Bitcoin (BTC) continues to commerce inside a slender worth vary, exhibiting restricted upward motion over the previous week. On the time of writing, the main cryptocurrency is priced round $117,719, representing a 1% decline prior to now 24 hours and a 4.2% drop from its latest all-time excessive above $123,000.

Amid this worth efficiency, a latest evaluation shared on CryptoQuant’s QuickTake platform by contributor BorisVest sheds gentle on doable underlying market dynamics influencing Bitcoin’s present state.

In response to the analyst, knowledge from Binance futures means that regardless of muted volatility, sure buying and selling patterns might be shaping BTC’s near-term course.

These observations have prompted discussions about whether or not market makers are intentionally sustaining a managed vary earlier than a big worth transfer happens.

Binance Knowledge Suggests Strategic Positioning

BorisVest highlighted that Open Curiosity on Binance has remained regular between $13 billion and $14 billion over the previous 20 days. This stability signifies that whereas new positions usually are not quickly growing, present trades are being actively maintained.

“Such habits in a variety surroundings typically indicators silent accumulation or strategic stalling,” the analyst wrote, suggesting that bigger gamers could also be fastidiously managing publicity throughout this consolidation section.

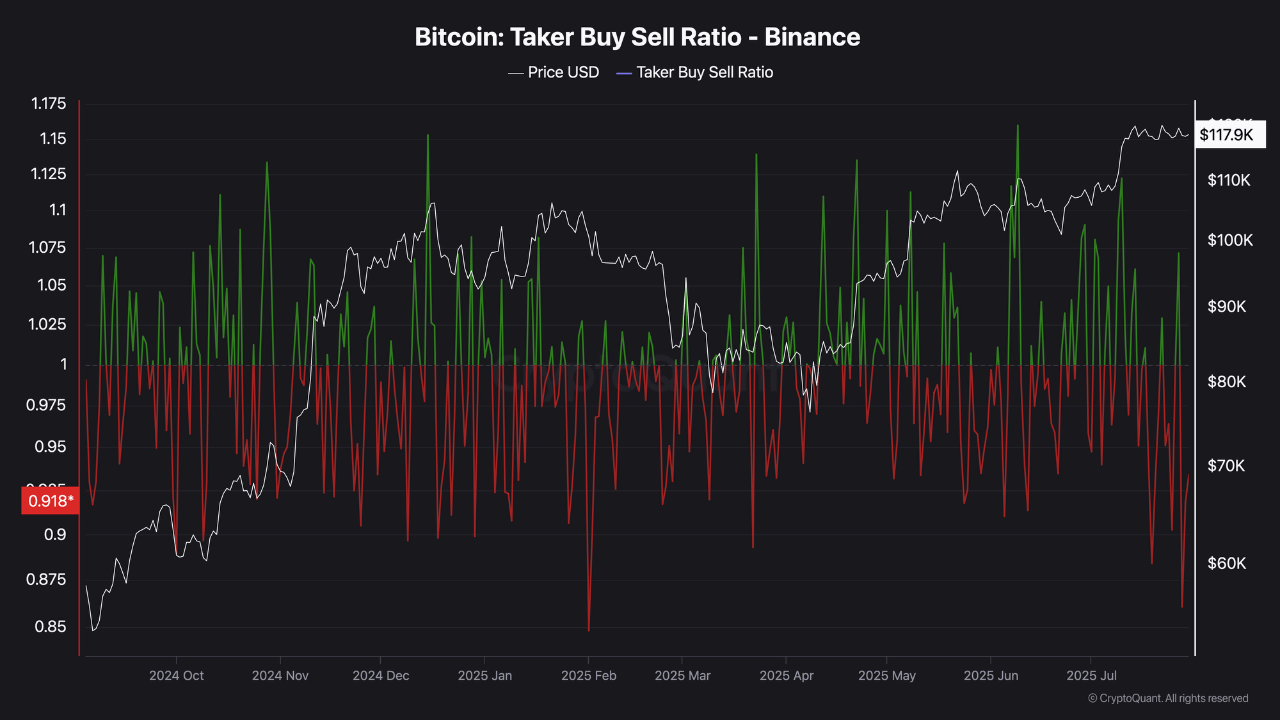

The Taker Purchase/Promote Ratio, at the moment at 0.9, factors to elevated promoting strain from market takers. Nevertheless, Bitcoin’s worth has not skilled a pointy decline regardless of this exercise, indicating that passive patrons are absorbing the promote orders.

