Regardless that Ethereum is going through bearish motion after a pullback from its all-time excessive a couple of days in the past, the second-largest crypto asset continues to be holding remarkably properly above the $4,000 worth mark. There was a notable bullish response from ETH traders within the midst of the waning worth motion, as indicated by an increase in demand.

Demand For Ethereum Is Returning

Ethereum has continued its downward development because the broader crypto market displays bearish motion. Regardless of the continued damaging stress on worth, Darkfost, an creator and market professional, has disclosed a resurgence in sentiment amongst Ethereum traders on the most important crypto platform, Binance.

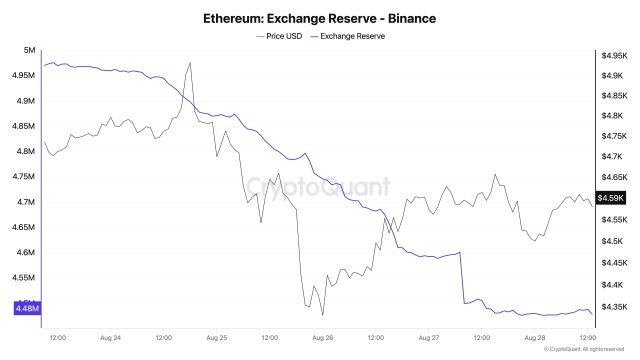

Darkfost highlighted that Ethereum’s market dynamics are shifting as soon as once more as contemporary information reveals a pointy decline in reserves held on Binance. Whereas demand for the main altcoin has gained substantial traction within the broader crypto sector, the variety of ETH on the crypto platform declined by about 10%.

This important decline implies that traders are eradicating ETH from centralized platforms, a habits steadily linked to long-term accumulation and rising confidence. Throughout this era, elevated market exercise has been pushed by rising demand, suggesting a possible provide squeeze that might intensify Ethereum’s subsequent important worth rise.

In lower than per week, the variety of ETH on the crypto change declined by 10 % from 4,975,000 ETH to 4,478,000 ETH, notably between August 23 and 27. In line with the on-chain professional, this sort of decline in Binance‘s Ethereum reserves, together with the truth that the development has continued for a number of days, is an apparent indication of excessive client demand.

When reserves on crypto exchanges lower like this, traders would fairly take their ETH out of the platforms. After this transfer, these investor both retailer their cash in private wallets or perform their duties in DeFi with a purpose to earn income.

Providing a key takeaway, Darkfost famous that the constant fee of this decline signifies that there was a excessive demand for ETH in latest days, whereas Binance’s inner transfers might need contributed to the surge.

Massive Capitals Are Flowing Into ETH

Because the bull market extends, Ethereum is experiencing strong inflows, signaling rising institutional confidence. Following a chronic interval of stagnation, information from the main analytics agency CryptoRank point out a notable improve in inflows, as Ethereum beneficial properties widespread recognition amongst institutional traders.

On condition that institutional members are more and more selecting long-term investing plans over short-term hypothesis, this renewed momentum demonstrates ETH’s resistance to important market corrections.

On the time of writing, the worth of ETH stays bearish and was buying and selling at $4,398, demonstrating an almost 4% decline within the final 24 hours. Buyers’ sentiment has turned damaging, as information from CoinMarketCap exhibits that its buying and selling quantity has reached a ten% decline prior to now.

Featured picture from Getty Pictures, chart from Tradingview.com

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.