Following final week’s macro-driven liquidation cascade, Ethereum has stabilized and is displaying early indicators of structural restoration. Regardless of the sharp selloff that swept by means of the crypto market, ETH has efficiently defended a significant demand zone and is now making an attempt to reclaim vital ranges that can decide whether or not this rebound evolves right into a full continuation or stays a short lived aid rally.

Technical Evaluation

By Shayan

The Day by day Chart

On the each day timeframe, Ethereum rebounded strongly from the $3.4K demand zone, which aligns with the 200-day transferring common and the decrease boundary of the ascending channel that has guided the value since mid-2025. The sharp restoration from this zone confirms it as a high-confluence help, whereas ETH’s surge above the 100-day MA close to $4K and the ascending midline trendline counsel that consumers try to reassert directional management.

Ethereum now faces its first main impediment across the $4.2K–$4.3K zone, the place damaged market construction aligns with the 0.618–0.702 Fibonacci retracement ranges from the current decline. This space serves as a decisive short-term resistance. The RSI has additionally proven a gentle bullish divergence from oversold territory, reinforcing the potential for continued upside if momentum persists.

A each day shut above $4.3K would affirm power and open the trail towards the $4.6K–$4.7K provide space, whereas rejection at this degree might set off one other retest of the $3.8K–$3.6K vary, the place consumers would once more be examined.

The 4-Hour Chart

On the 4-hour timeframe, Ethereum has reclaimed its beforehand damaged ascending trendline, turning it into short-term help following final week’s capitulation to $3.4K. The rebound has prolonged towards the 0.618 Fibonacci retracement zone ($4.25K), the place worth is now consolidating just under the important thing $4.3K resistance.

The $4.0K–$4.1K area now acts because the vital choice level. Holding above this degree would affirm structural power and help the restoration narrative, whereas shedding it might invalidate the present bullish setup and expose the $3.6K–$3.4K demand block as soon as extra.

For now, the short-term construction stays constructive however not confirmed. A sustained break above $4.3K would shift market sentiment again in favor of bulls, whereas rejection might lengthen the consolidation part for a number of periods because the market continues to soak up volatility.

Sentiment Evaluation

By Shayan

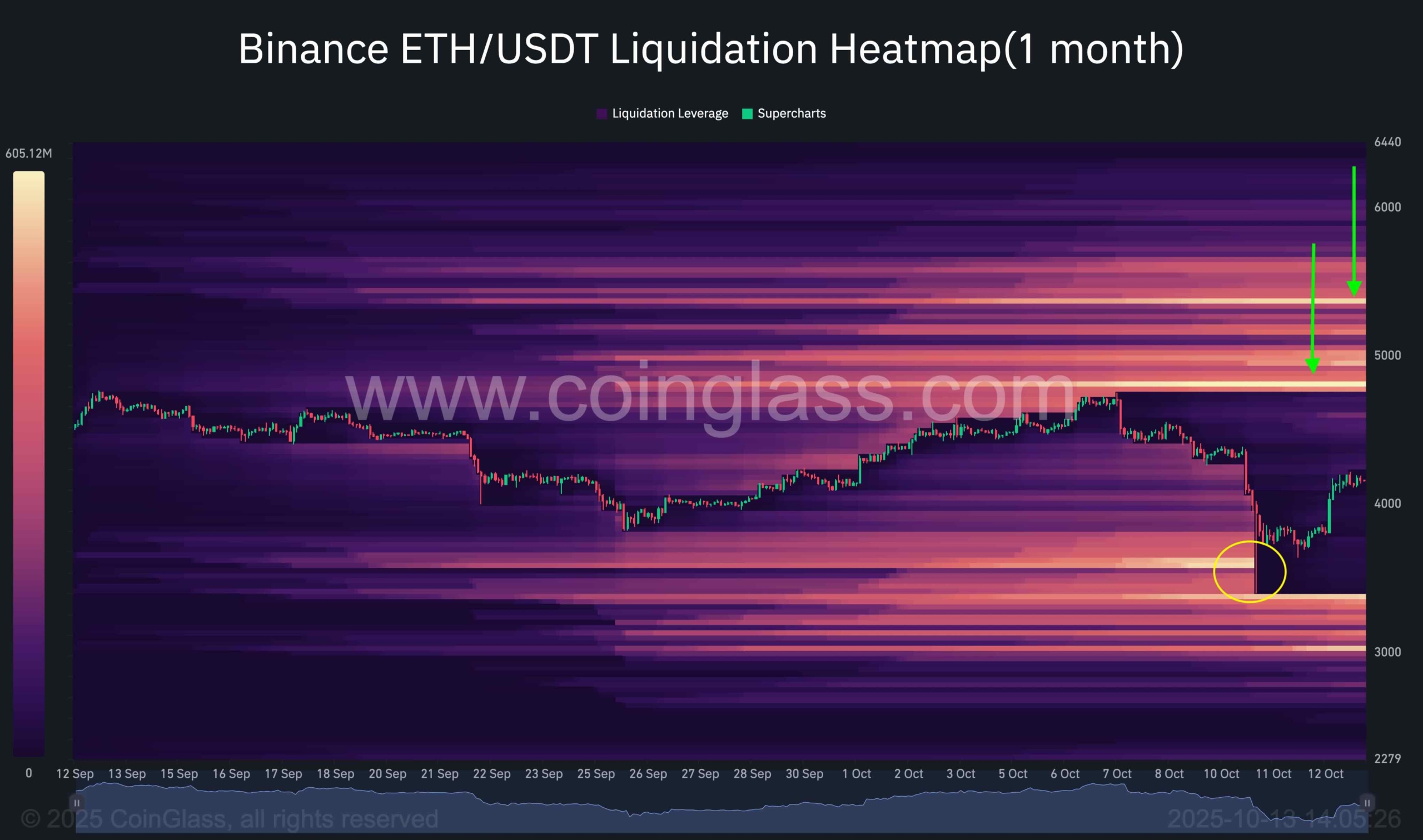

The most recent 1-month Binance liquidation heatmap reveals how final week’s macro-driven crash reshaped the derivatives panorama. An enormous liquidation cluster fashioned between $3.4K and $3.6K, marking the flush-out of closely leveraged lengthy positions as Ethereum briefly dipped beneath $3.5K. This occasion served as a cleaning part for market positioning, washing out weak longs and resetting each sentiment and funding circumstances.

Since that capitulation, the heatmap exhibits a transparent absence of main liquidity swimming pools beneath present worth, suggesting that short-term draw back strain has eased. The decline in lower-level liquidation density signifies that the market has successfully cleared extreme leverage, paving the best way for a extra secure restoration part.

In distinction, a number of high-density liquidity clusters have now developed above worth, most notably round $4.8K–$5.0K and once more close to $5.8K–$6.0K. These zones correspond to short-side liquidity pockets and unrealized brief publicity, successfully serving as future targets for potential upward strikes.

If Ethereum maintains its restoration momentum and reclaims the $4.3K–$4.4K resistance zone, the market is more likely to gravitate towards these higher clusters, aiming to brush short-side liquidity. Offered no new wave of extreme leverage emerges prematurely, Ethereum seems technically positioned for a medium-term continuation, with on-chain dynamics supporting a gradual climb towards these larger liquidity targets.