Ethereum’s rally exhibits no signal of slowing as Ethereum value immediately trades round $4,674 after a pointy upside break this week. The transfer has pushed ETH to its highest level since early 2022, slightly below the $4,869 resistance zone that’s seen on the weekly chart. Merchants are keeping track of the bulls to see if they will hold this run going or if the rally will cease for some time to calm down.

Ethereum Worth Forecast Desk: August 14, 2025

What’s Taking place with Ethereum’s Worth?

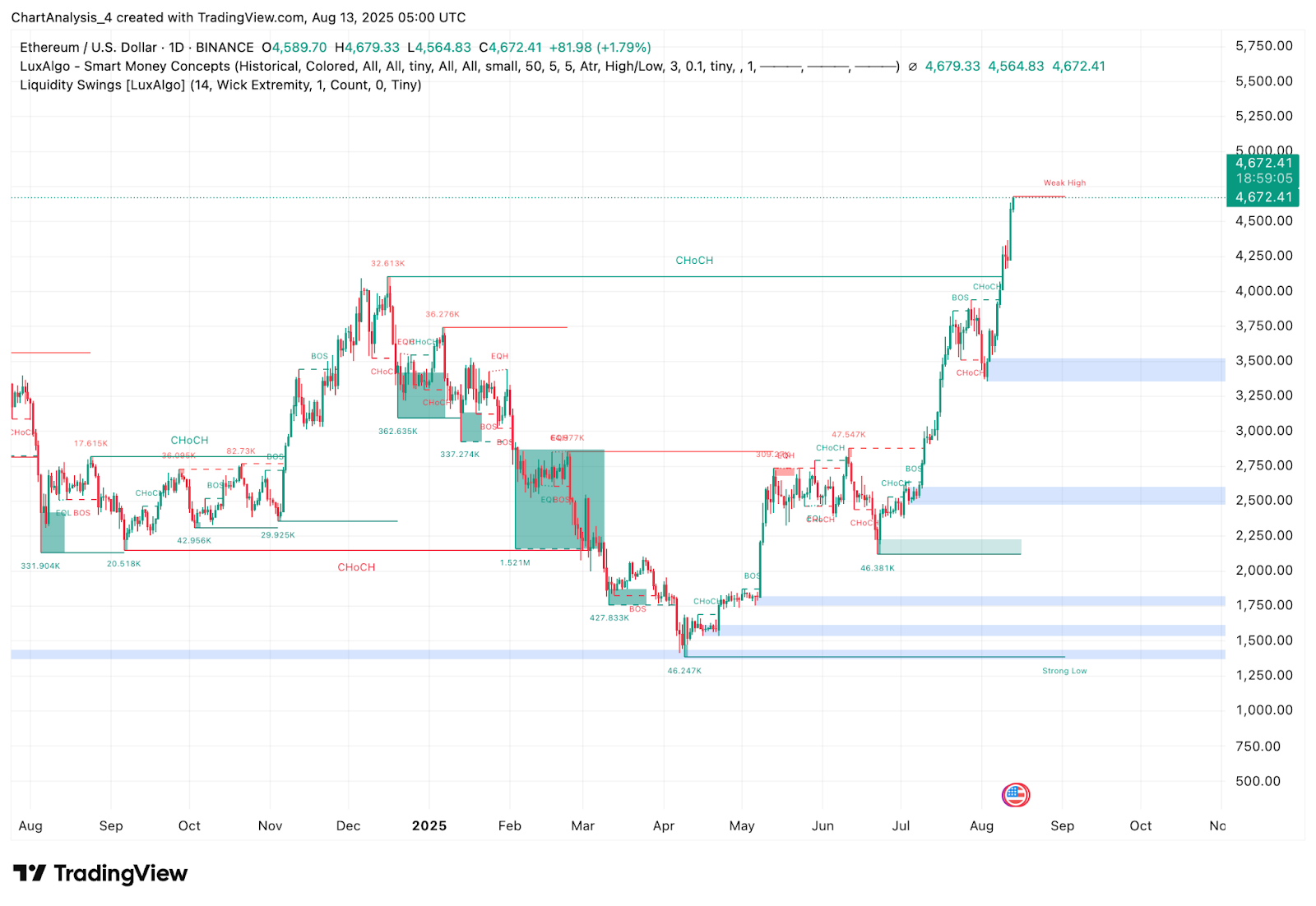

ETH value dynamics (Supply: TradingView)

