- In accordance with Bloomberg ETF analysts James Seyffart and Eric Balchunas, the XRP spot ETF at present has a 95% probability of being authorised by the SEC.

- Asset managers like Franklin Templeton, Bitwise, and ProShares have already filed functions for XRP ETFs.

Think about if the U.S. didn’t have a president like Donald Trump who helps cryptocurrency, progress within the house would seemingly be transferring a lot slower. Take Ripple (XRP), for instance. It’s confronted its justifiable share of authorized battles and delays in getting funding merchandise tied to it authorised.

However issues are beginning to search for. In accordance with Bloomberg ETF analysts James Seyffart and Eric Balchunas, there’s now a 95% probability {that a} Ripple spot Trade Traded Fund (ETF) will get the inexperienced mild from the Securities and Trade Fee (SEC).

XRP supporters are feeling optimistic, pointing to rising curiosity from establishments and a extra favorable regulatory local weather as key the reason why an XRP ETF may lastly get authorised. On the authorized aspect, issues have been transferring, although not and not using a few bumps.

Lately, each the SEC and Ripple Labs filed a joint request in Manhattan federal courtroom asking to undo a earlier ruling that categorized Ripple’s major XRP gross sales as securities violations.

As famous in our earlier put up, in addition they proposed decreasing the $125 million high-quality, suggesting that $50 million go to the SEC and the remaining $75 million be returned to Ripple. Nevertheless, Decide Analisa Torres denied the movement, saying they hadn’t proven the “distinctive circumstances” wanted to overturn the ruling.

Whereas the SEC hasn’t formally mentioned whether or not it would proceed pursuing its personal enchantment, Ripple has already agreed to drop its cross-appeal. Including to the hypothesis, a closed-door SEC assembly scheduled for July 3 has sparked hopes that the case may lastly be coming to an finish.

XRP’s Path to a Breakout

Though XRP gained authorized readability again in 2023, many establishments have remained cautious about leaping in. There’s hypothesis that even giants like BlackRock could also be ready for the Ripple-SEC case to completely wrap up earlier than making a transfer, probably with their very own XRP ETF submitting.

Within the meantime, a number of corporations have already stepped ahead. Bitwise Asset Administration kicked issues off with a submitting in October 2024, adopted by Canary Capital, 21Shares, WisdomTree, ProShares, and CoinShares, all displaying sturdy institutional curiosity. And it’s not simply ETF issuers getting concerned.

We featured in our current protection that XRP has entered what many are calling its “institutional period,” with over $1 billion in treasury allocations from corporations together with the Chinese language AI agency Webus, VivoPower’s $121 million dedication, and Florida-based pharmaceutical distributor Wellgistics. This might doubtlessly gasoline a run previous $5 and towards the $10 mark if circumstances align.

Including to the bullish case, Grayscale’s Digital Giant Cap Fund (GDLC), which incorporates XRP alongside Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), and Solana (SOL), has acquired SEC approval to transform right into a spot ETF. Whereas XRP doesn’t but have a devoted ETF approval, this oblique inclusion exhibits progress.

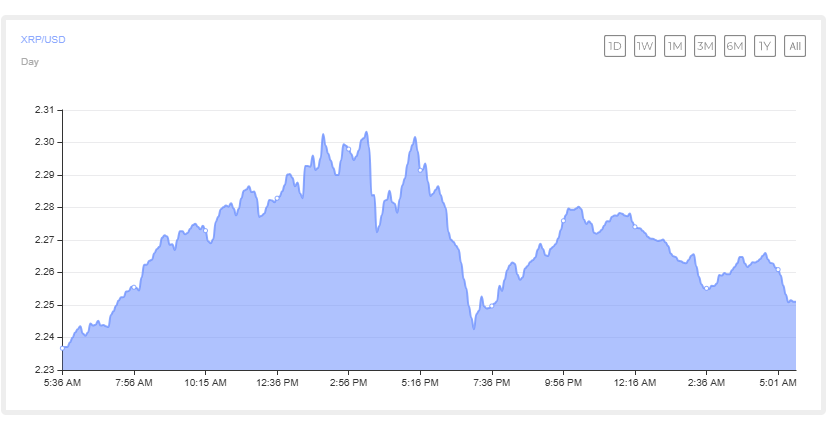

Nonetheless, short-term worth motion stays risky. Previously 24 hours, XRP has dropped 0.71%, buying and selling at $2.18, and it’s up 1.4% over the past 30 days and up by 348% previously yr. If the present promoting strain continues, there’s an opportunity XRP may dip beneath the $2.13 help, with a potential slide to $5 on the horizon.