The US labor market is clearly exhibiting indicators of pressure. With job development weakening and shopper sentiment pointing towards rising unemployment, the Federal Reserve is underneath strain to behave. Economists now anticipate at the very least one fee reduce in September, with extra to observe by year-end.

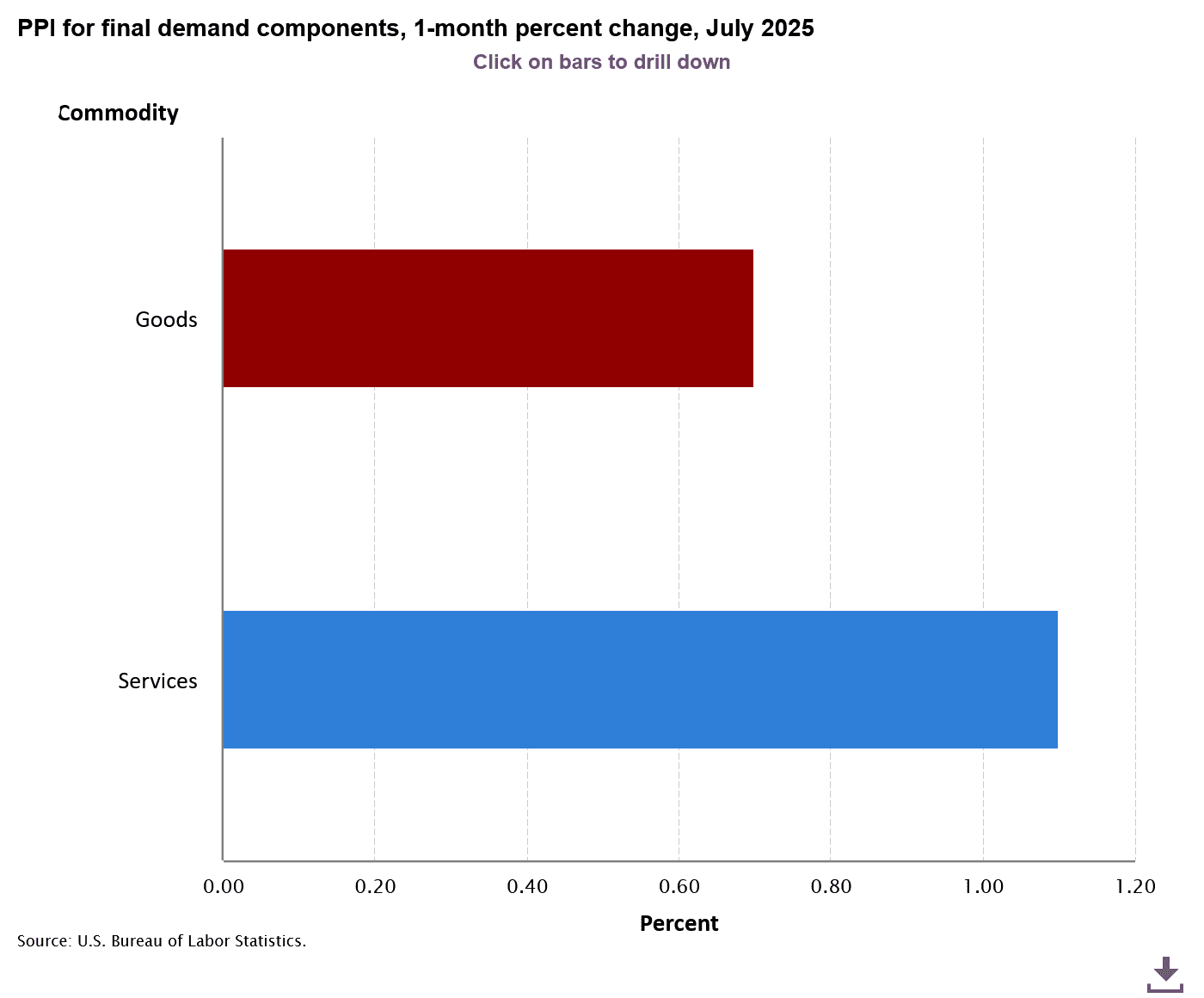

Markets, nonetheless, are already pricing in a good deeper easing cycle, anticipating the Fed will decrease charges into the three.5–3.75% vary by December. That might make borrowing cheaper, pump liquidity into threat property, and probably push cryptocurrencies larger. However there’s a catch: inflation stays sticky at round 2.9%, and tariffs are quietly creeping into shopper costs. If inflation flares again up, the Fed could gradual its easing path, chopping into market enthusiasm.

For Ethereum worth, this macro backdrop issues. Decrease charges often enhance demand for development and threat property like ETH, however inflation threat introduces volatility. Traders should watch upcoming CPI prints as carefully as they watch ETH’s chart.

