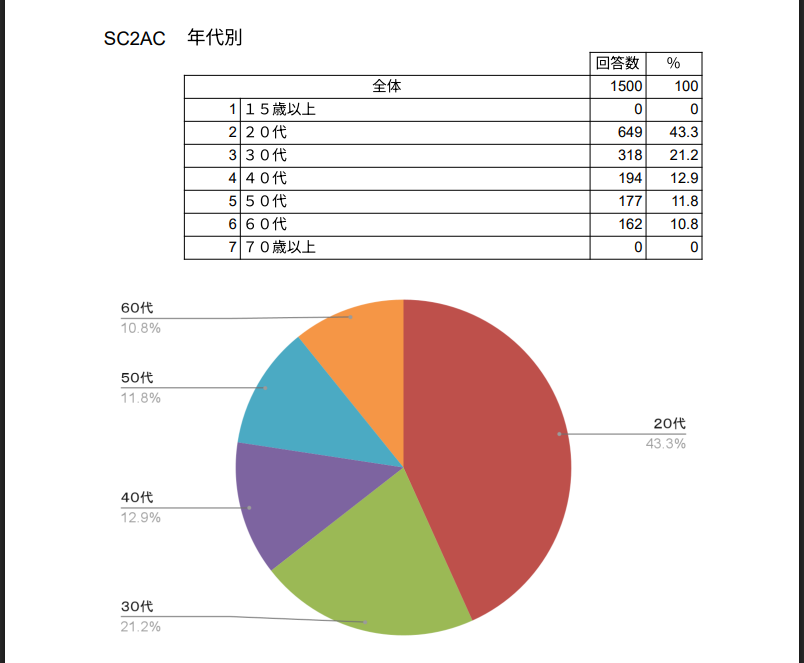

Japan’s robust strategy to crypto taxes is holding again each patrons and sellers. A survey of 1,500 adults in April discovered that simply 13% presently personal Bitcoin, Ethereum or different cryptoassets. Many say they’d be able to dive in—if solely Tokyo eased the tax burden.

Majority Again Flat Tax

In keeping with the Japan Blockchain Affiliation, 84% of the 191 individuals who already maintain crypto would purchase extra if earnings confronted a flat 20% levy.

And 12% of the 1,309 non‑holders stated they’d begin shopping for bitcoin or different cryptos underneath the identical rule. That’s an enormous shift from at the moment’s system, the place crypto beneficial properties land underneath “different revenue” on tax returns.

Supply: JBA

Proper now, earnings from bitcoin or crypto could be taxed at charges as much as 55%, relying in your bracket. That’s far larger than the ten–20% flat charge that applies to shares in lots of different nations.

Based mostly on studies, the JBA is pushing to maneuver crypto into the identical capital beneficial properties class, arguing it could increase buying and selling volumes on native exchanges.

Survey Reveals Easy Guidelines Attraction

Three quarters of survey members stated they’d slightly have taxes withheld on the supply after they promote bitcoins, as an alternative of submitting separate paperwork.

The JBA has requested Tokyo to let merchants select whether or not to pay on the level of sale or after they file their annual return. That flexibility may ease complications for each passion buyers and professionals.

BTCUSD buying and selling at $118,826 on the 24-hour chart: TradingView

The ballot regarded deeper into why some individuals nonetheless gained’t contact crypto. Simply 8% blamed excessive taxes, whereas 61% stated they don’t really feel they know sufficient about digital cash.

The pattern was 60% male and 40% feminine, with a mean age of 38. College students made up 5.3% of the group, and 213 individuals stated they had been unemployed.

Picture: Canva

FSA Considers Broader Reforms

In keeping with studies from the monetary regulator, the Monetary Providers Company is weighing a proposal to shift bitcoin underneath the Monetary Devices and Trade Act.

If accepted, that might formally deal with digital property as monetary merchandise—and will pave the way in which for a unified 20% tax by as early as subsequent 12 months.

Exchanges like bitFlyer already see Ethereum trades account for nearly half of their quantity. Any change may reshape Japan’s crypto market—by making it less complicated to commerce, and by bringing extra individuals into the fold.

Featured picture from Journey+Leisure, chart from TradingView

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.