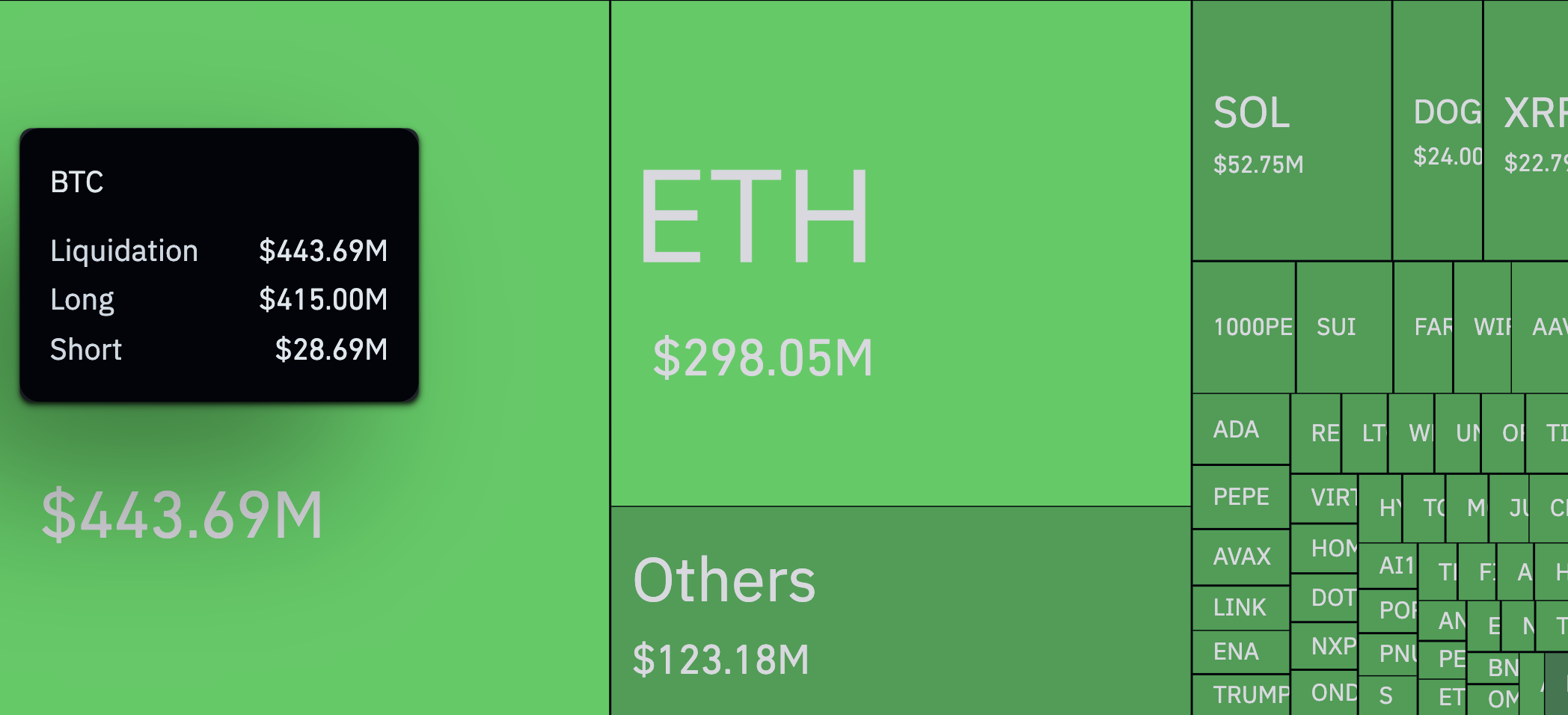

Over the previous 24 hours, BTC noticed a literal tsunami of lengthy liquidations totaling $415 million – in comparison with simply $28.69 million in shorts – a 1,446% imbalance between the 2 sides. CoinGlass knowledge exhibits that this provides as much as $443.69 million in complete liquidations for Bitcoin alone, attributable to a large worth drop that triggered a rush to dump on derivatives markets.

The worst of it occurred within the early hours, when BTC dipped beneath $103,000. That transfer set off a sequence response of compelled liquidations, largely hitting over-leveraged longs.

ETH was subsequent, with $298 million liquidated. SOL, DOGE and XRP additionally noticed double-digit tens of millions worn out, pushing complete crypto liquidations to $1.14 billion in a single day.

The 12-hour chart exhibits the size of the affect. Between lengthy and brief positions, a whopping $524 million have been liquidated, with greater than $449 million of that coming from longs alone. The imbalance carried on throughout shorter time frames too, together with $27 million within the four-hour window and $3.3 million within the final hour.

To place this into perspective, greater than 241,000 merchants have been affected. The most important single liquidation? A $201 million BTC/USDT lengthy on Binance.

Regardless that Bitcoin has had a little bit of a comeback and is above $104,900 once more, the market continues to be nervous concerning the state of affairs. Funding charges are in every single place, and the liquidation development has merchants bracing for extra turbulence into the weekend.

For now, the info suggests one factor: leveraged bulls bought caught off guard – and the imbalance that adopted might take a while to unwind.