Cryptocurrency funding merchandise attracted renewed inflows final week, offsetting the prior week’s $1.4 billion outflows.

Crypto exchange-traded merchandise (ETPs) logged $2.48 billion in inflows final week, information from CoinShares confirmed Monday.

Regardless of inflows, Bitcoin (BTC) struggled by way of market value, slipping below $108,000 after briefly buying and selling above $113,000 earlier within the week, in accordance with CoinGecko information.

Ether (ETH) additionally tumbled below $4,300 after beginning the week above $4,600, echoing Bitcoin’s turbulence.

Spot Ether ETPs retain dominance

Final week’s inflows have been notable following $1.4 billion in outflows the earlier week, however remained far in need of the $4.4 billion report set in July.

Spot Ether exchange-traded funds (ETF) retained market dominance final week, attracting $1.4 billion in inflows, whereas Bitcoin funds recorded smaller good points of $748 million.

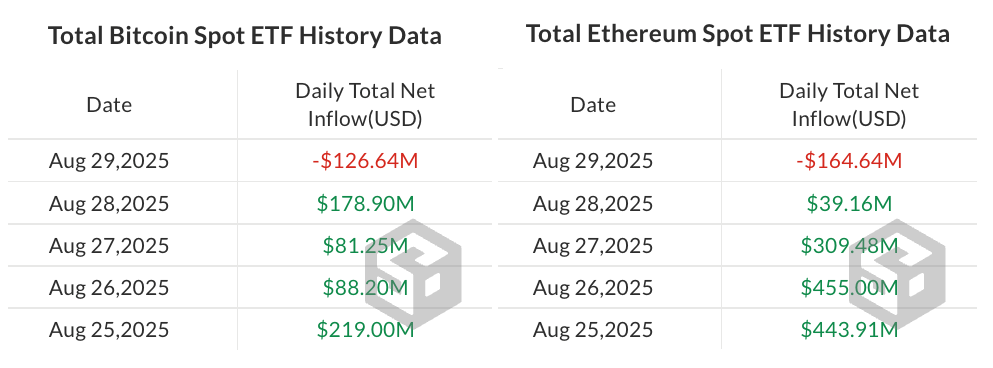

Each day flows in spot Bitcoin ETFs versus spot Ether ETFs final week. Supply: SoSoValue

Each Ether and Bitcoin ETFs skilled outflows final Friday, ending a six-day influx streak for Ether and a four-day streak for Bitcoin, in accordance with SoSoValue information.

Within the meantime, Solana (SOL) and XRP (XRP) continued to profit from optimism round potential US ETF launches, posting inflows of $177 million and $134 million, respectively, in accordance with CoinShares.

Journal: XRP ‘cycle goal’ is $20, Technique Bitcoin lawsuit dismissed: Hodler’s Digest, Aug. 24 – 30