Disclaimer: The analyst who wrote this text owns shares in Technique.

Technique (MSTR), below the management of Govt Chairman Michael Saylor, could have simply finalized its largest most well-liked inventory issuance to this point with an STRC (Stretch) providing becoming a member of the STRD, STRF and STRK most well-liked shares to construct out the corporate’s credit score yield curve.

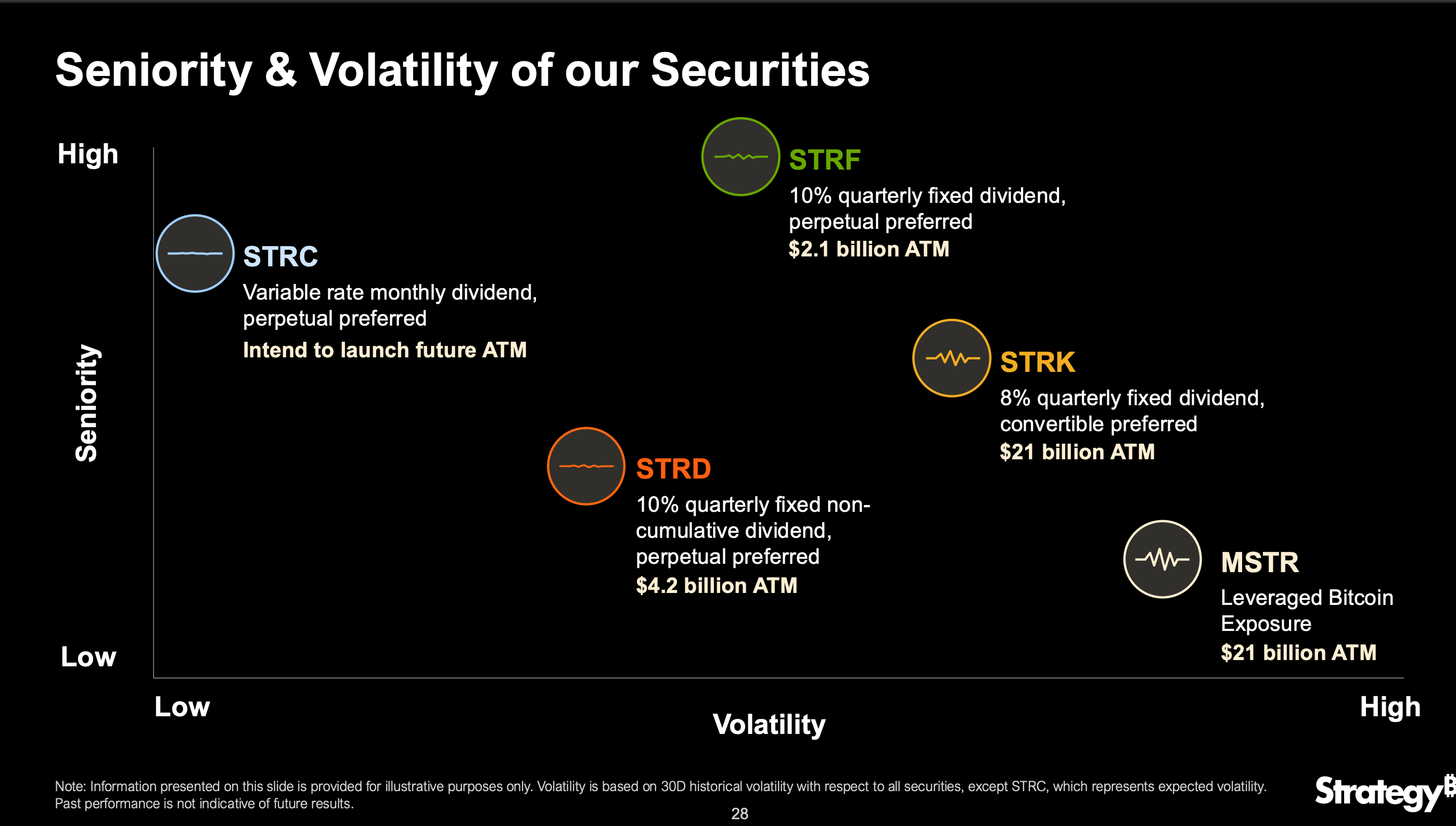

Amongst these, STRC is ranked excessive in seniority and low in anticipated volatility. It provides a brand new short-duration layer to Technique’s financing combine and diversifies how the corporate can increase capital for BTC acquisition.

