Bitcoin (BTC) is dealing with mounting stress after extending its two-week-long decline. The cryptocurrency has struggled to interrupt above resistance, suggesting rising investor fatigue.

Market situations stay fragile as buying and selling volumes decline and volatility spikes, leaving Bitcoin susceptible to additional losses if sentiment fails to get well quickly.

Bitcoin Holders Are Dropping Features

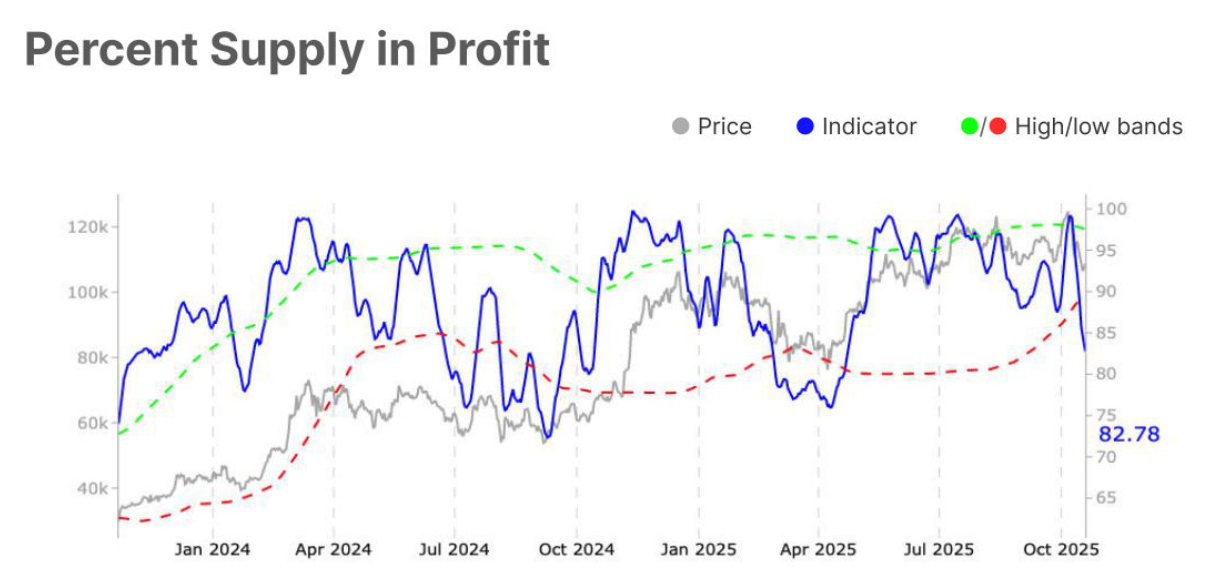

The proportion of BTC provide in revenue has dropped considerably, falling from 98% to 78% inside two weeks. This steep decline displays widespread unrealized losses and indicators rising investor warning. Such fast contractions are sometimes seen throughout capitulation phases, when concern dominates the market and promoting intensifies.

The diminished incentive for profit-taking highlights that the majority holders are both in loss or barely breaking even. This creates a self-reinforcing cycle of hesitation, the place consumers stay cautious whereas sellers search to exit on the first signal of energy.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

