The present ETH value vary is supported by hype, as mirrored on the Coinbase premium. On the identical time, whales desire to build up at a decrease vary.

Ethereum (ETH) remains to be displaying a robust stage of hype, as retail nonetheless reveals robust curiosity in shopping for. Current information reveals ETH nonetheless trades with a Coinbase premium, suggesting US-based merchants are able to foot the invoice for the rally.

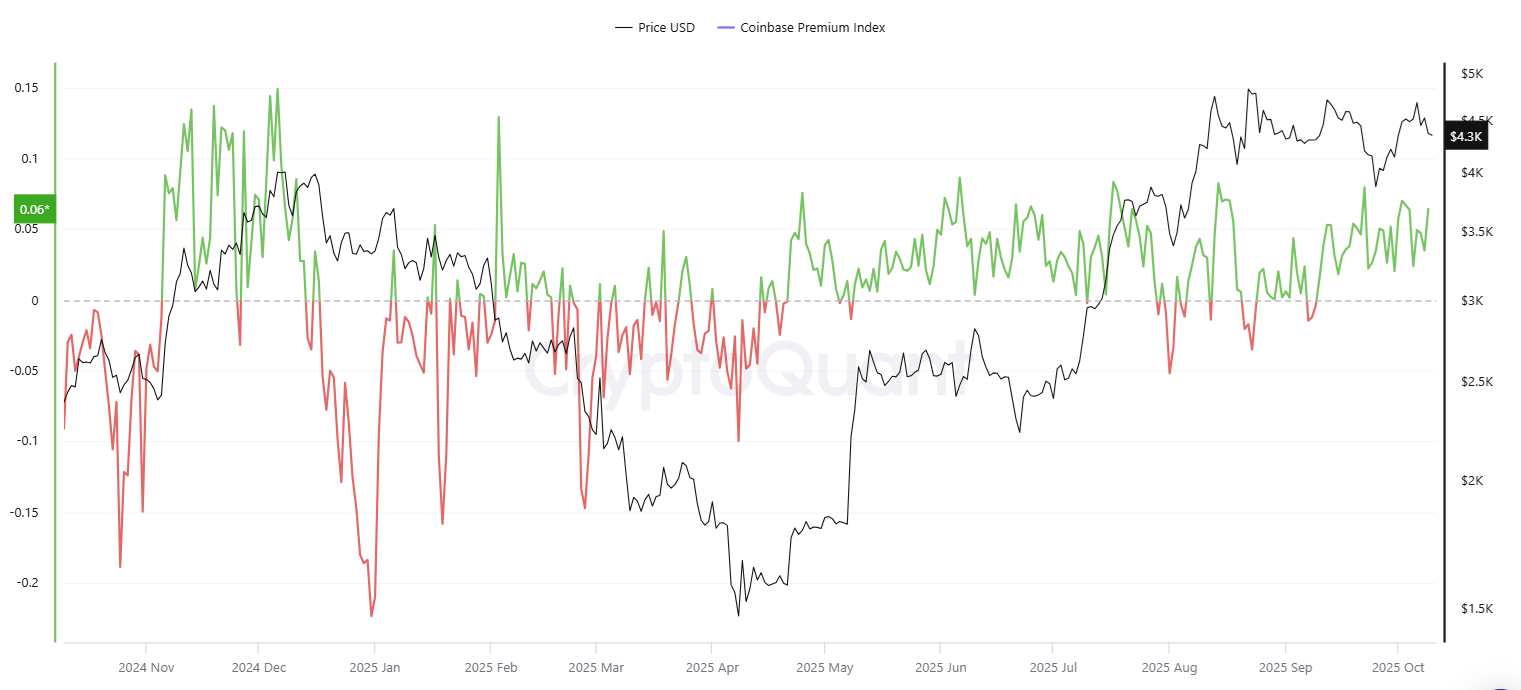

ETH nonetheless trades with a Coinbase premium, signaling hype from merchants within the USA, however not essentially strategic accumulation. | Supply: Cryptoquant

ETH traded at $4,357.20, whereas the Coinbase premium stays optimistic for the previous few weeks. The worth on Coinbase is a proxy for US investor sentiment, measuring the habits of retail quite than sensible cash. ETH has a number of sources of inflows, together with ETF and ETP, as Coinbase measures direct shopping for for hype.

The Ethereum Coinbase Premium Index has been persistently optimistic since early September, remaining so even throughout value fluctuations and the latest dip underneath $4,500.

Within the second half of 2025, ETH traded at a premium way more usually. ETH has proven short-term power, although whales are positioning themselves at a distinct value vary.

ETH recovers ETF demand extra slowly

In contrast to direct Coinbase purchases, ETF inflows are slower to recuperate. ETF consumers are nonetheless able to pouring in contemporary cash, as Cryptopolitan reported, however ETH consumers are extra cautious.

