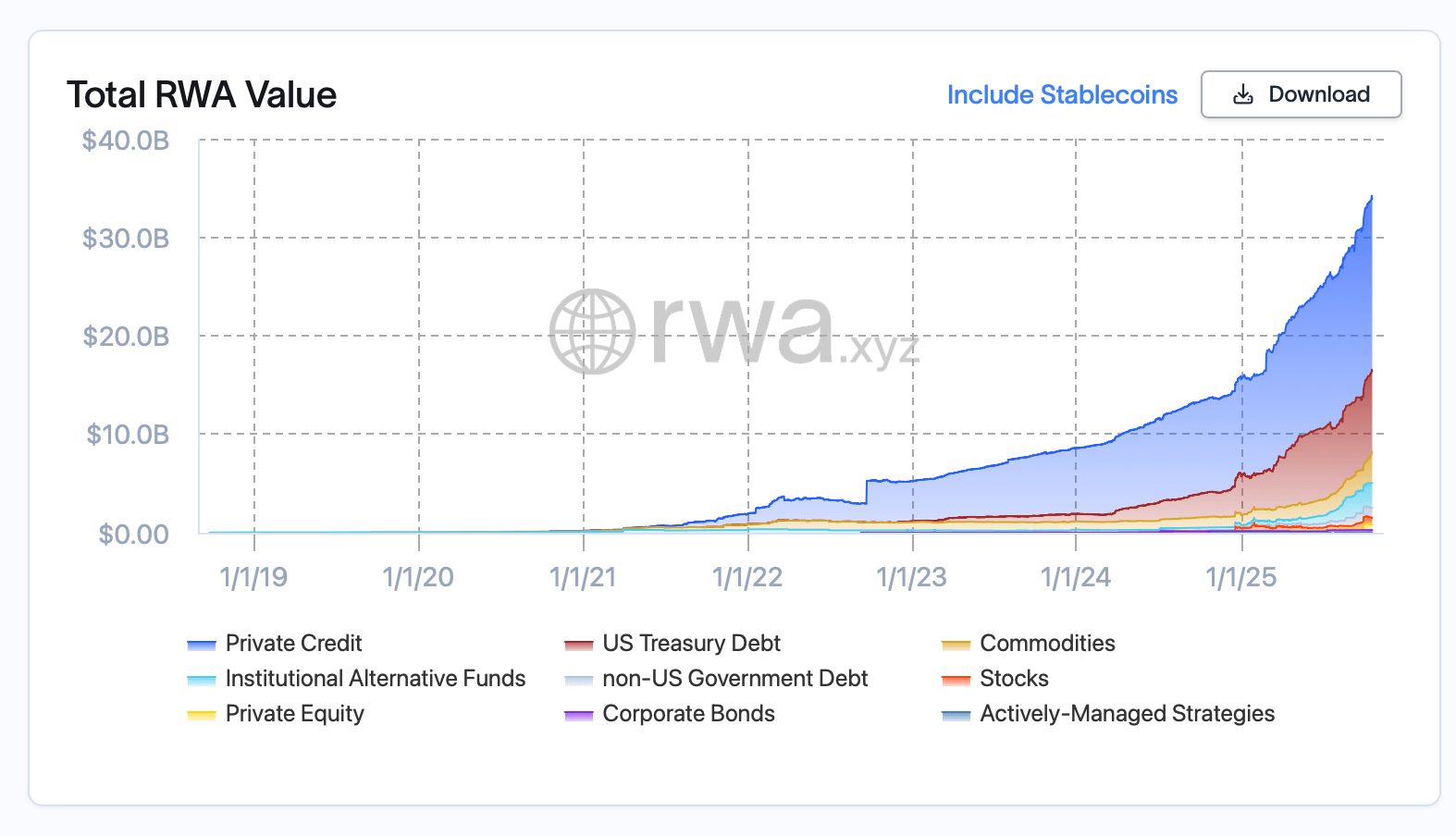

Tokenized real-world belongings (RWA) on public blockchains now complete $34.14 billion, up 10.58% previously 30 days, in line with rwa.xyz, placing the sector within reach of the $35 billion mark.

BUIDL, XAUT, PAXG Headline High RWA Property as Onchain Worth Advances

RWA tokenization points blockchain tokens that signify claims on off-chain devices—U.S. Treasuries, commodities akin to gold, institutional funds, personal credit score, shares, and extra—to allow them to be transferred and settled on public networks. Demand is pushed by 24/7 transferability, quicker settlement, composability with onchain functions, and entry to world liquidity with out legacy-rail frictions.