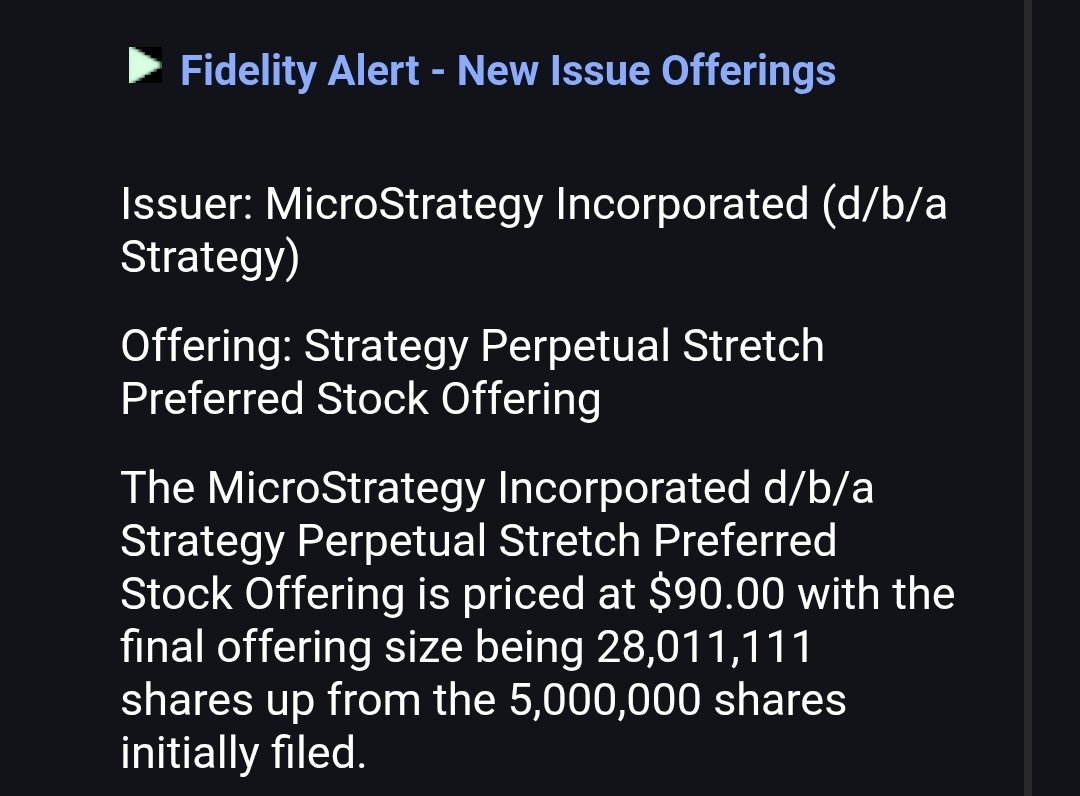

Constancy Alert MSTR STRC (Constancy)

In keeping with a Constancy alert on X, the deal is 28 million shares priced at $90 every, totaling over $2.52 billion. This represents a dramatic improve from the unique $500 million purpose introduced simply days earlier and underscores the corporate’s continued ambition to aggressively broaden its bitcoin

holdings.

Stretch Most popular Inventory (Technique)

