Regardless of tighter oversight from South Korea’s monetary authorities, leverage-driven “crypto lending” companies resurface throughout home exchanges.

Platforms like Upbit, Bithumb, and Coinone are reviving or reshaping the controversial merchandise beneath newly issued authorities tips, signaling a cautious however notable comeback.

Coinone Launches “Coin Borrowing”

On Monday, Coinone, South Korea’s third-largest cryptocurrency trade, launched its new cryptocurrency buying and selling service, “coin lending.” The rollout comes simply two months after rivals Upbit and Bithumb launched comparable companies in July.

The product lets customers borrow cryptocurrency in opposition to Korean gained collateral, enabling leverage-driven buying and selling methods. In observe, this consists of short-selling—borrowing crypto, promoting at market costs, and repurchasing later at a reduction if costs fall.

Coinone emphasised that the service strictly follows the Authorities’s, i.e., Monetary Providers Fee (FSC), lending tips. Beneath the foundations, particular person borrowing limits mirror fairness short-selling frameworks—$22,000 (KRW 30 million) to $51,000 (KRW 70 million), relying on the person.

Prospects can pledge as little as $37 by way of the service and borrow as much as 82% of their collateral, topic to the $22,000 cap. At launch, solely Bitcoin is supported.

Upbit and Bithumb Regulate Their Providers

Business chief Upbit reinstated its lending program final week, modifying phrases to satisfy the FSC’s necessities. Its most collateral cap fell by 25%—from $37,000 to $28,000.

Bithumb, the nation’s second-largest trade, continues working beneath its outdated construction however confirmed ongoing revisions.

“We totally perceive the intent of the FSC and the DAXA tips,” a Bithumb spokesperson mentioned, referring to the Digital Asset eXchange Affiliation. “We’re reviewing borrowing limits, ratios, and liquidation necessities to make sure investor safety and market stability. Our precedence is to transition the service easily whereas minimizing person disruption.”

Regulators Push Stronger Safeguards

The FSC launched its tips earlier this month in response to issues over investor danger and extreme leverage. Regulators clarified that lending companies should not function as unchecked, high-risk merchandise.

Exchanges should now present loans solely from their reserves and restrict borrowing to large-cap cryptocurrencies. Borrowing limits are capped for every particular person, and customers should full on-line teaching programs and move suitability checks earlier than accessing the service. To guard retail merchants, authorities additionally set a most annualized rate of interest of 20 p.c and strengthened disclosure obligations.

Officers mentioned the framework is designed to strike a stability—permitting innovation in digital asset markets whereas guaranteeing client safety and curbing reckless hypothesis.

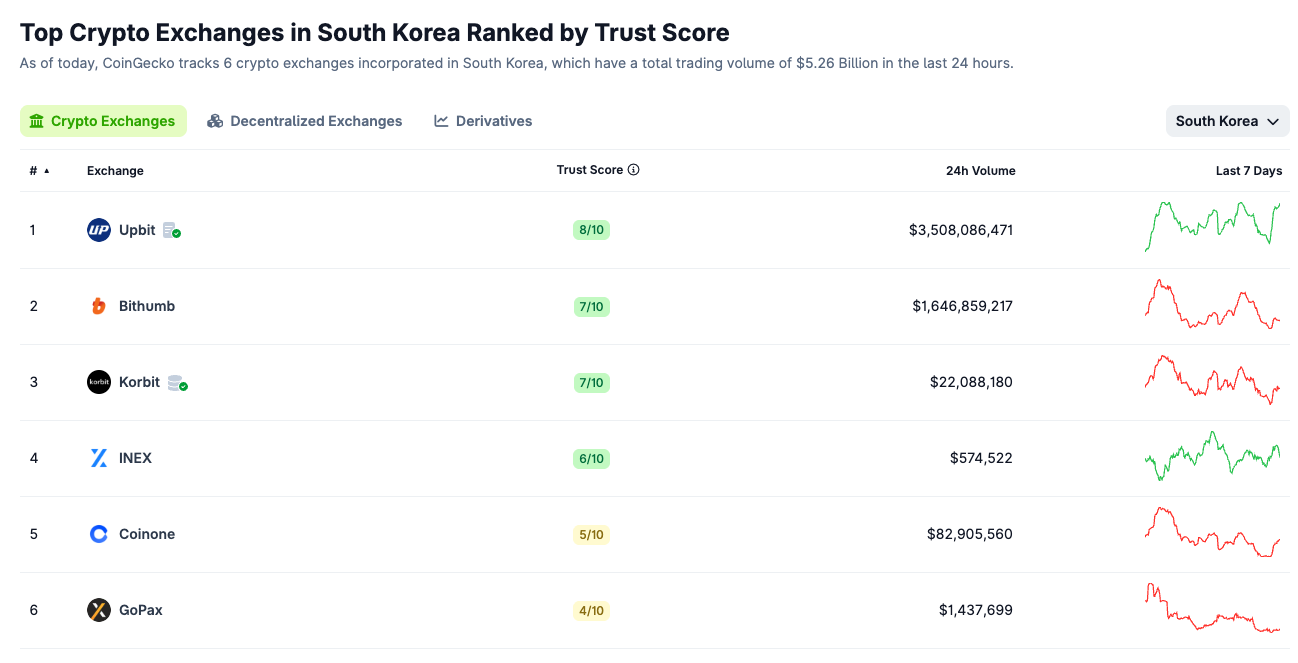

Prime Crypto Alternate in South Korea / Supply: coingecko

In line with CoinGecko, six South Korean-based exchanges—together with Upbit, Bithumb, and Coinone—collectively course of $5.26 billion in each day buying and selling quantity.

The put up Crypto Lending Revives in Korea Regardless of Stricter Authorities Guidelines appeared first on BeInCrypto.