Stats from rwa.xyz present participation continues to widen. RWA asset holders stand at 489,037, a 6.71% 30-day acquire, and lively issuers complete 225. The multi-year breakdown on rwa.xyz reveals Treasuries and institutional merchandise main complete worth, whereas commodities, company bonds, non-U.S. sovereign debt, and actively managed methods add incremental depth.

Whole tokenized real-world-asset (RWA) worth as of Sunday, Oct. 19, 2025.

By blockchain, Ethereum is the first venue with $12.476 billion in tokenized worth, up 20.73% over 30 days and holding 58.24% market share. Zksync Period follows with $2.365 billion (-2.46%, 11.04% share), then Polygon at $1.138 billion (-3.74%, 5.31%). Arbitrum holds $874.0 million after a 122.3% month-to-month bounce (4.08% share).

Avalanche carries $745.7 million (-0.56%, 3.48%), Aptos $724.8 million (+0.19%, 3.38%), Solana $695.9 million (+5.04%, 3.25%), Stellar $636.4 million (+23.28%, 2.97%), BNB Chain $515.4 million (+14.99%, 2.41%), and XRP Ledger $362.1 million (+3.45%, 1.69%). The highest 20 RWA belongings by market capitalization present Treasuries’ persevering with pull alongside gold-backed merchandise and institutional funds.