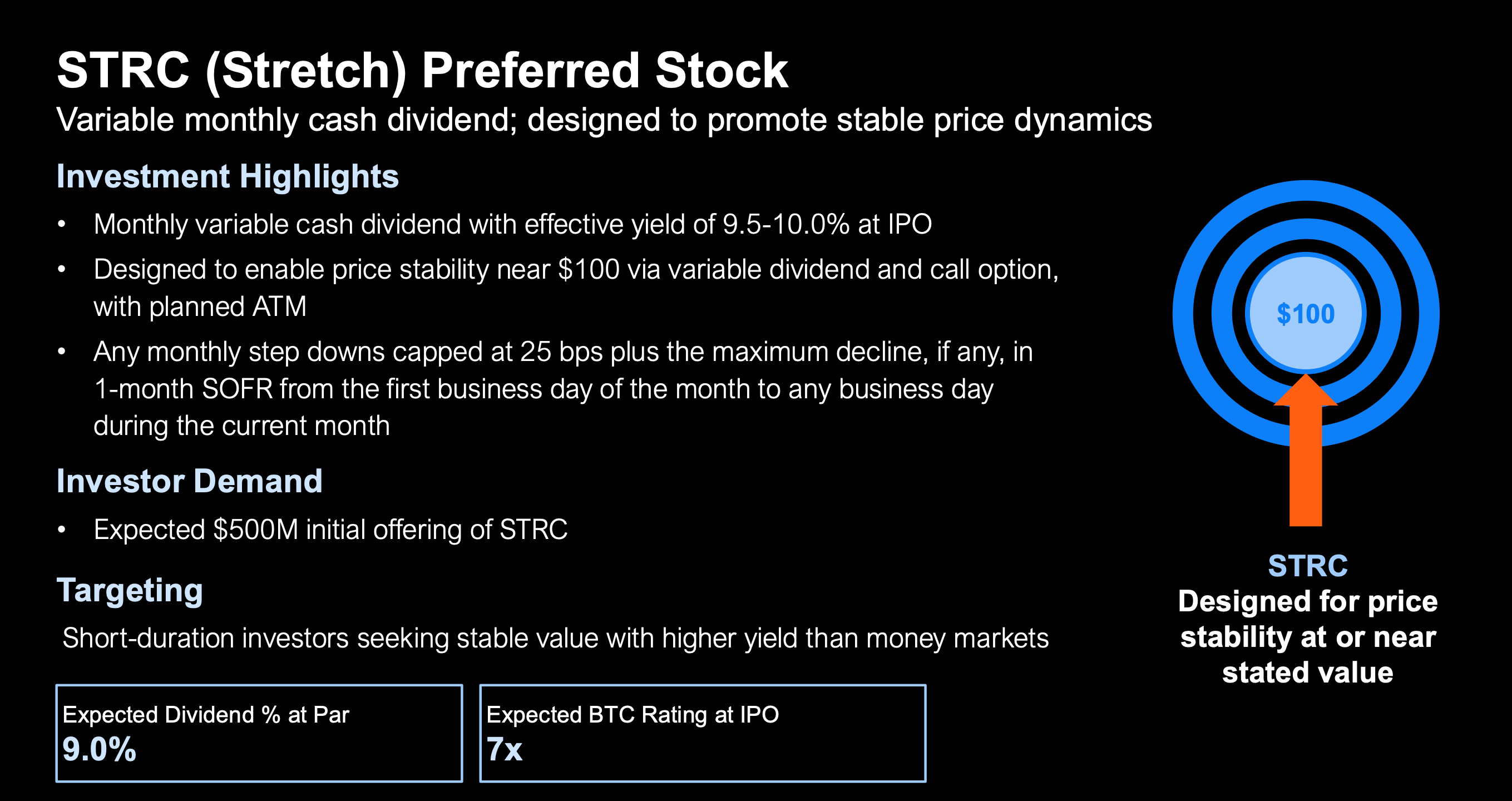

STRC is a senior, perpetual most well-liked inventory providing a variable month-to-month dividend designed to attraction to yield-seeking traders who need stability close to par worth. On the time of the providing, STRC carried an efficient yield of 9.5%–10.0% paid month-to-month. It accommodates mechanisms to keep up a buying and selling vary near $100, together with adjustable dividend charges, secondary issuance home windows and name choices above par.

