The upcoming week, from June 30 to July 6, 2025, is ready to carry vital volatility to the crypto market, as a number of main tasks are scheduled to launch beforehand locked tokens.

In keeping with information from Tokenomist, over $150.6 million value of those insider tokens are scheduled to unlock, a transfer that might set off vital turbulence as a result of sudden shifts in provide.

Which Main Altcoins Are Unlocking?

This week’s headliners embrace SUI, ENA, and OP, with SUI alone unlocking $77.35 million, accounting for 0.86% of its circulating provide. As buyers put together for elevated volatility, the charts for these tokens inform a compelling story of present sentiment, crucial ranges, and what could lie forward.

🟣 Weekly Insider Unlocks : 30 June – 6 July ’25

🔥 150.6m+ 🔥

Insider Unlocks Highlights 🔓:$SUI (0.86%) – $77.35m$ENA (2.82%) – $43.24m$OP (1.79%) – $16.69m$KMNO (3.82%) – $4.74m$REZ (12.16%) – $2.59m

.

( % of cir. provide) pic.twitter.com/SJy4ZTxROC— Tokenomist (@Tokenomist_ai) June 27, 2025

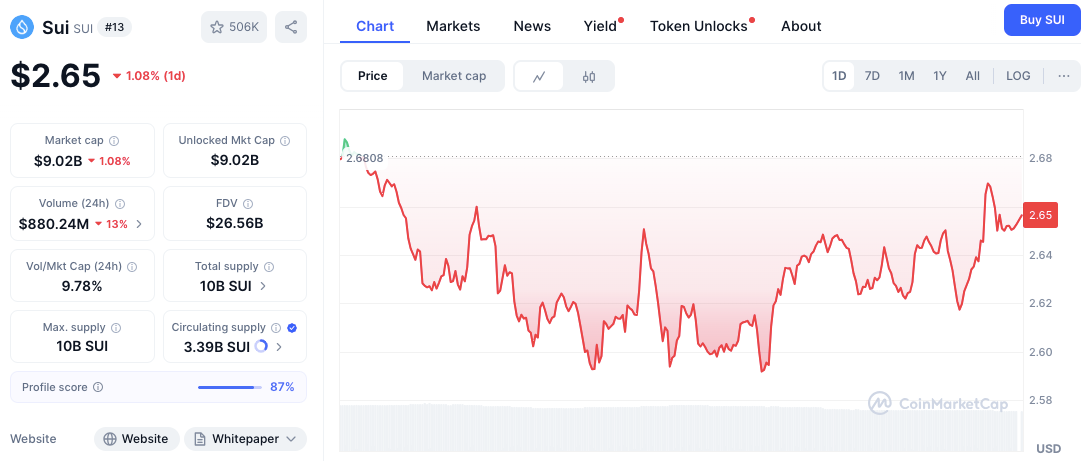

SUI: Holding the Line Amid Bearish Strain

SUI’s worth motion reveals cautious buying and selling conduct, with the token hovering at $2.65 after dropping from its every day excessive of $2.84. It tried a number of intraday recoveries however confronted sturdy promoting strain above $2.70.

A notable help degree has shaped round $2.56, simply shy of a psychological threshold at $2.50. If this degree cracks, a steeper fall may happen.

Supply: CoinMarketCap

Conversely, the $2.84 degree marks vital resistance. A breakout above this might revive bullish momentum. Presently, SUI is consolidating between $2.56 and $2.70, a variety that’s more likely to resolve sharply within the coming days, particularly given the massive unlock.

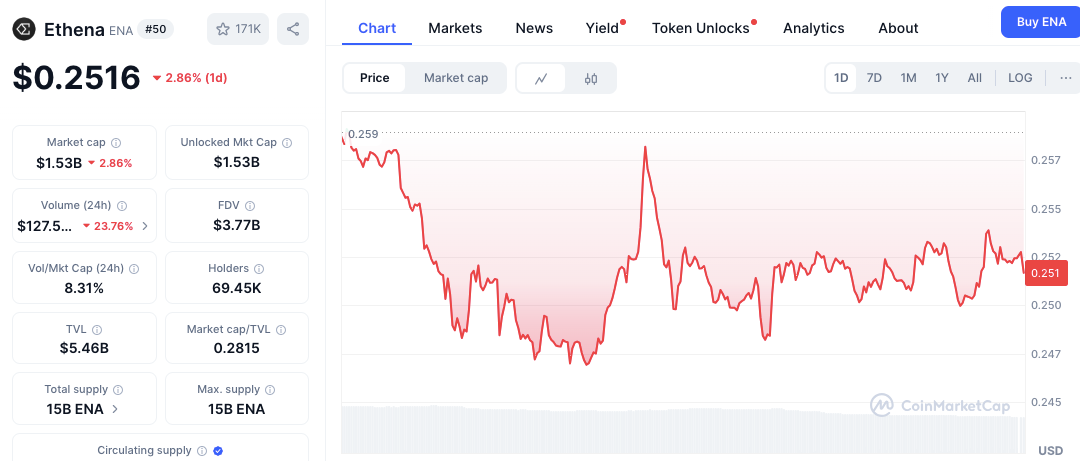

ENA and OP: Consolidation With a Facet of Uncertainty

Ethena (ENA) skilled a 2.44% drop, closing at $0.2525. The token’s intraday low of $0.245 has served as a short-term anchor. It’s bouncing again however struggling to interrupt by $0.257, with tighter consolidation round $0.250.

