Ethereum is as soon as once more within the highlight after smashing by means of its earlier all-time excessive, reaching $4,886 on Friday with an explosive 14% each day surge. This breakout underscores the power of ETH’s ongoing bullish development and highlights its rising dominance within the crypto market. Whereas Bitcoin has been consolidating round acquainted ranges, Ethereum has change into the point of interest of institutional curiosity, with massive gamers more and more allocating capital to the asset.

Fundamentals stay sturdy, as each on-chain and market knowledge affirm that Ethereum demand is accelerating. Establishments, funds, and whales are usually not solely holding but in addition aggressively including to their positions, signaling conviction in Ethereum’s long-term worth. In accordance with Arkham Intelligence, Tom Lee’s Bitmine has simply purchased $45 million value of ETH, additional cementing the narrative of large-scale accumulation. This transfer aligns with a broader development of influential traders and organizations betting on Ethereum because the spine of decentralized finance and the main good contract platform.

The mixture of latest highs, institutional adoption, and rising market confidence locations Ethereum on the focal point heading into the subsequent part of the cycle. Bulls now anticipate value discovery to unfold, doubtlessly pushing ETH towards uncharted territory.

Institutional Accumulation Alerts Bullish Upside

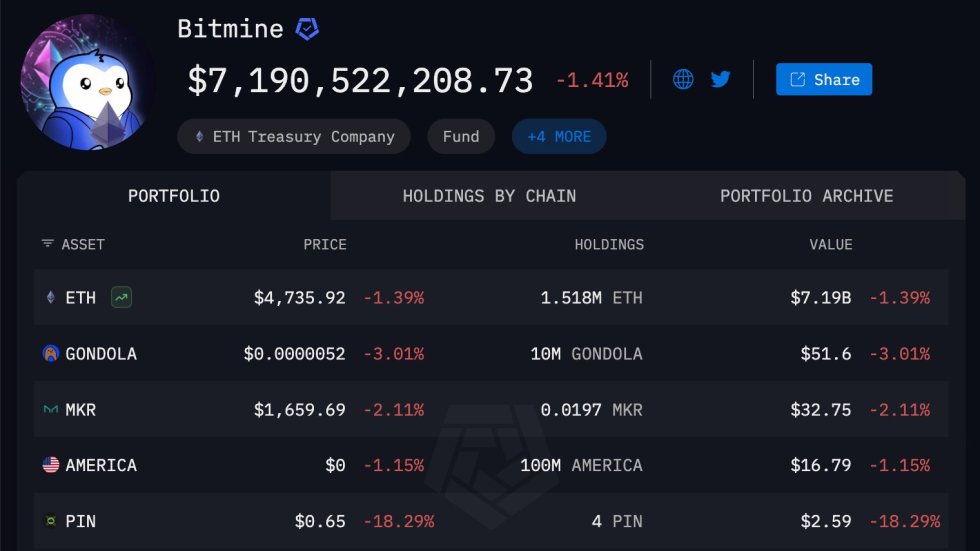

Ethereum’s rally is more and more being fueled by deep-pocketed institutional gamers, with Arkham reporting that BitMine now holds $7 billion value of ETH. This staggering place makes BitMine the most important company holder of Ethereum, with 1.518 million ETH beneath its management—equal to roughly 1.3% of the whole provide. Removed from slowing down, BitMine continues to build up, reinforcing the narrative that establishments see Ethereum as a cornerstone asset for the way forward for digital finance.

Shut behind is SharpLink Gaming, the second-largest company holder, which has amassed 729,000 ETH valued at roughly $3.2 billion. Collectively, these two gamers signify a major focus of Ethereum in company treasuries, underscoring the size of institutional conviction. Analysts level out that such accumulation not solely locks away large quantities of ETH from circulation but in addition shifts market dynamics by tightening obtainable provide.

When massive entities persistently purchase and maintain, it typically alerts confidence in each the asset’s utility and long-term value appreciation. Many market members view Ethereum’s newest breakout above its 2021 all-time excessive as solely the start, with company demand offering a robust basis for additional beneficial properties. If this tempo of accumulation continues, Ethereum may very well be coming into the form of supercycle many traders have lengthy anticipated.

Weekly Outlook: Key Resistance In Play

Ethereum’s weekly chart reveals a robust rebound that has carried the asset to new highs not seen since late 2021. After discovering sturdy assist close to the $2,400 area earlier this yr, ETH has staged a decisive rally, surging previous its long-term shifting averages (50, 100, and 200-week SMAs) and breaking by means of resistance ranges that beforehand capped momentum. This breakout has culminated in a recent push towards $4,779, placing Ethereum firmly again into value discovery territory.

The construction of the chart highlights how bulls have regained management. ETH has posted consecutive bullish candles, with sturdy shopping for momentum following institutional accumulation tendencies reported on-chain. The alignment of the shifting averages — with the 50-week SMA turning upward above the 100 and 200-week SMAs — alerts a strengthening long-term bullish development.

Nonetheless, the fast tempo of this climb additionally raises the danger of short-term exhaustion. ETH is now buying and selling close to traditionally important resistance ranges that align with prior cycle peaks, which may spark profit-taking amongst merchants. If a retracement happens, $4,300 and $3,800 emerge as key assist zones to observe.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.