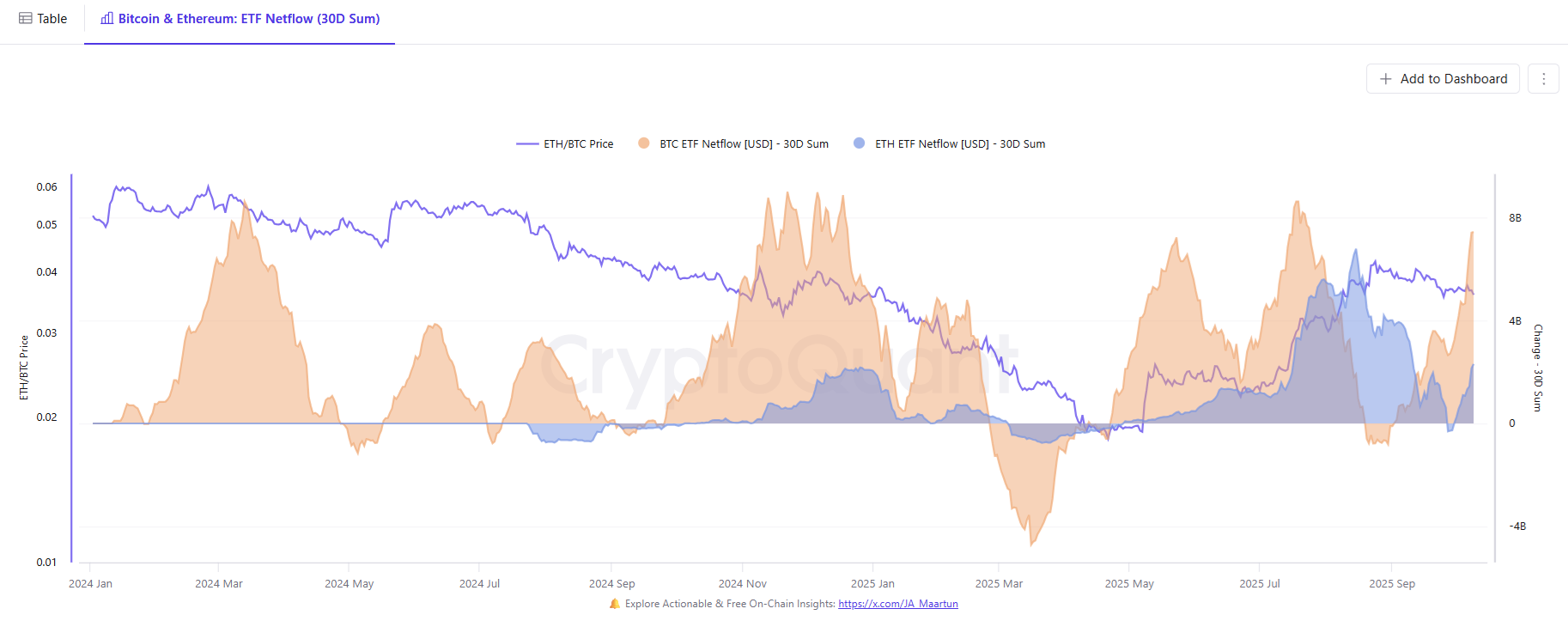

Demand for ETH by means of ETF is decrease, as BTC took the highest spot once more. | Supply: Cryptoquant

ETF netflows are a lot stronger for BTC, whereas ETH remains to be making an attempt to recuperate one among its latest peaks. In 2025, ETH had its first constant two-week interval the place inflows have been a lot stronger in comparison with BTC, however the pattern reversed.

ETH can also be flowing into accumulation wallets, nonetheless with a stability over 27M tokens. The market is on the watchout for one more spherical of much more lively demand, doubtlessly coming from staking ETF.

Will ETH appropriate extra?

The latest ETH flows recommend a correction could also be coming quickly. Strategic whales are nonetheless anticipating accumulation at a a lot decrease zone, at $2,200-$1,800. Nonetheless, the market has sufficient enthusiasm to keep away from drawdowns.

ETH whales already positioned at that value vary earlier than the latest rally. Most treasuries and among the ETP reserves have been constructed at a cheaper price vary.

ETH open curiosity is barely decrease at $27B, however merchants are reluctant to desert the token. As ETH remains to be a part of the altcoin season, merchants are nonetheless awaiting short-term breakouts. The worth motion can also be subdued as consideration shifted to BNB and SOL, in addition to different altcoin narratives. ETH misplaced some mindshare to these cash, after changing into the main focus in September.

Within the quick time period, ETH remains to be pushed by by-product buying and selling, rebuilding lengthy and quick liquidity between $4,200 and $4,400. Based mostly on accrued quick liquidity, a squeeze could also be attainable to $4,500. Nonetheless, ETH doesn’t present sufficient exuberance and remains to be looking for liquidity for an even bigger breakout. ETH market dominance is at 12.4%, taking a step again from the latest stage of 13%.