Ethereum’s Present Worth Motion: A Compression Earlier than the Break

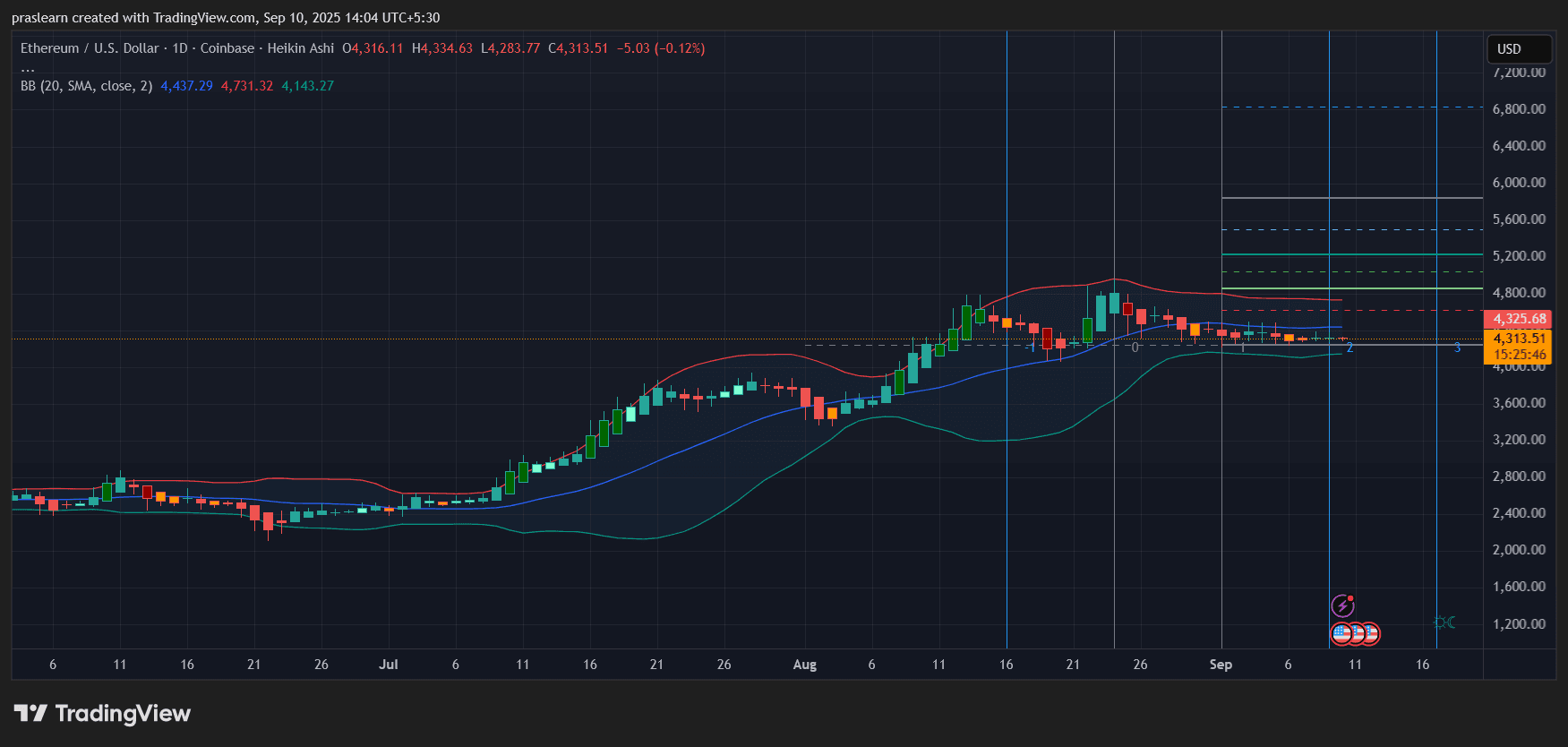

ETH/USD Every day Chart- TradingView

Ethereum worth is buying and selling round $4,313, sitting proper in the course of a tightening Bollinger Band construction. Volatility has compressed sharply since late August, a textbook signal that a big breakout is coming. The higher Bollinger Band sits close to $4,731, whereas the decrease boundary is round $4,143, marking the fast vary ETH should resolve.

The current worth motion exhibits ETH worth consolidating after its July–August rally, with patrons defending the $4,100 zone. This consolidation has fashioned a base simply above the 20-day transferring common, which suggests accumulation reasonably than distribution. Nonetheless, failure to carry $4,100 would open draw back threat towards $3,800.

On the upside, a breakout above $4,750 might set off a rally towards the Fibonacci extension ranges at $5,200, and probably $5,600 if momentum aligns with Fed-driven liquidity.

Ethereum Worth Prediction: What Traders Ought to Count on?

The alignment of macroeconomics and technicals makes the approaching weeks essential for ETH:

- If the Fed cuts by 0.25% in September and indicators extra easing, ETH might escape of its consolidation zone, concentrating on the $5,200–$5,600 vary.

- If inflation knowledge surprises larger, limiting Fed motion, ETH could stall underneath $4,750 and threat revisiting $4,000–$3,800 help.

- A extra aggressive 0.50% Fed reduce might turbocharge threat urge for food, igniting a breakout rally that extends towards $6,000 by This autumn.

The true driver might be how the market interprets the Fed’s steadiness between inflation warning and labor weak point. If buyers consider the Fed will err on the facet of development, ETH worth stands to learn.

Funding Outlook: Endurance Earlier than Positioning

Ethereum worth is at present in a ready recreation. With Bollinger Bands compressing and the Fed’s choice looming, merchants ought to put together for top volatility. A disciplined strategy could be to observe for a breakout affirmation above $4,750 earlier than going lengthy, with cease ranges set close to $4,100. Lengthy-term buyers, nonetheless, could view any dip towards $4,000 as a chance to build up earlier than the subsequent liquidity-driven rally.

What this actually means is $ETH is sitting at a macro-technical inflection level. The Fed’s subsequent transfer might both unlock the subsequent leg larger towards $5,600–$6,000, or power $Ethereum right into a deeper retest of $3,800. Both manner, the present consolidation received’t final for much longer.