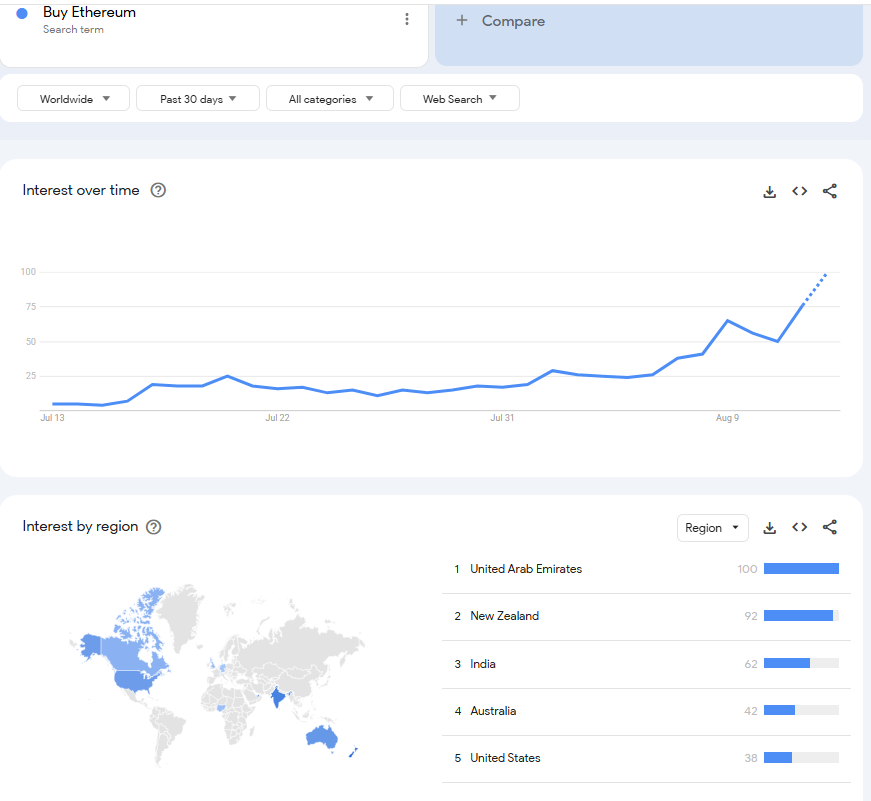

As Ethereum’s (ETH) worth tears previous main resistance ranges, international curiosity in buying the asset has surged over the previous month, leaping practically 20-fold.

On July 13, search curiosity stood at simply 5 on Google’s scale of 0 to 100. By August 13, it’s projected to hit 100, the best stage in at the least a 12 months, marking a 1,900% improve, based on Google Tendencies information retrieved by Finbold.

Geographically, the United Arab Emirates recorded the best curiosity with a rating of 100, adopted by New Zealand (92), India (62), Australia (42), and america (38).

It’s price noting that search curiosity doesn’t instantly translate to purchasing exercise. Nonetheless, such spikes in on-line consideration typically precede durations of heightened market volatility.

If the development continues, Ethereum might face elevated upward stress, doubtlessly testing key resistance ranges within the close to time period.

ETH worth evaluation

This surge comes after Ethereum rallied previous the $4,600 mark. As of press time, ETH traded at $4,618, up over 6% previously 24 hours. On the weekly chart, the asset has gained 27%.

Moreover, technical setups recommend Ethereum might prolong this momentum. Particularly, evaluation by Gert van Lagen, shared in an X put up on August 13, indicated that the second-largest cryptocurrency by market capitalization has damaged out of a four-year inverse Head and Shoulders sample, doubtlessly paving the best way for a rally towards $22,000.

Based on the analyst, Ethereum is on monitor to finish its 2019–2025 bull market cycle with a textbook Increasing Diagonal formation. This bullish construction alerts sustained upside potential if the sample continues as anticipated.

On the similar time, for sustained momentum, Ethereum will possible require continued inflows from institutional buyers by way of exchange-traded funds (ETFs).

On this regard, Coinglass information retrieved by Finbold on August 13 exhibits that Ethereum spot ETFs recorded $523.9 million in web inflows on August 12, led by BlackRock’s ETHA with $318.7 million and Constancy’s FETH with $144.9 million.

Grayscale’s ETH and ETHE merchandise added $44.3 million and $9.3 million, respectively, whereas different issuers posted smaller positive aspects. The day gone by noticed a good bigger $1.02 billion influx.

If these inflows persist and the $4,500 assist stage holds, Ethereum might be on monitor to focus on the $5,000 mark.

Featured picture through Shutterstock