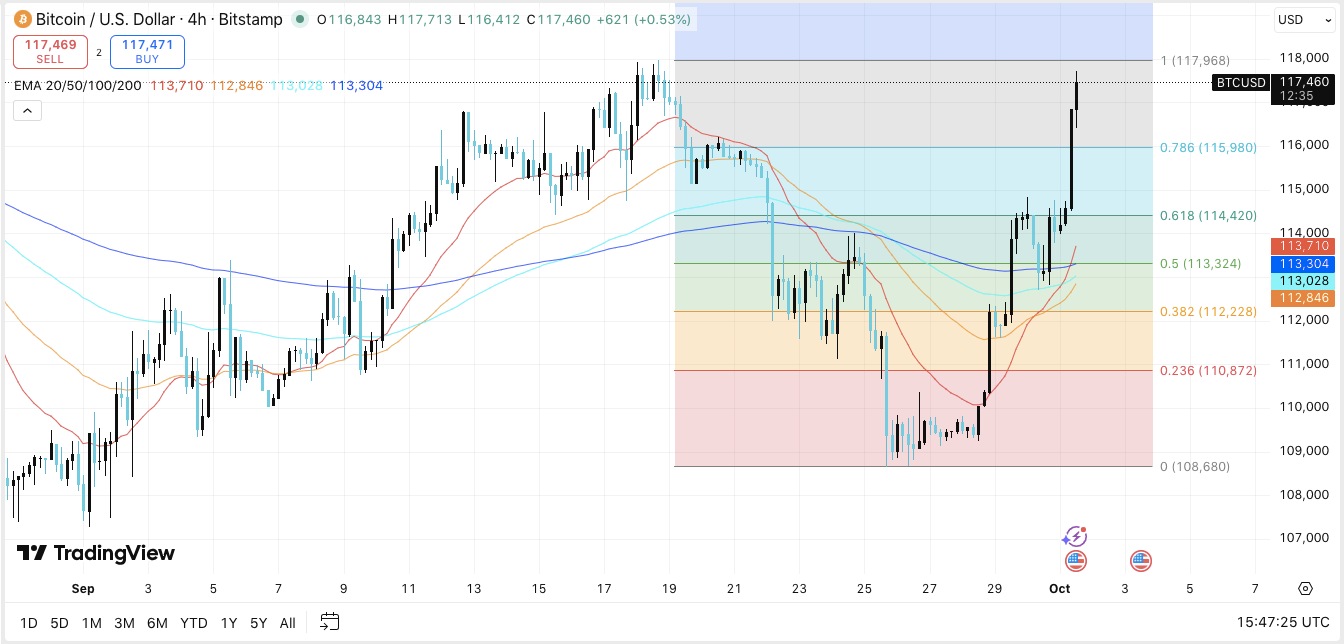

Bitcoin has not too long ago demonstrated outstanding power, reclaiming key Fibonacci retracement ranges on the 4-hour chart. This transfer indicators renewed bullish momentum because the cryptocurrency approaches vital resistance zones.

Merchants and traders are intently watching the $117,968 stage, which has acted as a short-term ceiling. A decisive breakout above this space may propel Bitcoin towards greater targets, doubtlessly reaching $118,500–$120,000 within the close to time period.

Key Ranges and Pattern Outlook

Quick assist for Bitcoin lies round $115,980 and $114,420, comparable to the 0.786 and 0.618 Fibonacci ranges. Ought to promoting stress intensify, the $113,324 zone, aligned with a number of EMAs, presents a powerful demand space. Past that, $112,228 marks the following vital assist if the market faces a deeper pullback.

SOL Value Dynamics (Supply: TradingView)

The upward trajectory from the $108,680 low has flipped the 50 and 100 EMA zones into assist close to $113,000. Sustaining momentum above $116,000 may encourage consumers to push towards contemporary highs. Nevertheless, failure to carry above $115,980 could set off a retracement towards the EMA cluster round $113,000–$113,500.

Futures Market Exercise Alerts Continued Engagement

Bitcoin futures open curiosity has surged all through 2025, rising from underneath $20 billion early this yr to over $80 billion in October. This progress signifies elevated speculative exercise and rising institutional participation.

Supply: Coinglass

Whereas increasing open curiosity helps a bullish outlook, it additionally indicators heightened volatility throughout sharp value swings. At the moment, the $80 billion stage underscores robust market engagement, reinforcing Bitcoin’s dominance in derivatives buying and selling.

