Ethereum broke via to $4,880 Friday, reaching its highest recorded worth so far, whereas Solana crossed the $200 mark for the primary time in eight months, and XRP pulled off a pointy return to 3rd place in complete crypto market worth.

This aggressive motion on the high of the board adopted new indicators from the U.S. Federal Reserve and chaos round an ETH-heavy inventory providing from an organization backed by Peter Thiel.

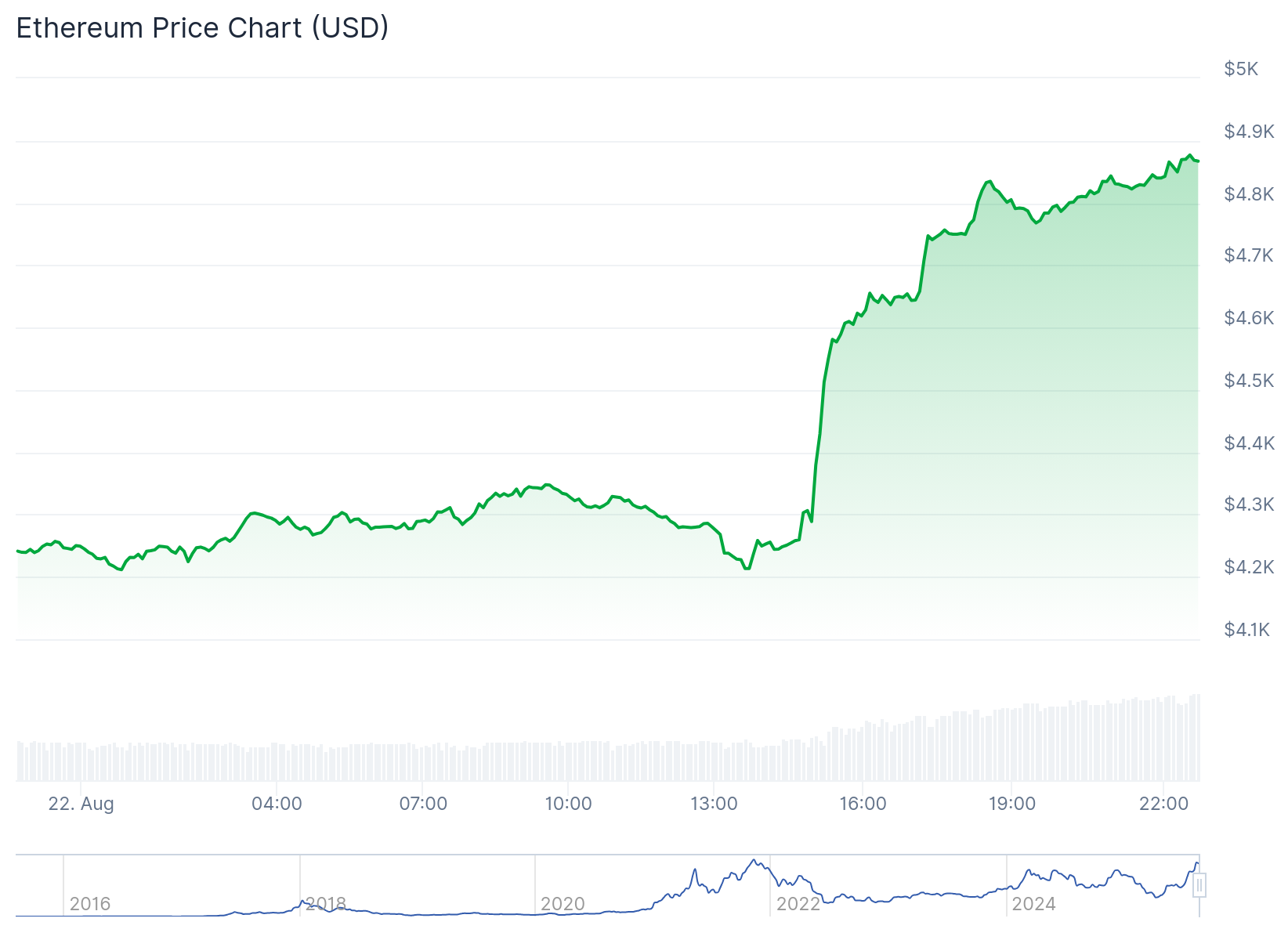

In response to knowledge from CoinGecko, Ethereum moved up 14.4% in 24 hours, whereas Bitcoin climbed 4%, reaching $116,826, however staying flat throughout the previous hour.

ETH/USDT worth 1d worth chart

Solana adopted shut behind, leaping 11.3% to hit $203, and XRP rose 7.3% in the identical timeframe to succeed in $3.08, overtaking Tether in complete worth. XRP’s present market cap is $183.5 billion, whereas Ethereum’s climbed to $587.1 billion with a day by day buying and selling quantity of practically $50 billion.

Powell hinted at cuts, merchants responded with $300M in minutes

Jerome Powell, Chair of the Federal Reserve, addressed the central financial institution’s annual gathering in Jackson Gap, Wyoming, on Friday. He stated, “The baseline outlook and the shifting stability of dangers might warrant adjusting our coverage stance,” including that “the stability of dangers seem like shifting” between sustaining steady costs and full employment.

He additionally pointed to “sweeping adjustments” in tax coverage, commerce, and immigration, pushing traders to brace for a possible shift in financial coverage.

After Powell’s feedback, the CME Group’s FedWatch Instrument confirmed the likelihood of a quarter-point fee lower in September jumped to 83%, up from 75% earlier in the identical week. Chris Zaccarelli, Chief Funding Officer at Northlight Asset Administration, reacted by saying, “The bar is extraordinarily excessive now for the Fed to depart charges unchanged in lower than a month.”

Markets didn’t look ahead to affirmation. Inside quarter-hour of Powell’s speech, about $300 million flooded into Binance derivatives, immediately pushing Bitcoin’s Open Curiosity on Binance to roughly $13.3 billion. Liquidity poured into futures, not spot buying and selling. That was the response from huge cash desks.

ETHzilla tanked after revealing a large inventory resale

On the identical time Ethereum was climbing, the worth of ETHzilla, the Ethereum-focused inventory, collapsed. Shares of the agency, which lately rebranded from 180 Life Sciences, plummeted over 38% Friday, after saying it could resell as much as 74.8 million shares.

Regardless of a partial restoration, it nonetheless closed the day down about 31%, whilst broader markets rallied after Powell’s speech. ETHzilla had beforehand seen a short-lived worth increase earlier within the week after disclosing a large Ethereum stake and revealing a 7.5% stake held by Peter Thiel.

However Friday’s information erased these good points. The inventory is now up simply 13% from its July 29 treasury announcement, and fully flat for the month of August. That is even though ETHzilla had, at one level this week, been the top-performing title within the crypto treasury area.