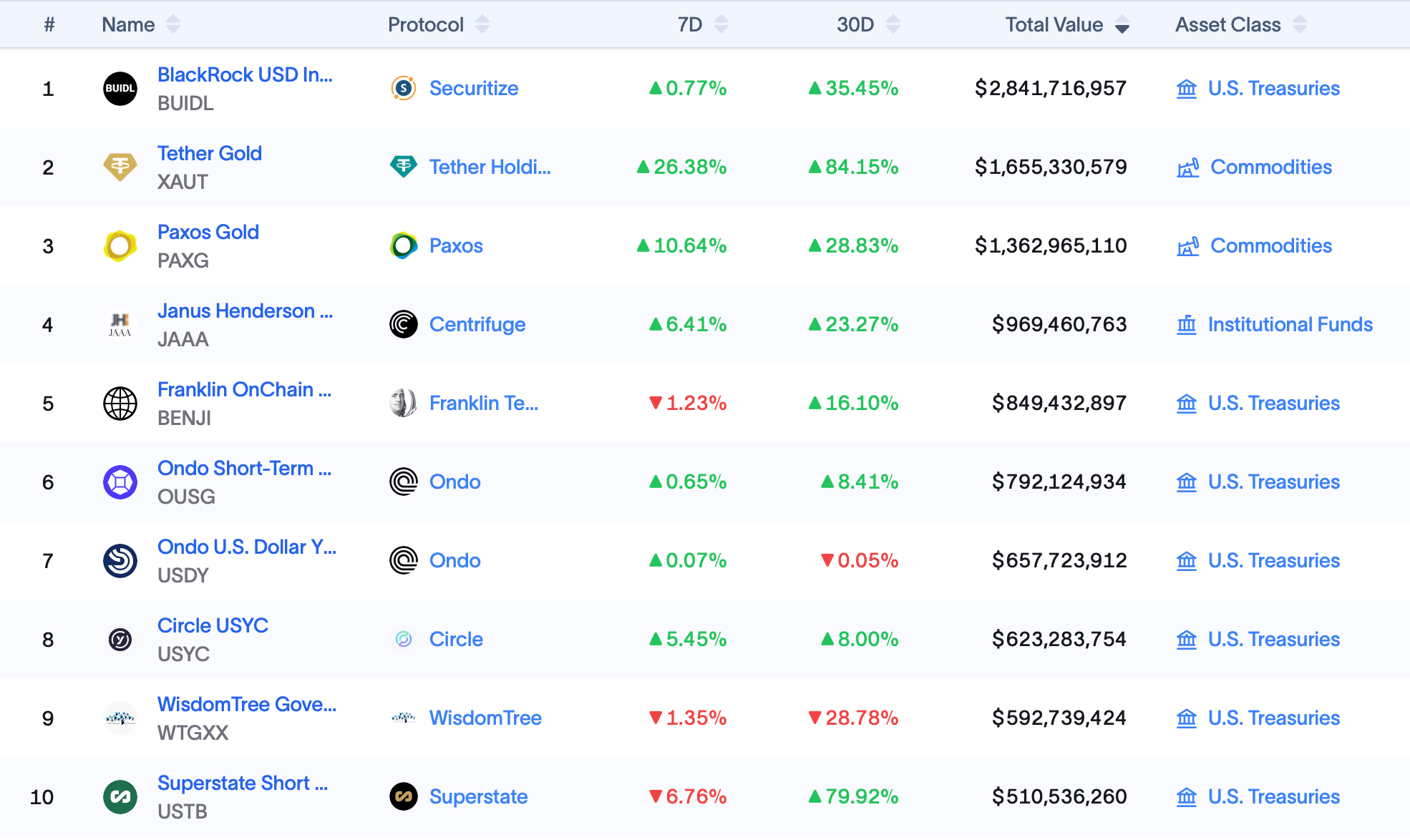

In Treasuries, the Blackrock USD Institutional Digital Liquidity (BUIDL) fund rose 0.77% over seven days and 35.45% over 30 days to $2.84 billion; Franklin Templeton’s Franklin Onchain U.S. Authorities Cash Fund (BENJI) is down 1.23% on the week and up 16.10% on the month at $849.43 million; the Ondo Quick-Time period U.S. Authorities Bond Fund (OUSG) gained 0.65% (7D) and eight.41% (30D) to $792.12 million; and the Ondo U.S. Greenback Yield (USDY) is roughly flat at +0.07% (7D) and -0.05% (30D) with $657.72 million.

High ten RWA belongings by market cap excluding stablecoins on Oct. 19, 2025.

Circle’s USYC (USYC) superior 5.45% (7D) and eight.00% (30D) to $623.28 million; Superstate Quick-Time period U.S. Treasuries (USTB) climbed 6.76% (7D) and 79.92% (30D) to $510.54 million; Janus Henderson U.S. Treasuries (JTRSY) fell 14.67% (7D) and 14.51% (30D) to $295.20 million; Constancy Digital Intermediate Treasuries (FDIT) was flat on the week and up 9.21% on the month at $222.45 million.

In commodities, Tether Gold (XAUT) rose 26.38% (7D) and 84.15% (30D) to $1.66 billion, Paxos Gold (PAXG) gained 10.64% (7D) and 28.83% (30D) to $1.36 billion, and JSOY OIL superior 2.00% (7D) and was flat over 30 days at $313.34 million. Authorities and non-U.S. sovereign merchandise embody China AMC USD (CUMIU) up 0.20% (7D, 30D) at $503.10 million and Spiko EU T-Payments (EUTBL) up 0.57% (7D) and down 0.85% (30D) at $324.58 million.

Institutional funds are represented by Janus Henderson AAA (JAAA) up 6.41% (7D) and 23.27% (30D) to $969.46 million, Blockchain Capital (BCAP) flat on the week and up 11.49% on the month to $404.96 million, Superstate Crypto Money (USCC) down 6.87% (7D) and up 10.81% (30D) to $253.64 million, and Legion Methods (LS) flat on each time frames at $217.93 million.

Fairness and private-market entries embody Exodus Motion EXODB down 12.77% (7D) and flat on the month at $480.97 million (personal fairness) and Exodus Motion EXOD down 12.77% (7D) and 14.80% (30D) at $223.37 million (shares). Collectively, these 20 devices illustrate how Treasuries, gold, and institutional funds anchor the class whereas area of interest exposures increase its breadth.

Structurally, RWA progress follows a easy sample: issuers wrap acquainted, yield-bearing or reserve-style devices into tokens, custodians and trustees handle the off-chain collateral, and protocols deal with main issuance and secondary settlement. Onchain traders search predictable yields (for Treasuries and institutional funds), inflation hedges (for gold), and operational advantages akin to quicker redemption home windows, automated payouts, and integration with decentralized finance (DeFi) primitives.

Whereas RWA lives throughout many chains, liquidity nonetheless concentrates the place institutional wrappers are mature and custody flows are established. The month’s broad advance—together with rising holder counts and a bigger issuer set—indicators regular, incremental adoption somewhat than one-off spikes, with the $35 billion threshold now inside vary.

FAQ 🧭

- What’s RWA tokenization? It’s the issuance of blockchain tokens that signify claims on off-chain belongings akin to Treasuries, gold, funds, or credit score.

- Why is demand rising? Traders search 24/7 transferability, quicker settlement, and integration with DeFi whereas retaining publicity to acquainted devices.

- Which chain leads? Ethereum leads with $12.48 billion in RWA worth and 58.24% market share.

- How large is the market now? Whole onchain RWA equals $34.14 billion, up 10.58% in 30 days, per rwa.xyz.