The crypto market is seeing Bitcoin and XRP as potential buy-low alternatives, based on on-chain analytics agency Santiment. Retail merchants are displaying far much less pleasure towards Bitcoin and XRP in comparison with Ethereum, seemingly extra within the latter’s worth actions heading into the weekend.

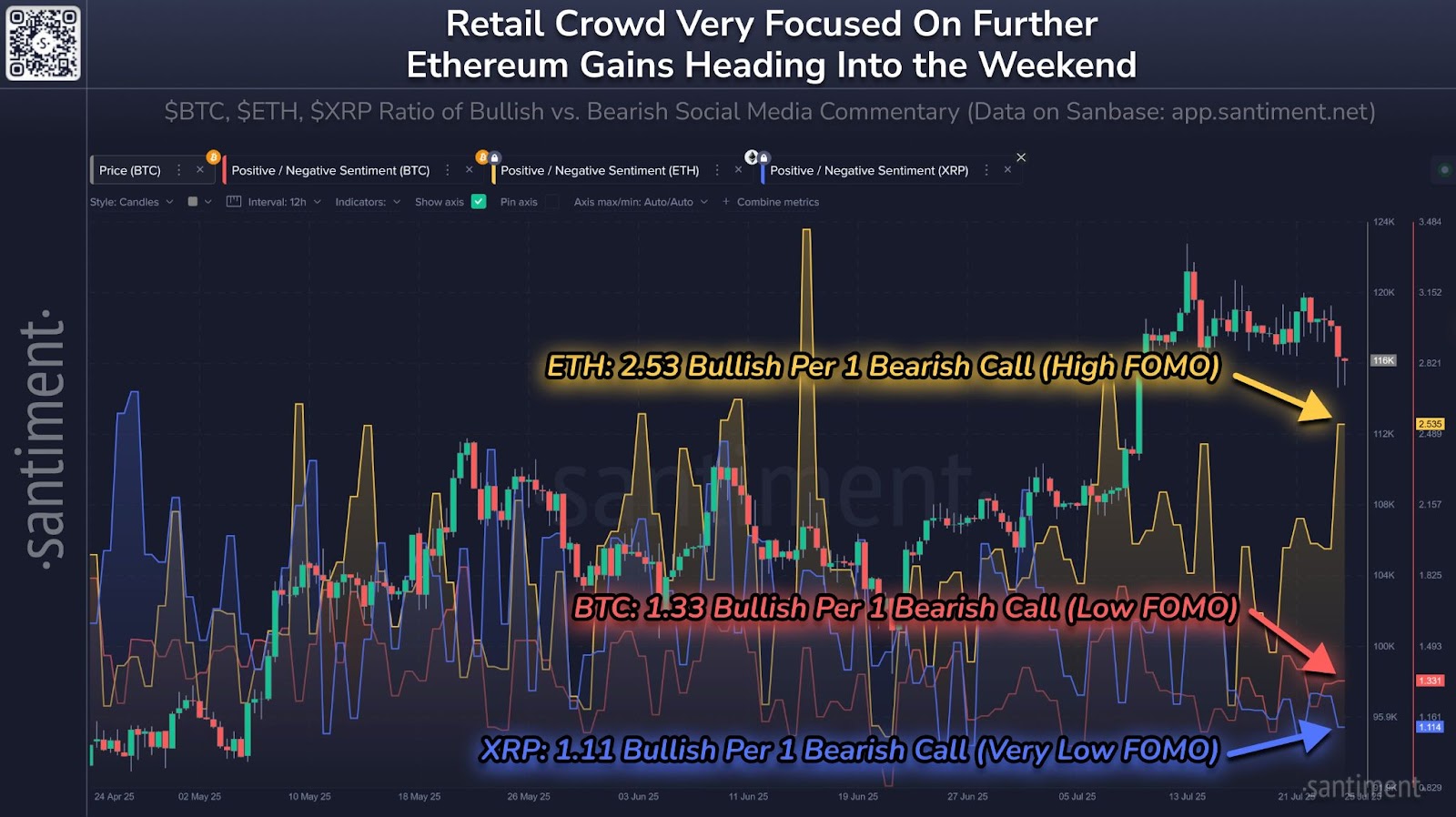

Santiment feed shared a social knowledge chart on X Friday that reveals an imbalance in how retail customers are speaking in regards to the high three cryptocurrencies on social media.

Santiment Feed Retail Crowd Social Mentions chart. Supply: Santiment

Ethereum leads the sentiment index by a 2.53 to 1 ratio of bullish to bearish calls. The excessive degree of optimism is interpreted as proof of Ether crowd FOMO, concern of lacking out, which may usually precede worth corrections for the related asset.

On the flipside, Bitcoin and XRP confirmed extra muted sentiment readings of 1.33 to 1 and a 1.11 to 1 bullish-to-bearish ratio, respectively. Santiment analysts word that such situations usually create entry factors, as markets have a tendency to maneuver in opposition to the bulk’s expectations.

Ethereum is extra susceptible to reversal, whereas BTC and XRP’s decrease enthusiasm ranges may create room for an upside worth acceleration.