Supply: CoinMarketCap

The unlock measurement, $43.24 million (2.82% of provide), provides one other layer of strain. A transfer beneath $0.245 may see ENA retreat to $0.240.

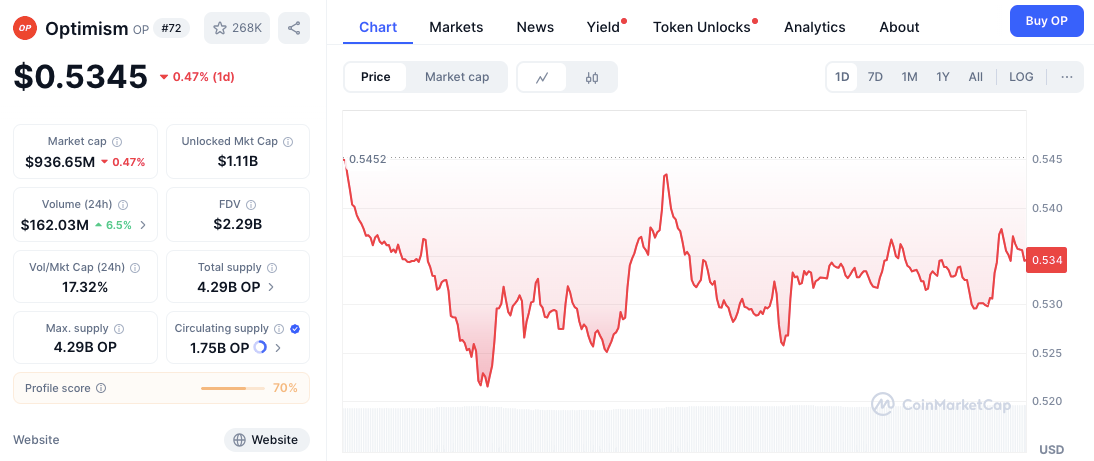

Optimism (OP), buying and selling at $0.5345, displayed an analogous story. Regardless of a slight end-of-day restoration, OP did not reclaim highs round $0.545.

Supply: CoinMarketCap

Assist stays agency at $0.520, with a short-term resistance band at $0.542–$0.545. A break above may gasoline a rally towards $0.550. Nevertheless, given its $16.69 million unlock (1.79% of provide), merchants are doubtless watching cautiously.

Smaller Caps: KMNO and REZ Supply Speculative Strikes

Supply: CoinMarketCap

Kamino Finance (KMNO) and Renzo (REZ) spherical out the week’s unlock record with $4.74 million and $2.59 million respectively. KMNO confirmed an intraday low at $0.0555 and confronted rejection close to $0.059. The bearish development continues, with resistance stacked at $0.058.

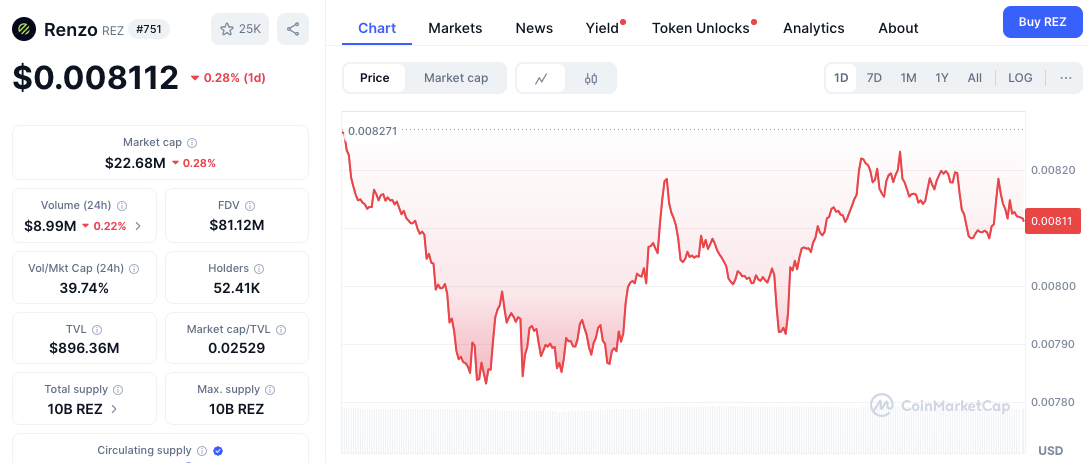

Supply: CoinMarketCap

REZ, in the meantime, traded tightly close to $0.00811 after recovering from a low of $0.00787. With excessive quantity relative to market cap, REZ could expertise sharper swings as its 12.16% unlock hits the market.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be answerable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.