When Ethereum broke above the $4,092 resistance stage on the day by day chart, it precipitated a transparent “Change of Character” (CHoCH) in Sensible Cash Ideas phrases, which confirmed a bullish shift. The worth has shot as much as a “Weak Excessive” at $4,869, which is a stage that will get examined once more when momentum is that this robust.

ETH value dynamics (Supply: TradingView)

The Supertrend indicator on the 4-hour chart exhibits a gradual rise, and it stays bullish with its flip stage at $4,386.31. The Directional Motion Index (DMI) exhibits that +DI is at 45.66, which is far increased than –DI at 9.87. Because of this consumers have robust management over the route.

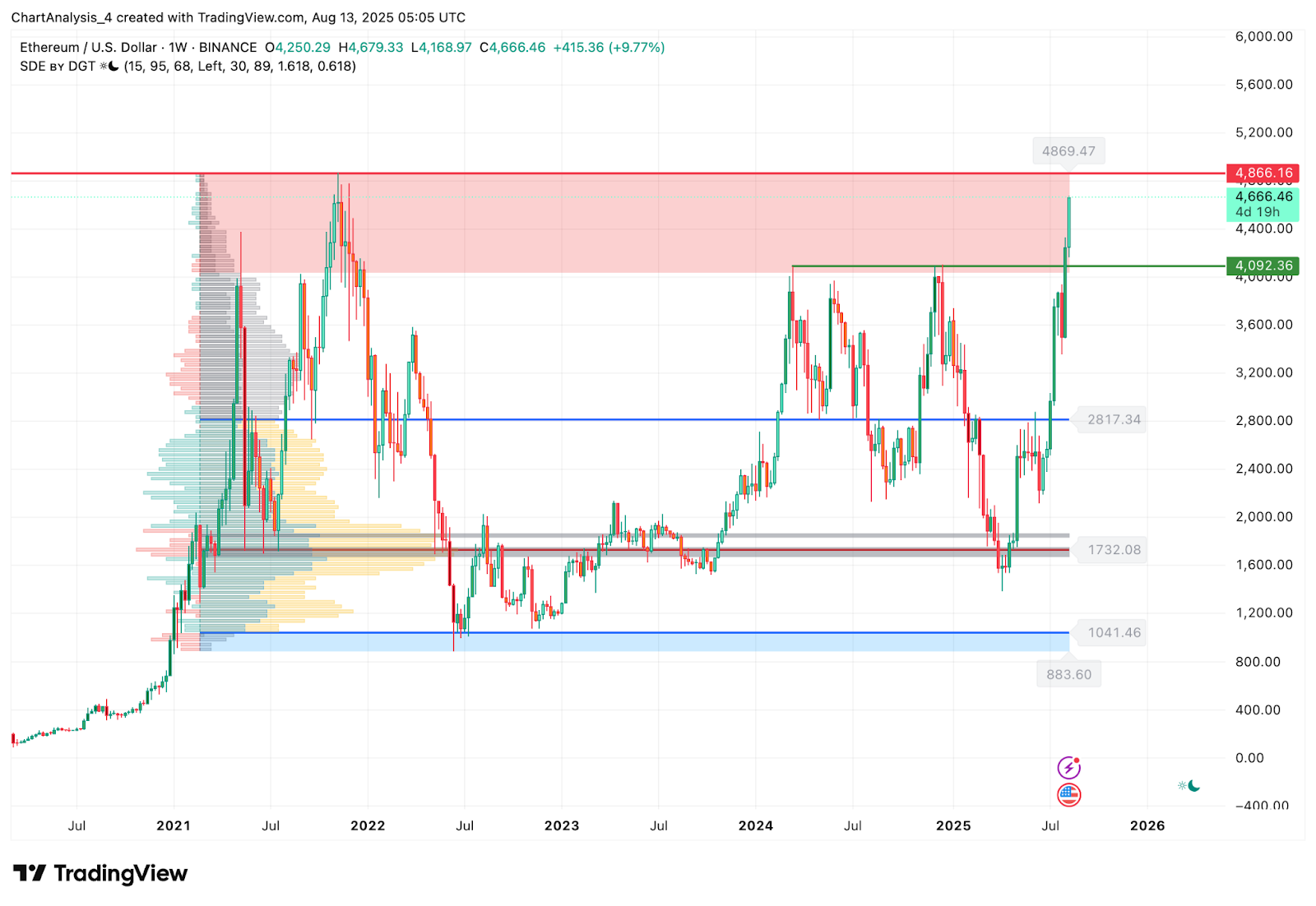

ETH value dynamics (Supply: TradingView)

Weekly quantity profile highlights the $4,869 to $4,870 band as a high-volume resistance space. The subsequent important liquidity hole is above this zone, which suggests a breakout may speed up the transfer.

Why Ethereum Worth Going up Immediately?

ETH value dynamics (Supply: TradingView)

Each technical and market circulation components are driving Ethereum’s power. On the intraday 30-minute chart, ETH broke free from a consolidation triangle on August 12 and cleared the $4,400 provide zone with an explosive transfer. VWAP readings present $4,656.09 (higher band) and $4,626.03 (midline), with value now holding above each, a transparent signal of intraday bullish management.

ETH value dynamics (Supply: TradingView)

RSI (14) on this timeframe is at 76.14, indicating overbought circumstances, however in robust developments, such readings usually persist for longer. The rise additionally coincides with a bounce in derivatives exercise.

