Ethereum has confronted a big decline in its worth, dropping from a excessive of $4,750 to the present worth of $4,200.

Regardless of this, the decline may not be over. Ethereum may expertise additional downtrends within the coming days, with a number of indicators signaling potential promoting strain.

Ethereum Holders May Trigger A Crash

Lengthy-term holders (LTHs) of Ethereum are presently seeing a surge in income, as indicated by the MVRV Lengthy/Quick Distinction, which has reached a yearly excessive. Usually, when this indicator falls deep into the damaging zone, it alerts that short-term holders (STHs) are gaining income, making them susceptible to promoting.

Nonetheless, Ethereum’s indicator is within the constructive zone, suggesting that LTHs are having fun with substantial income. This constructive motion typically alerts energy however can even point out that LTHs might take into account taking income, resulting in potential promoting strain.

The continued revenue for LTHs places Ethereum in a precarious place. As these holders are sitting on substantial good points, their determination to promote may exacerbate downward worth motion.

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

Ethereum MVRV Lengthy/Quick Distinction. Supply: Glassnode

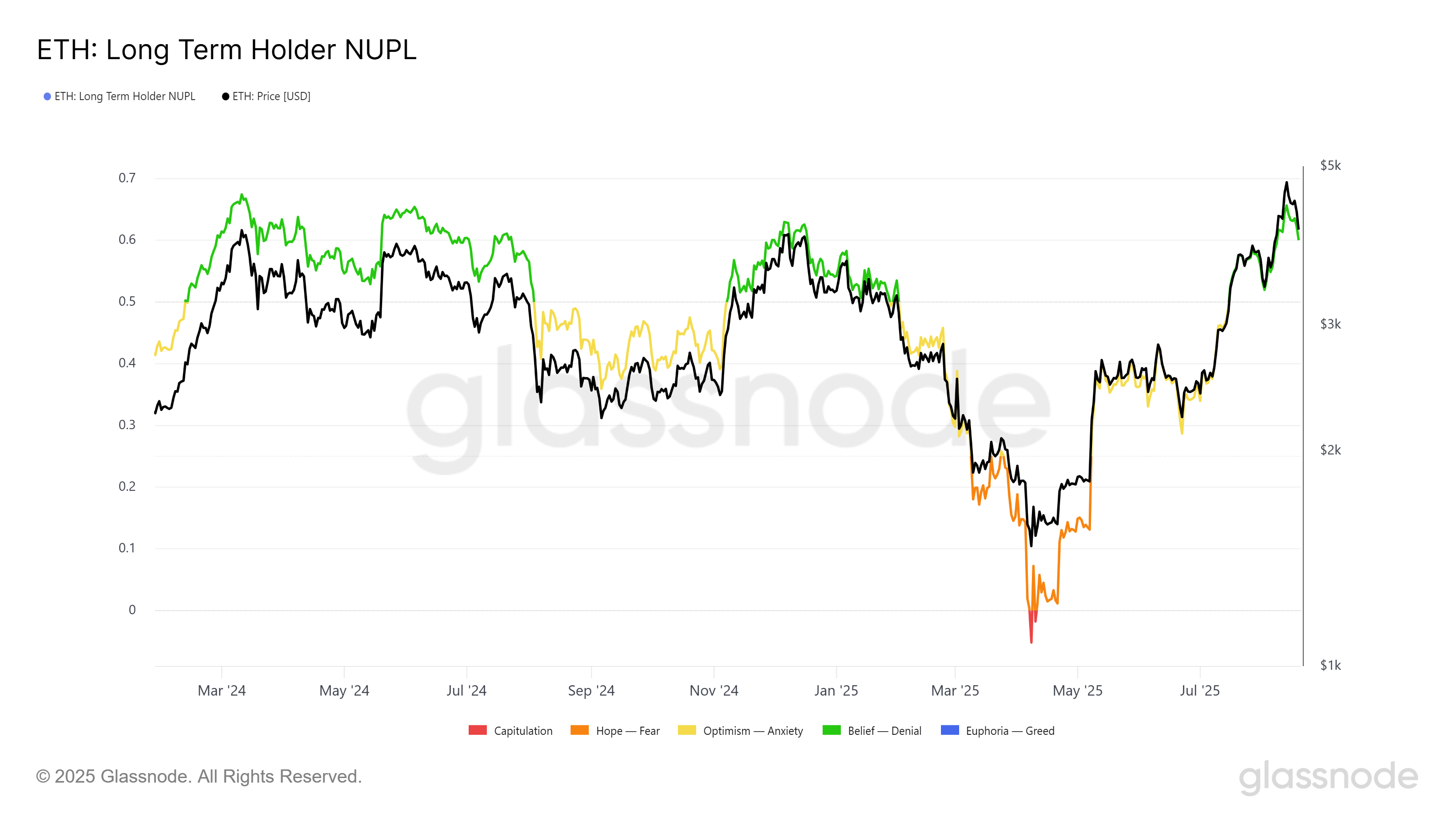

Ethereum’s LTH NUPL (Web Unrealized Revenue/Loss) is presently at an 8-month excessive, reflecting a historic sample. The NUPL indicator reveals the distinction between realized income and losses for long-term holders, and the latest rise suggests vital good points for these holders.