Stretch Most popular Inventory (Technique)

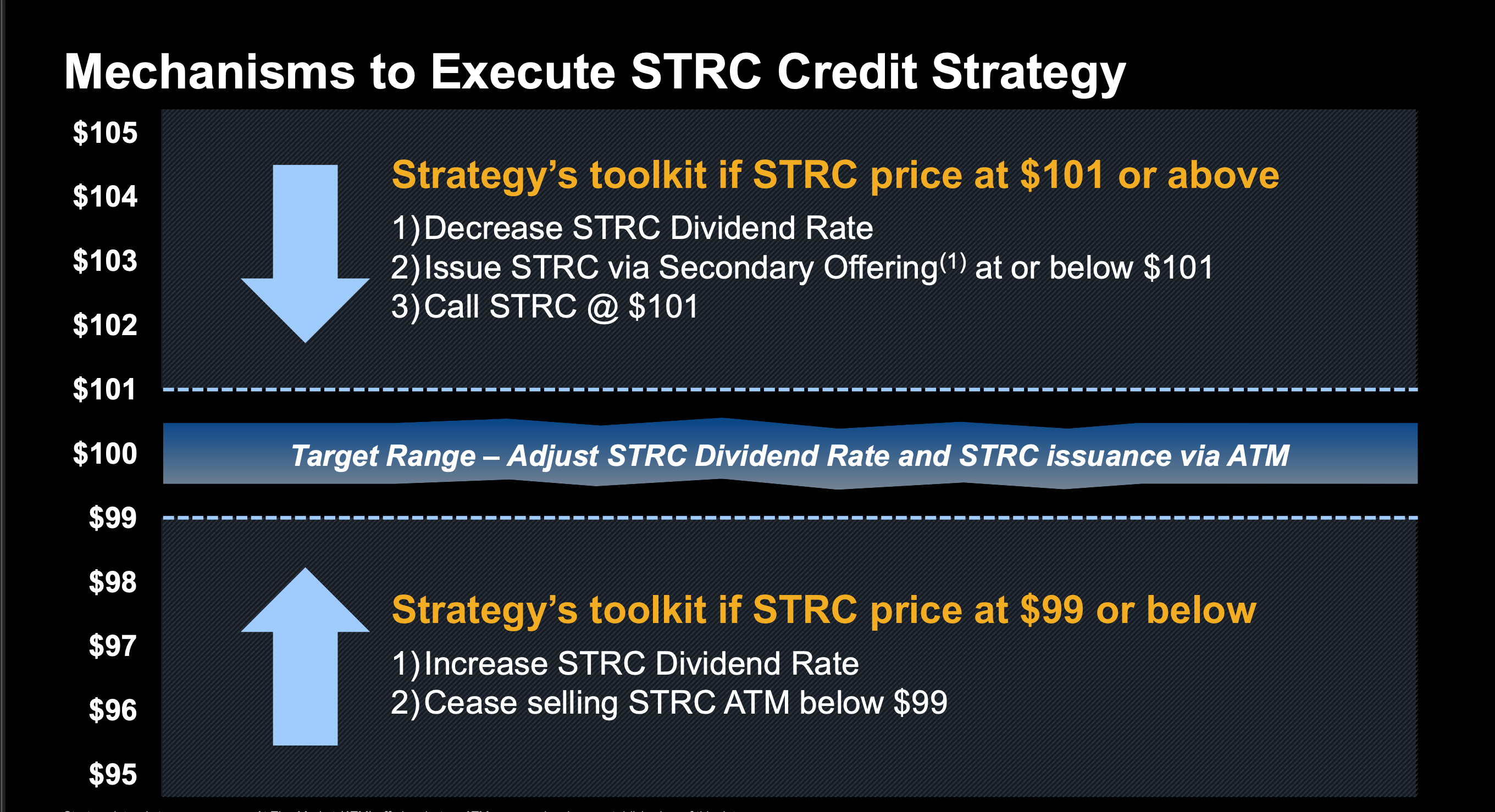

The toolkit consists of elevating dividends and halting gross sales when STRC trades beneath $99, or issuing new shares and calling the inventory if it rises above $101. These levers are designed to create a self-correcting system that promotes market stability whereas providing engaging returns within the present interest-rate setting.

Any step-downs within the dividend are capped at 25 foundation factors plus the utmost decline within the one-month secured in a single day financing price (SOFR) over the interval.