Supply: Coinglass

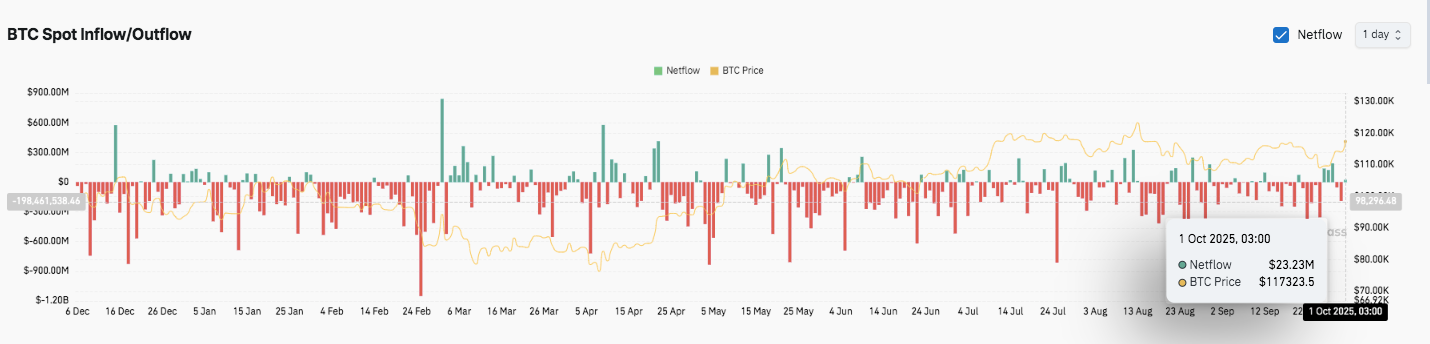

Current inflows and outflows additionally mirror cautious accumulation. On October 1, Bitcoin noticed a modest constructive outflow of $23.23 million, suggesting minor short-term promoting stress. Regardless of this, broader accumulation traits stay intact, supporting a bullish mid- to long-term perspective.

Associated: Shopping for Bitcoin in 2025? Right here’s the Most secure and Best Route

Michael Saylor’s Bold Trillion-Greenback Technique

Technique govt chairman Michael Saylor has outlined an formidable imaginative and prescient for company Bitcoin adoption. He compares Bitcoin’s transformative potential to breakthroughs resembling electrical energy and oil, framing it as a type of digital vitality. Saylor envisions a “trillion-dollar endgame,” aiming to build up Bitcoin at scale whereas redefining company treasuries.

Based on Saylor, Bitcoin presents a novel mixture of property, capital, and vitality in our on-line world. It permits the switch of worth throughout each time and area, creating alternatives for companies and establishments looking for long-term preservation of wealth. Considerably, this technique may affect company treasury practices and institutional engagement with digital belongings.

Technical Outlook For Bitcoin Value

Bitcoin has proven robust restoration after reclaiming key Fibonacci retracement ranges, signaling renewed bullish momentum heading into October.

Key Ranges and Pattern Outlook

- Upside ranges: $117,968 short-term ceiling, adopted by potential extensions towards $118,500–$120,000 if consumers keep power.

- Draw back ranges: Quick assist lies at $115,980 (0.786 Fib) and $114,420 (0.618 Fib). Additional assist zones are $113,324 (EMA cluster) and $112,228 if promoting intensifies.

- Resistance ceiling: $117,968 stays a key stage to interrupt for medium-term bullish momentum.

The technical image suggests Bitcoin is consolidating above main EMA clusters, with decisive breakouts prone to broaden volatility and pattern continuation in both path. Sustaining above $115,980 is vital for bulls to maintain upward stress.

Will Bitcoin Go Increased?

Bitcoin’s near-term trajectory depends upon consumers holding assist zones whereas making an attempt to breach $117,968. A profitable breakout may drive momentum towards $118,500–$120,000, whereas failure to carry $115,980 might even see retracements towards $113,000–$113,500.

Associated: Ethereum Value Prediction: Can ETH Break $4,300 to Attain the $4,565 Goal?

Futures market exercise and inflows/outflows point out cautious accumulation alongside robust institutional participation. Constructive developments, together with Michael Saylor’s “trillion-dollar technique” imaginative and prescient, add a structural bullish narrative, reinforcing Bitcoin’s potential as a long-term retailer of worth.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be chargeable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.