Japan’s Monetary Companies Company (FSA) is getting ready to approve the issuance of yen-denominated stablecoins as early as this fall, marking the primary time the nation will permit a home fiat-pegged digital forex.

Tokyo-based fintech agency JPYC will register as a cash switch enterprise inside the month and can lead the rollout, Japanese information outlet The Nihon Keizai Shimbun reported on Sunday.

JPYC is designed to take care of a hard and fast worth of 1 JPY = 1 yen, backed by extremely liquid belongings equivalent to financial institution deposits and Japanese authorities bonds. After buy functions from people or firms, the tokens are issued by way of financial institution switch to digital wallets.

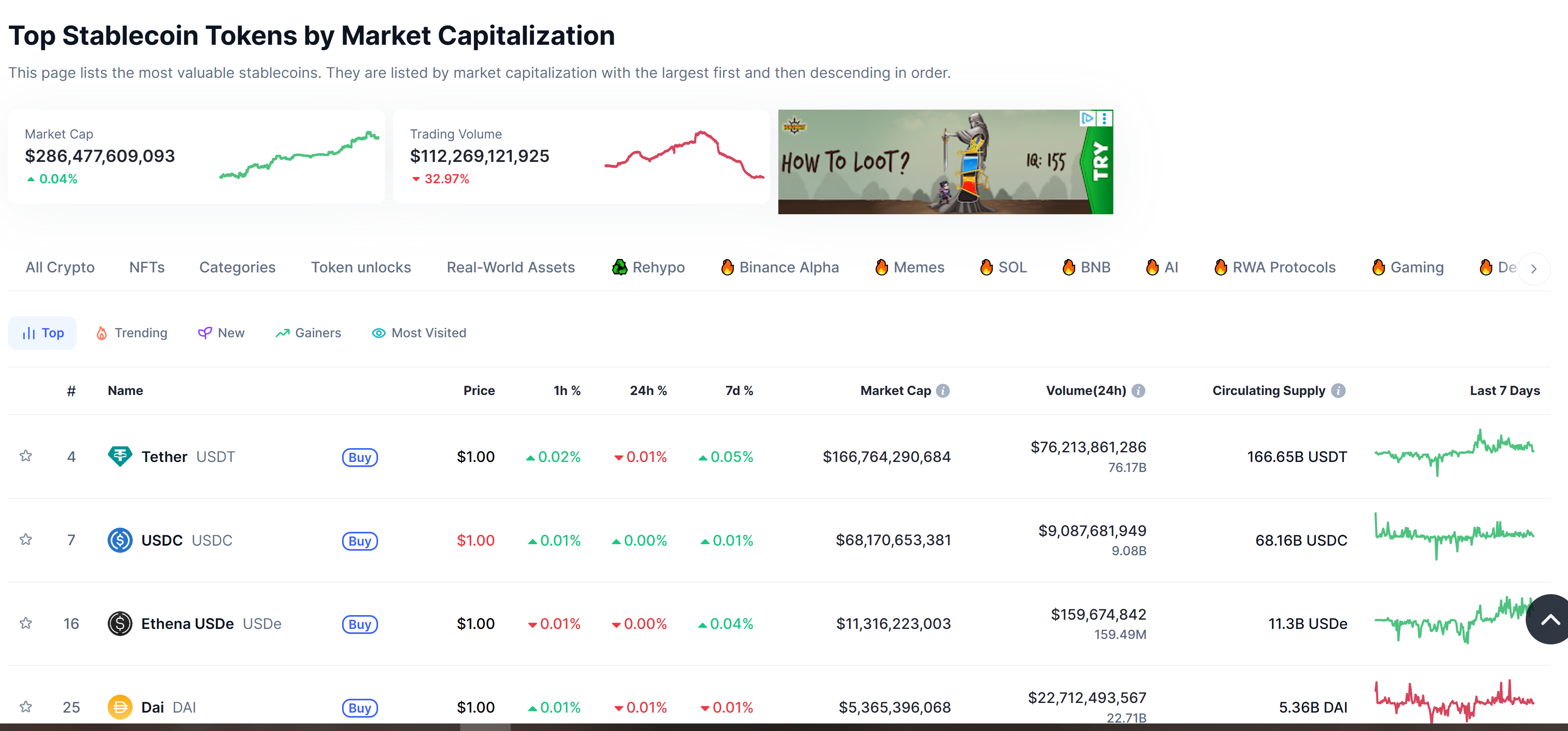

The approval comes as the worldwide stablecoin market, dominated by dollar-pegged belongings like USDt (USDT) and Circle’s USDC (USDC), has expanded to greater than $286 billion. Whereas US greenback stablecoins have already got a foothold in Japan, this would be the nation’s first yen-based providing.

Prime stablecoins by market cap. Supply: CoinMarketCap

Associated: Metaplanet outperforms Japan’s most liquid blue-chip shares in 2025

Yen stablecoins might reshape Japan’s bond market

In a current publish on X, Okabe, a consultant of the JPYC issuing firm, stated yen stablecoins might have a major impact on Japan’s bond market. He famous that within the US, main stablecoin issuers have turn out to be main patrons of US Treasurys, holding them as collateral for circulating tokens.

An identical development in Japan, he recommended, might increase demand for Japanese authorities bonds (JGBs) if JPYC features widespread adoption. “JPYC will doubtless begin shopping for up Japanese authorities bonds in giant portions going ahead,” he wrote.

Okabe additionally famous that international locations lagging in stablecoin improvement threat increased authorities bond rates of interest, as they miss out on a brand new class of institutional demand. He argued that financial coverage concerns at the moment are driving governments, together with Japan, to speed up stablecoin frameworks.

Associated: Japan’s crypto tax overhaul: What buyers ought to know in 2025

Circle launches USDC in Japan

As reported, Circle formally launched USDC in Japan on March 26, following regulatory approval for its itemizing on SBI VC Commerce, a crypto alternate operated below a three way partnership between SBI Holdings and Circle Japan KK.

The approval, granted on March 4, marked the primary time the nation’s Monetary Companies Company cleared a foreign-issued stablecoin below its regulatory framework.

On the time, Circle stated it plans to develop USDC listings to Binance Japan, bitbank, and bitFlyer, two of which rank amongst Japan’s largest exchanges, every processing over $25 million in every day quantity and drawing greater than 1.85 million month-to-month visits.

Journal: MapleStory apologizes for cheaters, Tokyo Beast blows up in Japan, FIFA Rivals