Stretch Most popular Inventory (Technique)

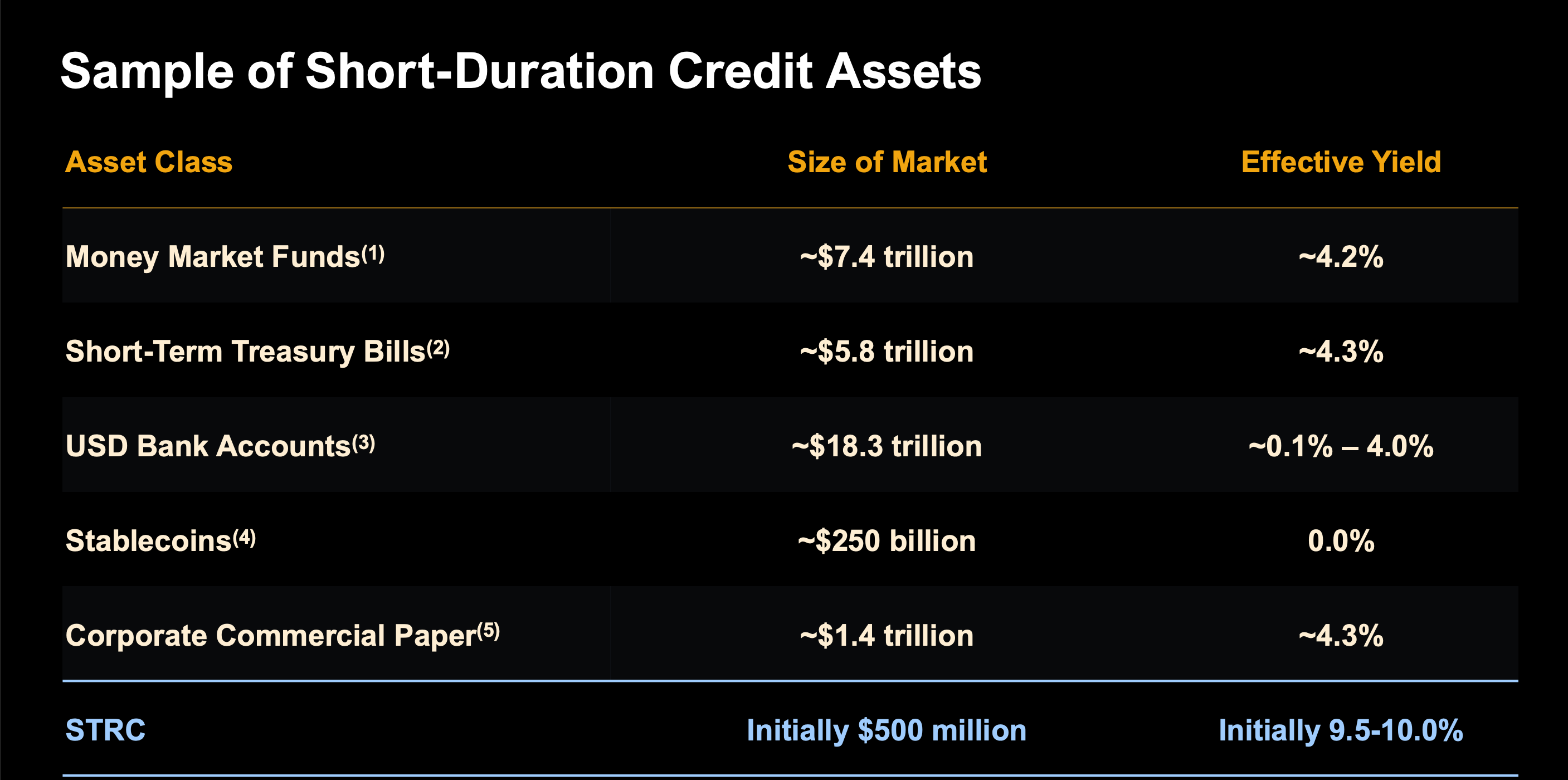

In contrast with standard short-duration credit score choices, STRC stands out, providing greater than double the 4% obtainable from cash market funds and Treasury payments. It’s focusing on traders on the lookout for greater yield with out important worth volatility, positioning it competitively in opposition to conventional devices like industrial paper and financial institution deposits.

Stretch Most popular Inventory (Technique)