- Whale gathered 1.974 million ARB price $1.14M, triggering a 16.9% worth soar in 24 hours.

- Sturdy quantity and bullish technicals confirmed dealer confidence after key resistance was damaged.

The value of the Arbitrum (ARB) token has surged 16.90% previously 24 hours. On-chain knowledge signifies a significant transfer by a single whale, quietly accumulating an enormous quantity of ARB.

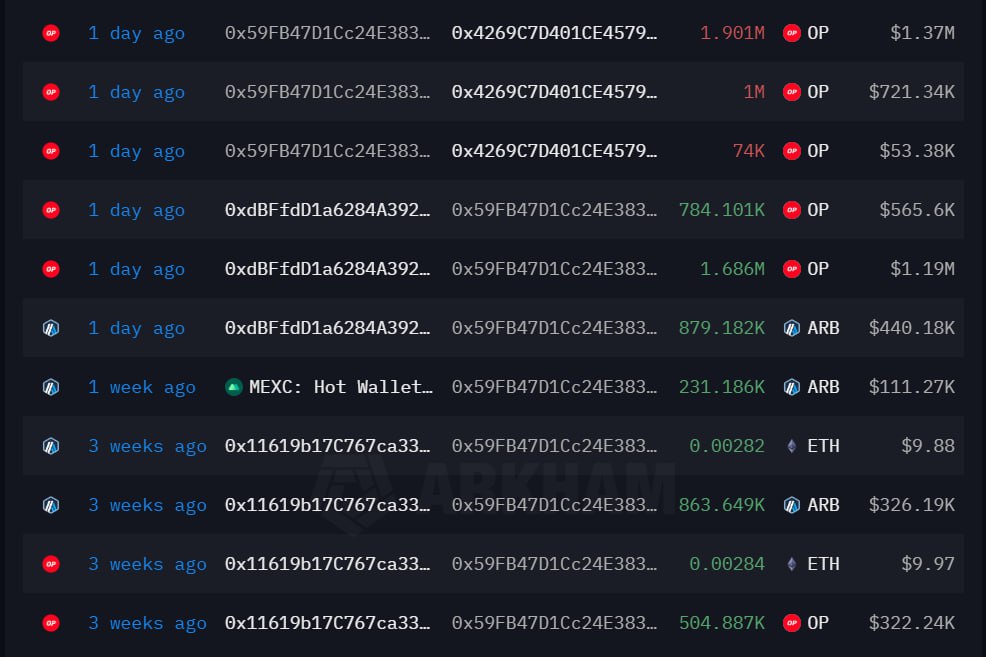

In line with on-chain analyst Rose, the whale’s whole purchases reached 1.974 million ARB, price roughly $1.14 million. Curiously, this buy occurred after the whale exchanged ETH to fund its ARB token accumulation.

Supply: Rose on X

Such a big transfer definitely didn’t go unnoticed by market members. When an entity pumps such a lot of funds in such a brief time period, there’s definitely a motive behind it. Many see it as a sign of confidence within the short- and long-term potential of the Arbitrum ecosystem.

Moreover, technical assist has additional bolstered optimism. ARB broke by key resistance, with buying and selling quantity surging 227% in a single day to achieve $1.44 billion. Technical indicators just like the MACD histogram additionally returned to optimistic territory for the primary time since July, whereas the 14-day RSI hovered round 63—a wholesome degree with no indication of overbought.

So, the mix of whale accumulation, technical assist, and excessive quantity seems to be fueling this surge.

Supply: TradingView

Adoption Momentum Builds as Arbitrum Attracts Main Gamers

In the meantime, developments inside the ecosystem additionally proceed to move. In mid-July, CNF reported that PayPal quietly added assist for Arbitrum in its stablecoin product, PYUSD. This info was first revealed by an replace to PayPal’s phrases and circumstances web page.

Whereas not extensively introduced, this transfer paves the way in which for sooner and cheaper transactions by this Layer-2 community.

In the identical month, NodeOps formally launched its permissionless computing protocol on Arbitrum. This protocol had beforehand undergone a testnet testing section with promising outcomes. NodeOps is now additionally increasing its providers with staking, cross-chain integration, and AI-based orchestration to assist the DePIN ecosystem.

In the event you’re questioning if all this may have an effect on the worth, it gained’t essentially be within the brief time period, however the long-term influence might be important, particularly in attracting new customers and builders.

No much less attention-grabbing, Arbitrum is now additionally an possibility for giant initiatives seeking to migrate. For instance, Sky Mavis—developer of the sport Axie Infinity—lately submitted a proposal emigrate its Ronin community to Arbitrum Orbit as a Layer 2.

If applied, the Ronin community, with 1.7 million day by day energetic customers, shall be straight built-in into the Arbitrum ecosystem. Sure, this migration isn’t risk-free, however think about the transaction quantity that may observe.

Wyoming’s Stablecoin Transfer Hints at What Comes Subsequent

Past customers and builders, this community can also be beginning to achieve traction in a extra severe space: conventional finance. On August 19-20, the state of Wyoming launched Frontier Secure Token (FRNT)—the primary state-issued stablecoin in the US.

This token was launched on seven networks concurrently, together with Arbitrum. Help from massive names like Visa and Kraken makes it much more interesting. Furthermore, this stablecoin has a 2% overcollateralization system and is backed by institutional asset reserves.

With this integration, Arbitrum’s position as a part of a extra regulatory monetary infrastructure is additional strengthened. It’s no exaggeration to say it’s the brand new spine for large-scale cross-chain transactions.

In the meantime, Circle additionally joined the fray by launching its Gateway protocol—a cross-chain liquidity answer that helps built-in USDC throughout a number of networks, together with Arbitrum. They intention to cut back capital fragmentation and make it simpler for establishments to handle funds effectively.

Moreover, Arbitrum stays a powerful chief within the Ethereum scaling sector, with a TVL of over $2.53 billion and over 900 energetic dApps as of early August.