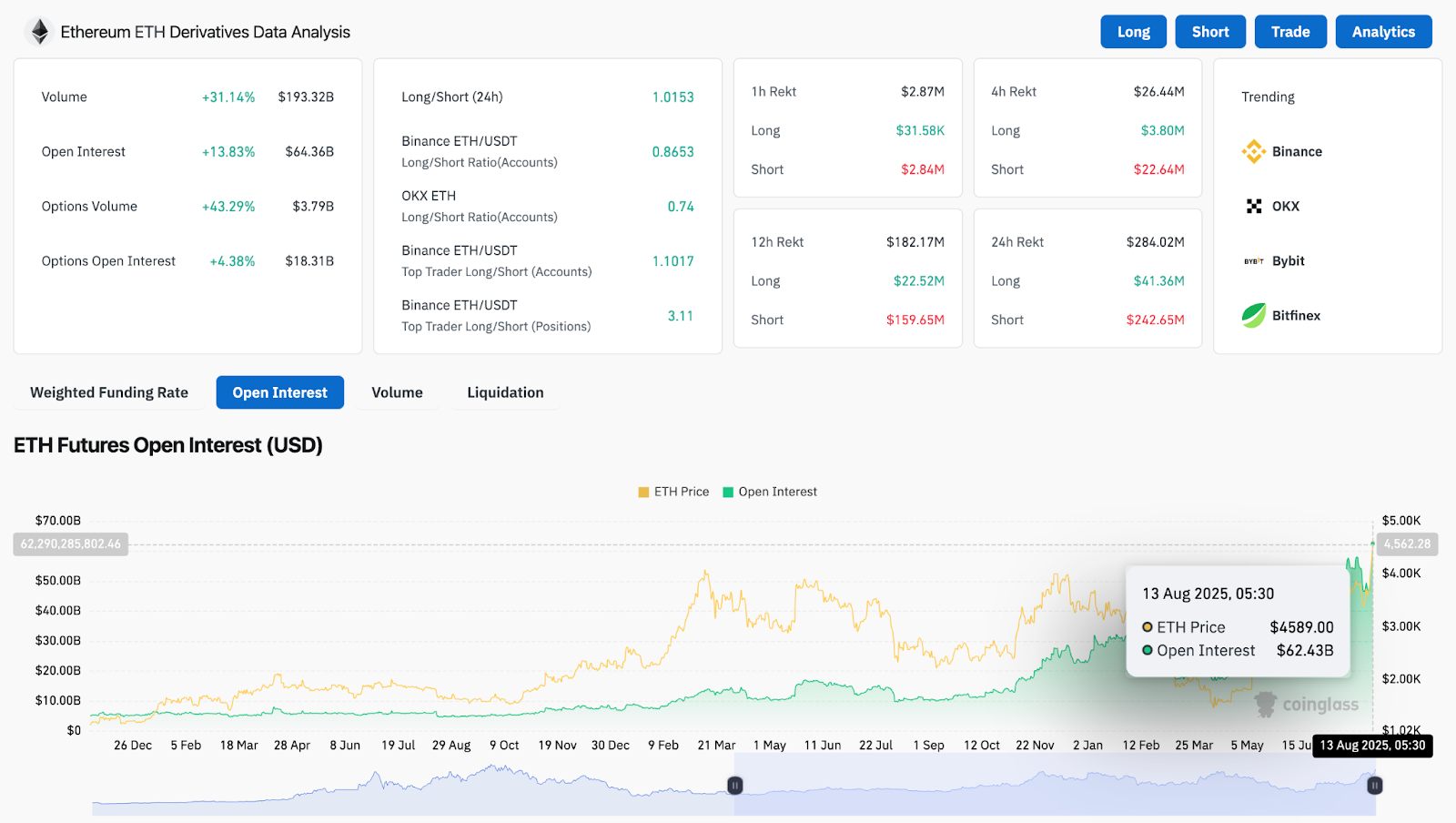

ETH By-product Evaluation (Supply: Coinglass)

Coinglass information for August 13 exhibits open curiosity up 13.83 p.c to $64.36B, whereas choices quantity spiked 43.29 p.c to $3.79B. Lengthy/quick ratios stay constructive, with Binance prime dealer positions closely skewed lengthy at 3.11.

EMA Cluster and Keltner Channels Verify Momentum

ETH value dynamics (Supply: TradingView)

On the 4-hour chart, Ethereum trades above all main EMAs. EMA20 is at $4,357.01, EMA50 at $4,125.27, EMA100 at $3,922.84, and EMA200 at $3,640.32. This stacked configuration helps sustained upside.

Keltner Channels (KC 20,2) present the higher band at $4,540.95, with ETH comfortably buying and selling above it. This means robust momentum. Sometimes, such strikes are adopted by both continuation surges or transient pullbacks towards the higher channel earlier than resuming development.

Quantity profile on the weekly chart additionally exhibits ETH has damaged above the $4,092 high-volume node, leaving restricted resistance earlier than the $4,869 prime.

Ethereum Worth Prediction: Quick-Time period Outlook (24h)

If ETH sustains above $4,656, bulls may make a direct push towards $4,750 after which $4,869. A breakout above $4,869 would put $5,000 in view, particularly with derivatives positioning strongly favoring longs.

If profit-taking units in, first assist lies at $4,540 (Keltner higher band) adopted by $4,386 (Supertrend assist). A drop beneath $4,386 can be the primary signal that short-term momentum is fading, with deeper assist at $4,092.

Given the mixture of robust development construction, rising open curiosity, and bullish EMAs, the bias for the following 24 hours stays bullish, with merchants watching the $4,869 stage carefully.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be accountable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.