Bitcoin Provide In Revenue. Supply: Santiment

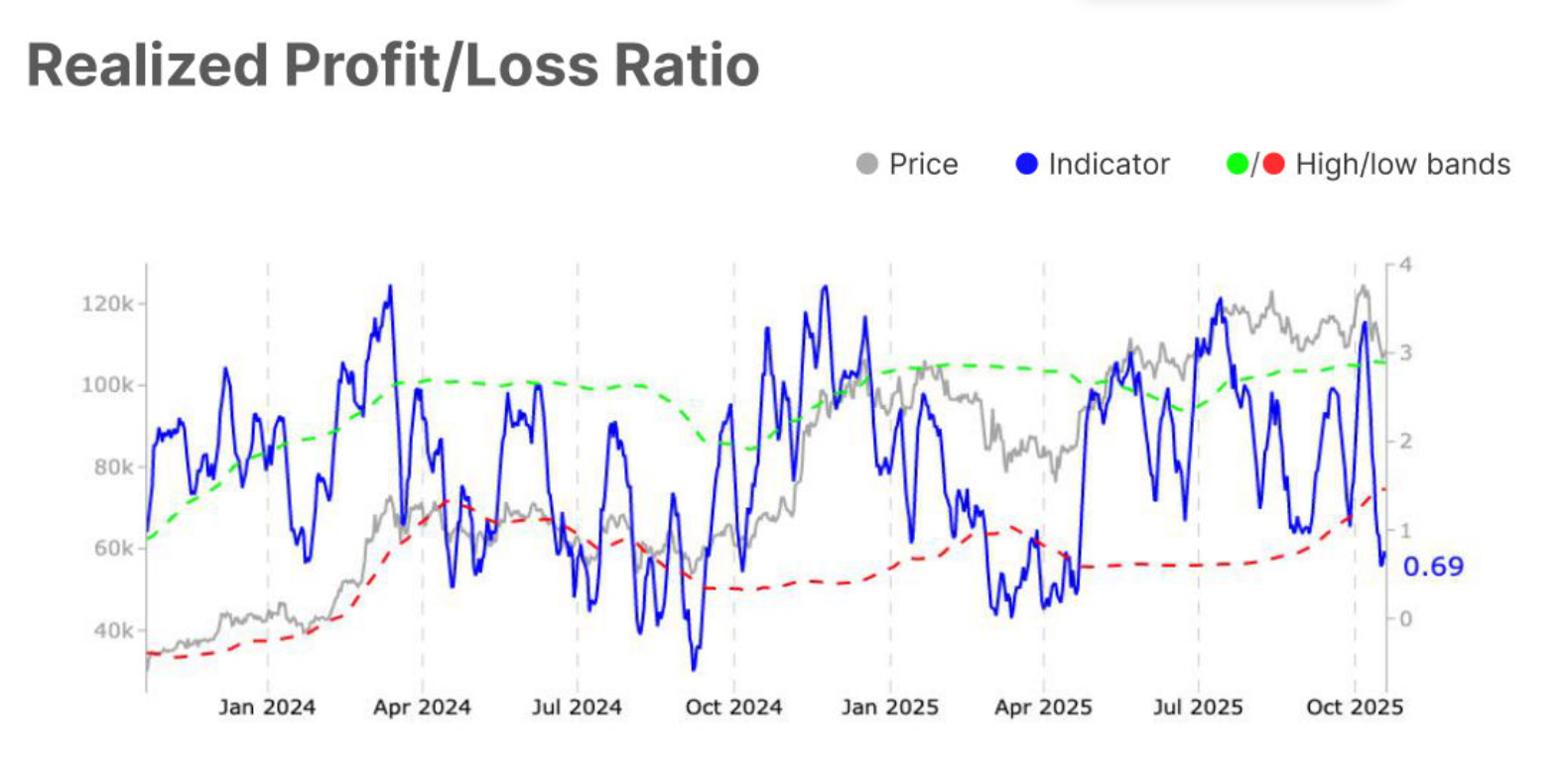

The Realized Revenue to Loss (RPL) Ratio reinforces this capitulation narrative. The metric, which tracks Bitcoin’s realized good points versus realized losses, has slipped from 1.2 to 0.7, breaching the decrease certain of 1.5. This implies extra traders are promoting at a loss, indicating capitulation-like situations throughout the market.

Such a low ratio displays the rising dominance of loss realization, the place members exit positions in panic slightly than strategic profit-taking. The broader macro atmosphere—tight liquidity, risk-off sentiment, and declining inflows—provides additional stress.

Bitcoin RPL Ratio. Supply: Santiment

BTC Worth Below Strain

On the time of writing, Bitcoin trades at $107,734, holding under the $108,000 resistance. The crypto large has repeatedly failed to interrupt the two-week downtrend line, signaling weakening momentum and rising skepticism amongst traders.

The formation of decrease lows this week is regarding. If Bitcoin can not reclaim the $110,000 psychological degree, the value might slip additional towards $105,000 and even decrease, amplifying promoting stress. Sustained bearishness might speed up this transfer, pushing BTC into deeper correction territory.

Bitcoin Worth Evaluation. Supply: TradingView

Nevertheless, if Bitcoin manages to regain $110,000 as assist, the technical outlook might enhance sharply. This might invalidate the downtrend and open the door to a transfer towards $112,500 and probably increased. In that case, short-term restoration can be again on the desk, however for now, warning stays the dominant theme throughout the Bitcoin market.

The submit Bitcoin’s Revenue Provide Shrinks as Worth Fails to Breach 2-Week Downtrend appeared first on BeInCrypto.