Japan’s Monetary Providers Company (FSA) is getting ready sweeping modifications to its digital asset framework. The modifications, which mix tax reforms and regulatory upgrades, might introduce exchange-traded funds (ETFs) tied to cryptocurrencies.

The initiative indicators Japan’s intent to combine crypto into mainstream finance and entice broader funding.

Tax Burden Below Assessment

The reform bundle, reported domestically, contains two key components. First, it consists of revising the tax code that might transfer crypto from complete taxation to the identical class as equities. Second, it features a authorized modification reclassifying crypto as a monetary product, enabling the FSA to use insider-trading guidelines, disclosure requirements, and investor protections below the Monetary Devices and Trade Act.

At the moment, Japan taxes crypto positive aspects as “miscellaneous earnings,” with progressive charges that may exceed 50 p.c as soon as native levies are included. Alternatively, equities and bonds are topic to a 20 p.c flat tax.

In keeping with Nikkei, the FSA has proposed shifting crypto into that 20 p.c system in fiscal 2026. Buyers would additionally be capable to carry ahead losses for 3 years. Officers consider parity with shares will cut back investor burden and enhance market exercise.

Regulatory Shift to Allow ETFs

The FSA’s second pillar entails amending securities regulation to categorise crypto as a monetary product. This could clear the trail for crypto ETFs, together with spot Bitcoin funds, which stay unavailable in Japan. Observers argue ETFs might present accessible, regulated choices for traders whereas boosting market transparency.

In keeping with BeInCrypto, the company additionally plans an inner restructuring, making a bureau devoted to digital finance and insurance coverage. That displays how crypto has turn out to be intertwined with broader monetary methods, requiring constant oversight.

Japan’s historical past with crypto illustrates each danger and resilience. In 2014, Tokyo-based Mt. Gox as soon as processed over 70 p.c of world Bitcoin trades earlier than collapsing. Regulators embedded classes from that disaster into right this moment’s stricter frameworks.

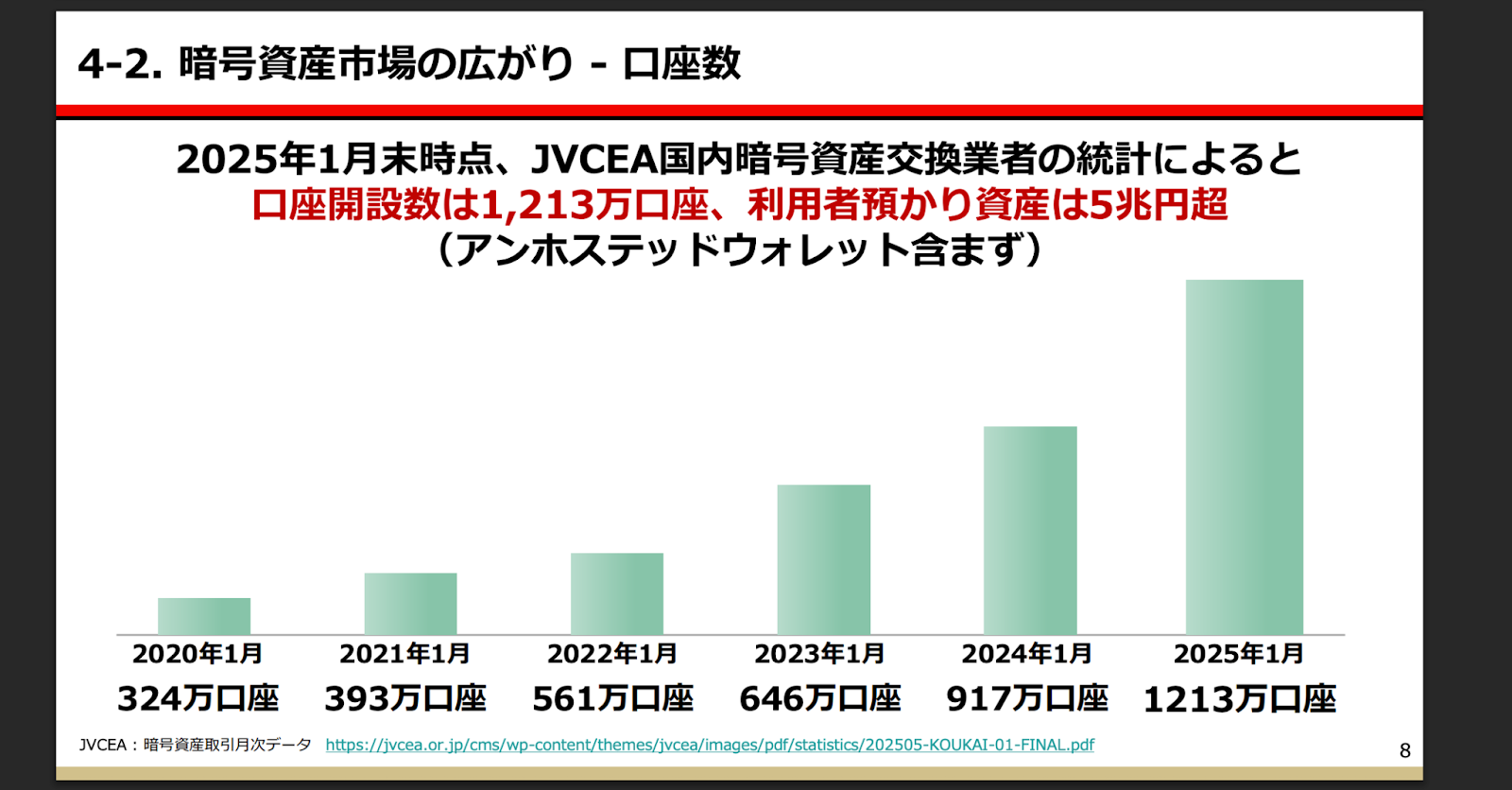

The variety of custody wallets in Japan. Supply: JVCEA

Momentum has since shifted towards measured however regular progress. Japan Crypto Enterprise Affiliation Vice Chairman Shiraishi has documented the worldwide market’s growth from $872 billion to $2.66 trillion. In distinction, Japan’s home buying and selling quantity superior from $66.6 billion in 2022 and is forecast to double to $133 billion. This underscores that whereas company adoption is accelerating, retail participation stays subdued.

88% Nationals By no means Owned Bitcoin

A survey by the Cornell Bitcoin Membership, cited by DocumentingBTC, discovered that 88 p.c of Japanese residents have by no means owned Bitcoin. Analysts counsel that tax burdens and regulatory uncertainty have discouraged wider family adoption. The FSA’s reforms purpose to handle these boundaries by simplifying tax therapy and offering trusted ETF buildings.

Institutional curiosity, nevertheless, is rising. A joint survey by Nomura Holdings and Laser Digital revealed that 54 p.c of Japanese institutional traders plan to spend money on crypto belongings inside three years, with 62 p.c citing diversification advantages. The FSA additionally revealed the findings, noting most well-liked allocations of two–5 p.c of belongings below administration. The outcomes spotlight readiness amongst main monetary gamers to embrace ETFs as soon as regulatory situations permit.

The reforms align with Japan’s “New Capitalism” agenda, emphasizing investment-led progress. By clarifying the authorized framework and decreasing tax burdens, officers hope to encourage households to deal with digital belongings as a part of long-term portfolios relatively than purely speculative bets.

The put up Japan Prepares Massive Scale Amend of Crypto Insurance policies appeared first on BeInCrypto.