Bitcoin nears all-time highs, may see good points

Regardless of having a comparatively impartial sentiment, Bitcoin has stored its strides close to the all-time excessive $123,000 degree. Over the previous week, it has traded inside a decent band between $123,120 and $123,471, after days of aggressive good points earlier within the month. The most important coin by market cap now factors to a attainable transitional part for the market, closing Friday’s buying and selling session.

Funding charges throughout main derivatives exchanges, together with Binance, OKX, Bybit, Deribit, BitMEX, and HTX, have been impartial to barely optimistic.

The absence of maximum lengthy positioning or extreme leverage may imply merchants are in a ”wait and see” stance, hoping for a transparent worth path.

In accordance with CryptoQuant contributor Nino, the market conduct is a seasonal lull in exercise sometimes called the “summer season doldrums,” which may precede heightened volatility later in Q3 2025.

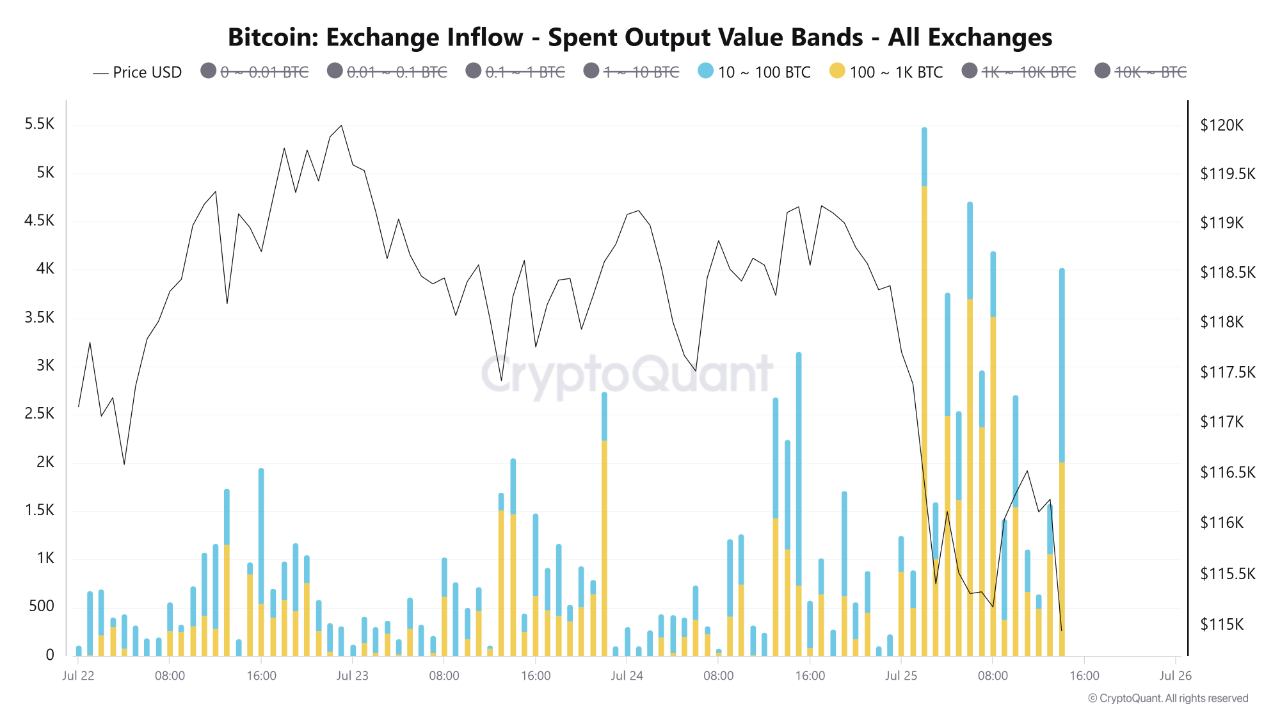

Alternate inflows present institutional exercise up throughout worth peaks

Over the interval between July 22 and July 25, Bitcoin’s worth ranged from $115,000 to $119,500, peaking on July 24 at 16:00 earlier than dropping to round $115,000 by the morning of July 25.

CryptoQuant’s trade influx knowledge reveals there was extra exercise from giant holders on the time, significantly within the mid-to-large worth bands. Wallets holding between 10 and 100 BTC recorded spikes in trade deposits across the worth peak on July 24.

BTC Alternate Influx chart. Supply: CryptoQuant

Equally, wallets within the 100 to 1,000 BTC and 1,000 to 10,000 BTC bands had excessive numbers of inflows on the similar time, suggesting that enormous stakeholders could have contributed to the worth motion by profit-taking or repositioning.

Smaller transactions, these between 0.01 and 1 BTC, have been regular all through the interval, however inflows from addresses holding over 10,000 BTC remained minimal, though a slight uptick was registered in the course of the July 24 peak.

XRP low social curiosity may spark short-term rally

In the meantime, XRP has a subdued social media sentiment, because it ranks lowest among the many three property tracked by Santiment. The 1.11 to 1 bullish-to-bearish commentary ratio means that few merchants are presently taking note of XRP’s potential.

XRP’s worth has not dropped under $2.99 within the final seven days, and bulls and bears haven’t had sufficient impression to sway the token in both path by a lot.

Per Santiment’s evaluation, this lack of consideration could itself turn out to be a bullish indicator. XRP has beforehand staged worth recoveries throughout instances of low engagement, and present situations could also be setting the stage for the same transfer.