Nonetheless, historic developments present that when the NUPL crosses the 0.60 mark, Ethereum’s worth has confronted a reversal. This means that Ethereum may expertise a worth decline if the present pattern continues, because the income famous by LTHs may encourage them to promote.

With Ethereum’s LTH NUPL at an elevated stage, there’s an elevated chance that long-term holders might promote their positions, amplifying the market correction. The previous has proven that this can be a robust sign for potential worth drops, and Ethereum could also be poised for the same state of affairs.

Ethereum NUPL. Supply: Glassnode

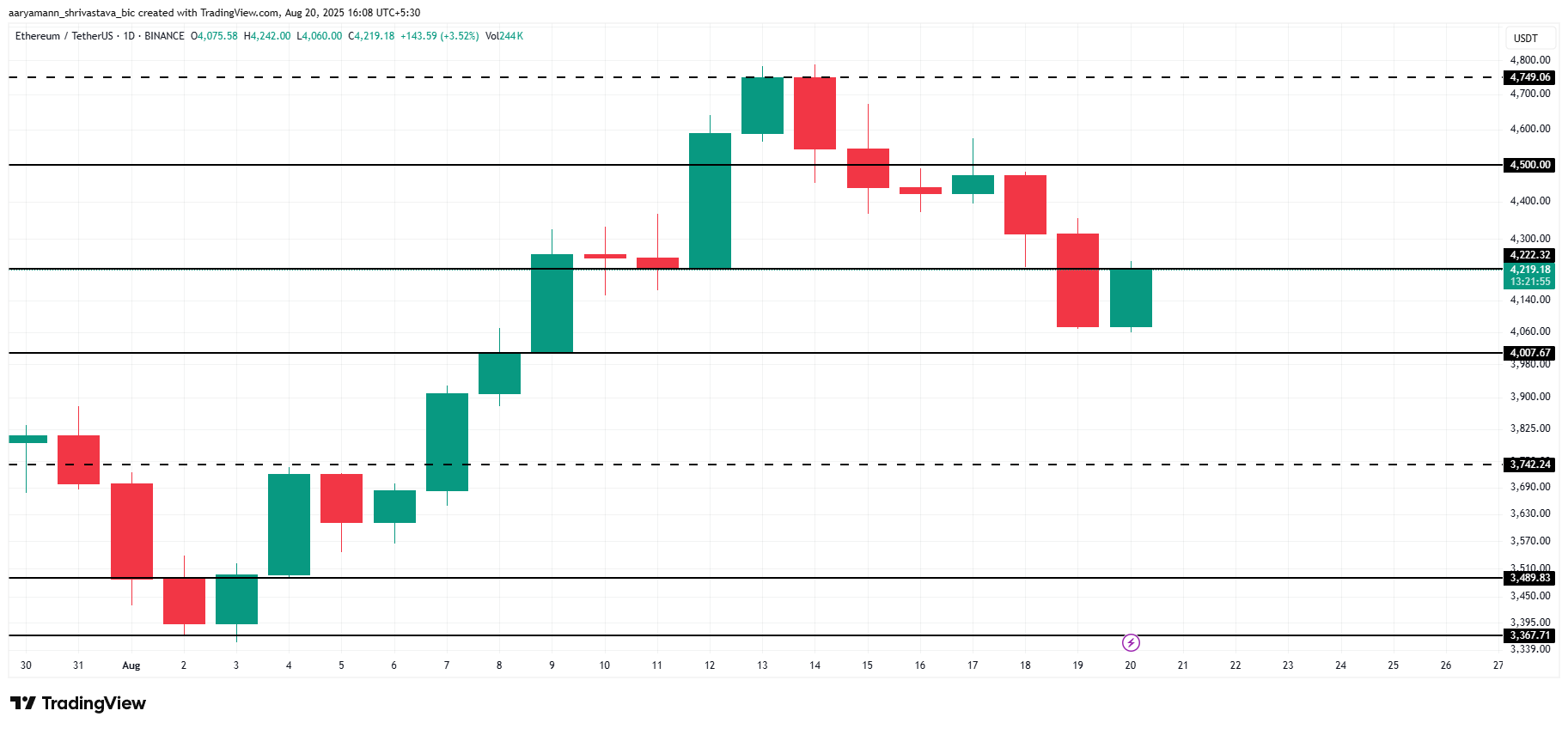

ETH Worth Might Drop to $3,000

Ethereum’s worth has already seen a decline, with the present worth at $4,219. If the downtrend continues, it may fall under the important thing $4,000 stage. The bigger concern, nonetheless, is the potential drawdown attributable to long-term holders deciding to promote. If the LTHs begin taking income, it may put vital strain on Ethereum’s worth.

Taking a look at Ethereum’s previous worth actions, the NUPL indicator reveals that when LTHs created a market prime, Ethereum’s worth dropped under $3,000, reaching lows of round $2,800. If this sample repeats itself, Ethereum’s worth may expertise the same decline, making $3,000 a vital stage to look at.

ETH Worth Evaluation. Supply: TradingView

Then again, if Ethereum’s LTHs maintain onto their positions and resist promoting, the market may see a bounce. If Ethereum manages to reclaim help at $4,222, it may push again towards $4,500, doubtlessly invalidating the present bearish outlook. This could depend upon whether or not the LTHs stay assured and don’t set off additional promoting strain.

The publish Ethereum’s Worth Faces Drop Under $3,000 As These Holders Type Market Prime appeared first on BeInCrypto.