Abstract

- The important thing vary is $115K to $120,000; the upside state of affairs goals for $125K to $130,000, whereas the draw back state of affairs would threat $110K to $100K in keeping with Bitcoin value prediction analysts.

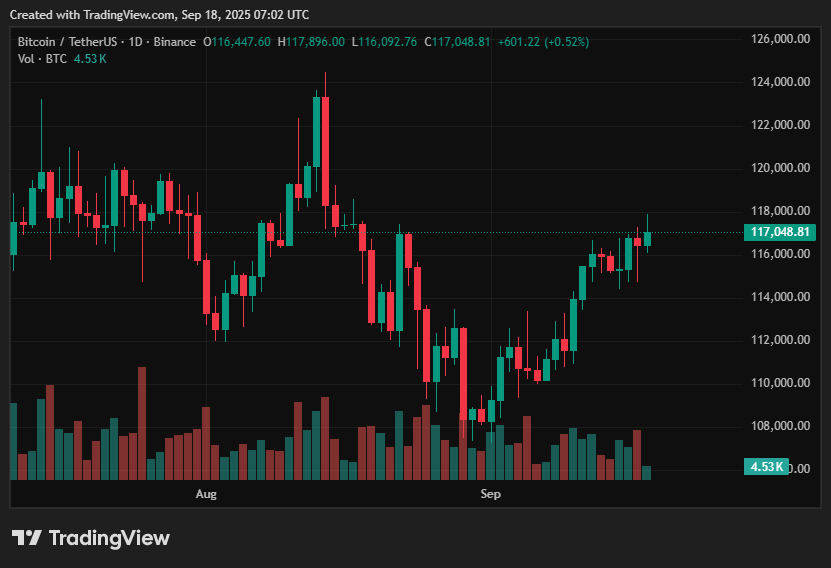

- On September 18, 2025, Bitcoin is buying and selling near $117,000 after the Fed’s 25 foundation level fee drop prompted a dovish response from the market.

- The intraday band is between $116K and $118K, open curiosity in futures is stronger, and volumes are greater.

- Vital change withdrawals are seen in on-chain flows, which reduces the quantity of provide accessible.

- Institutional demand and spot ETF inflows are supporting the upward bias; a breakout to $125K–$130K is feasible.

- Dangers embrace profit-taking, September seasonality, a stronger USD/yields, and the collapse of the $115K assist.

Following the U.S. Federal Reserve’s 25-basis-point fee lower yesterday, discussions in regards to the Bitcoin value prediction has intensified, with the cryptocurrency at present buying and selling at roughly $117,000 as of this writing on September 18, 2025.

Dangerous belongings underwent a fast repricing on account of the lower and the Fed’s dovish ahead steerage; in cryptocurrency, this manifested as elevated spot volumes, rising futures open curiosity, and revived demand for spot ETFs. Though the macro transfer decreased some short-term coverage threat, it left buyers questioning if the Fed will lower extra this yr.

Desk of Contents

Bitcoin value prediction: What’s taking place now

BTC 1d chart: Supply: crypto.information

With intraday highs and lows grouped within the $116k–$118k vary and 24-hour spot quantity considerably greater than the earlier week, Bitcoin’s intraday conduct on September 18 represents a good however marginally upward session.

Whereas on-chain flows reveal vital internet withdrawals from centralized exchanges throughout September, decreasing the quantity of obtainable spot provide, derivatives measures (open curiosity) and change orderflow point out merchants have gotten increasingly leveraged into directional bets. After the Fed’s transfer, Bitcoin (BTC) has been rangebound however skewed upward, which could be defined by these mixed indicators.

You may also like: Bitcoin value rallies above $117K as first 2025 Fed fee lower boosts sentiment

Optimistic components on Bitcoin value

Institutional demand by way of spot Bitcoin ETFs and decreased change liquidity are at present the principle bullish drivers. Bids within the $115k–$120k vary have been significantly supported by a number of days of internet ETF inflows this month, in addition to vital US-listed spot ETF purchases in the course of the week surrounding the FOMC.

As leveraged futures roll and momentum merchants observe the transfer, Bitcoin might quickly retest $120,000 and check out a run towards $125,000–$130k if spot demand (ETF creations + OTC buys) holds and change withdrawals persist. The probability of sustained institutional demand can also be elevated by current regulatory and market plumbing developments that facilitate ETF launches and listings. This strengthens the medium-term Bitcoin outlook.

Unfavourable components for BTC value

Dangers exist regardless of the bullish flows. Bitcoin may return to the low-$110k vary or decrease if it have been to interrupt out of the mid-$115k degree, which might encourage profit-taking and trigger short-term deleveraging in futures markets.

Any hawkish studying of Fed directions, seasonality (September has traditionally been unhealthy), or an surprising spike in Treasury yields / USD power are nonetheless believable draw back catalysts.

Moreover, the beforehand withdrawn provide might re-enter exchanges and exert stress on the worth if the urge for food for spot ETFs wanes or if new promoting by main token holders happens.

You may also like: Right here’s why Bitcoin mining shares Bitfarms and IREN are surging

Bitcoin Value Prediction Primarily based on Present Ranges

BTC assist and resistance ranges, Supply: Tradingview

Key vary for the instant time period for BTC is $115k–$120k. Merchants can count on two eventualities right here:

Situation A: A persistent rise over $120,000, propelled by ongoing ETF inflows and low change liquidity, signifies that the market will attain targets within the $125,000–$130k vary within the upcoming weeks. This varieties the short-term BTC value forecast that merchants are watching carefully.

Situation B: Failure/pullback: If leveraged positions are liquidated, a lack of $115k (or a big improve in U.S. yields) may trigger a decline towards $110k and, in a extra extreme unwind, the $104k–$100k vary. So long as change withdrawals and ETF flows proceed to be robust, the market is at present impartial to optimistic with an upside volatility skew. Present ETF movement statistics, change provide measures, and the Fed’s Sept. 17 feedback all assist these state of affairs projections and align with market expectations.

Disclosure: This text doesn’t symbolize funding recommendation. The content material and supplies featured on this web page are for academic functions solely.