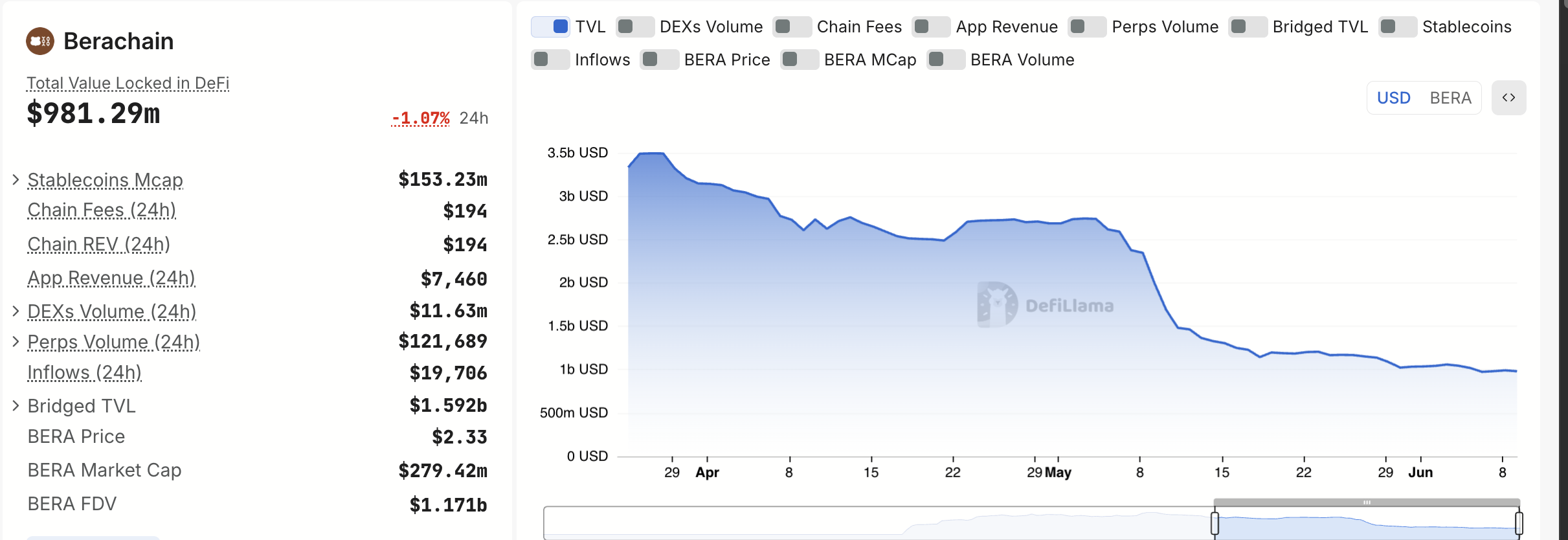

On the similar time, the DeFiLlama TVL dashboard stories a TVL drop of greater than 70% from its peak. This vital lower displays not solely a dip in liquidity but additionally waning confidence amongst customers and builders. The mixed information alerts sustained retreat, elevating fast considerations about Berachain’s stability within the brief time period.

Berachain TVL. Supply: DefiLlama

What Lies Forward for Berachain?

Primarily based on on-chain information and TVL analytics, the state of affairs is evident: Berachain’s expertise stays, but perceptions round worth and development are shifting rapidly. Builders and neighborhood managers should reply transparently and act swiftly to stabilize sentiment.

If destructive sentiment persists, Berachain might solidify its repute as a “ghost chain.” For venture leads and constant customers, decisive engagement is crucial to restrict additional losses and keep relevance in an evolving DeFi ecosystem.

In abstract, Berachain’s current trajectory is a stark reminder that, for brand new blockchain platforms, lack of neighborhood confidence can happen even quicker than liquidity drains. The chain faces a pivotal second as information and social sentiment level to pressing challenges forward.