BorisVest added that the Funding Fee, hovering round 0.01, displays a scarcity of aggressive leverage from both lengthy or brief positions. This might imply that institutional or high-volume merchants are constructing positions step by step, avoiding extremes that usually result in fast worth swings.

Bitcoin Potential Draw back Shakeout Earlier than a Breakout

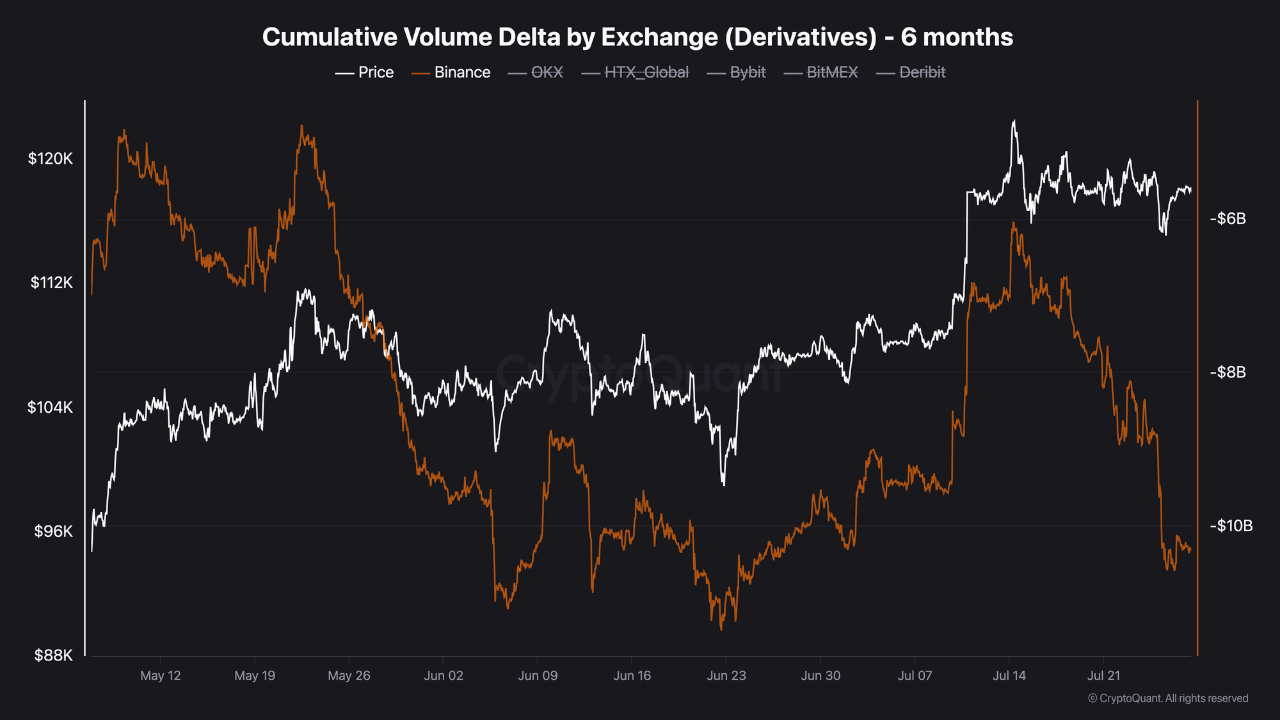

The evaluation additionally examined Cumulative Quantity Delta (CVD) knowledge on Binance, which reveals persistent promoting in futures markets. But, regardless of ongoing sell-side exercise, Bitcoin continues to withstand vital downward motion. In response to BorisVest, this might set the stage for a possible liquidity-driven shakeout.

He steered that BTC would possibly quickly dip towards $110,000 to filter weak lengthy positions and appeal to extra brief curiosity. This might pave the best way for a stronger, extra sustainable breakout sooner or later.

Whereas these metrics don’t assure an imminent breakout or breakdown, they level to a fragile equilibrium in Bitcoin’s market construction. Traditionally, extended consolidation phases in BTC have typically preceded sharp strikes in both course.

Featured picture created with DALL-E, Chart from TradingView