A large 201,435% liquidation imbalance hit the Bitcoin derivatives market on Tuesday, as per CoinGlass. Sarcastically, this occurred simply as Michael Saylor confirmed one other multibillion-dollar growth of Technique holdings. The software program agency revealed that it had bought 4,048 BTC for $449 million, averaging $110,981 per Bitcoin.

Nevertheless, moderately than cheering the market, this announcement coincided with a sell-off, pushing the value of the principle cryptocurrency under $109,000 and rattling leveraged positions throughout a number of exchanges without delay.

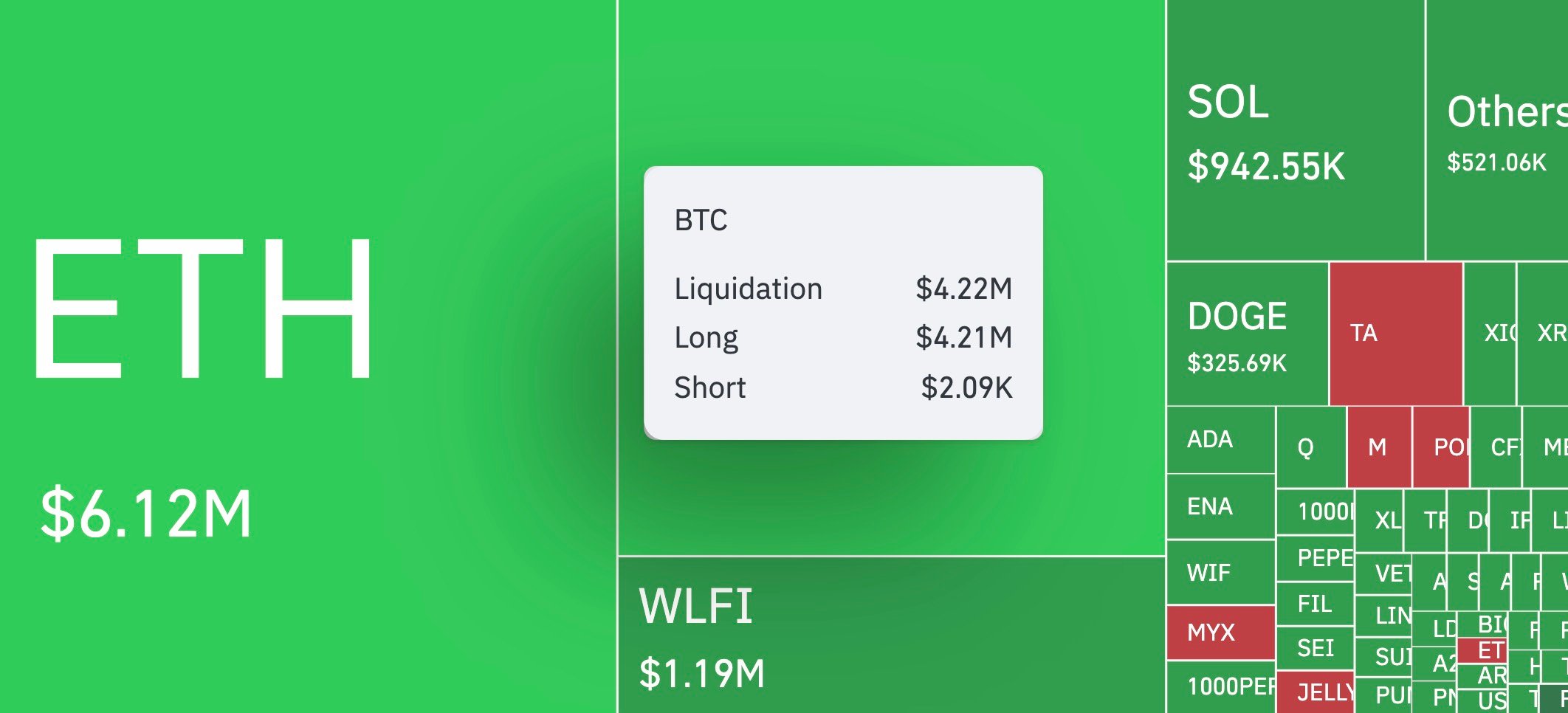

In an hour after the announcement, $4.21 million value of Bitcoin longs have been liquidated, in comparison with solely $2,090 on the brief facet — that’s the place the imbalance was hiding in plain sight.

It’s not an remoted occasion, although, as over the 24-hour interval, greater than $393.9 million in leveraged positions have been liquidated, with lengthy contracts taking the larger hit at $292 million versus $101.8 million in shorts.

Whose margin name was most painful?

Binance noticed the biggest liquidation of the day: an ETH/USDT place value almost $9.8 million. The stress prolonged properly past Bitcoin itself, pulling altcoin markets into the storm.

Saylor’s firm now holds 636,505 BTC at a mean price of $73,765 per coin, with the full stack valued at $46.95 billion. It’s nonetheless a 25.7% acquire on paper for Saylor & Co.

A backside line could also be that regardless of huge spot accumulation from the likes of Saylor, the present value motion of Bitcoin could also be dictated extra by derivatives positioning than company shopping for. And imbalance figures show that time as we speak.