The huge crash on October 10 that noticed Bitcoin (BTC) contact $102,000 is nearly being shadowed by a value correction every week later, with the liquidations chart displaying a traditional setup for a market quick squeeze if the king coin crosses the $111,000 mark once more.

Bitcoin fell under $108,000 throughout Tuesday’s US pre-market periods, now consolidating round $107,700 after shedding 3.7% of its value within the final 24 hours. Merchants try to determine what to do with combined indicators, and this has prompted funding charges to plummet right into a territory the place quick bets are beginning to pay longs.

In accordance with analysts, there are $14 billion value of cumulative quick leveraged bets primed for liquidation if Bitcoin’s bearish pattern flips and the coin ticks upwards to its all-time-high degree of $124,000.

Brief squeeze imminent if BTC revisits $110,000 choice

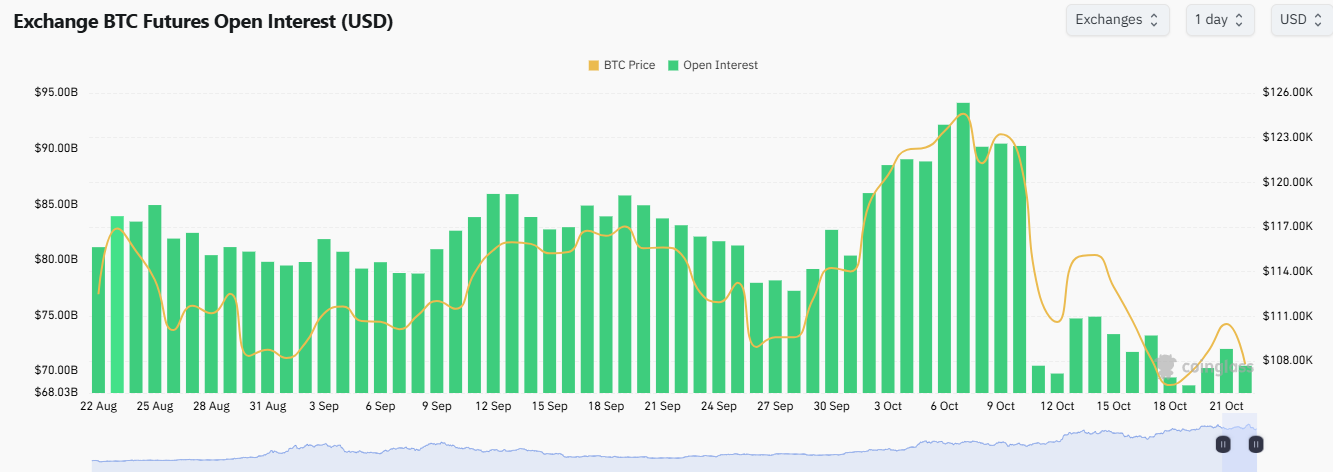

Perpetual futures knowledge exhibits funding charges have turned destructive, signaling that quick positions are beginning to pay lengthy holders as soon as once more. Per knowledge from Coinglass, open BTC futures curiosity has slumped by about $20 billion since October 9, when BTC clocked its all-time-high worth.

Unfavourable funding charges and reducing quick curiosity point out an imbalance that may amplify sudden value reversals. Merchants at the moment are intently watching if Bitcoin can reclaim the $111,000 degree, which analysts imagine is the set off level for the following squeeze.

BTC futures open Curiosity. Supply: Coinglass

Different analysts have in contrast the present state of affairs to January 2021, when the king coin surged from $30,000 to over $40,000 inside days, catching bearish merchants off guard. A squeeze additionally unfolded within the US spring of 2024, when Donald Trump’s presidential win prompted a week-long rally that despatched Bitcoin above $100,000 for the primary time ever, liquidating thousands and thousands in leveraged shorts.

On-chain analytics agency CryptoQuant’s Bitcoin Mixed Market Index (BCMI), which aggregates a number of market well being indicators, has retraced to the 0.5 impartial zone, the mid-point between overvaluation and undervaluation throughout Bitcoin’s market cycles.

In earlier cycles seen in 2020 and early 2024, a retest of the 0.45 to 0.5 vary meant the tip of corrective phases and preceded new growth legs. As defined by Woominkyu, it’s a cooling interval the place speculative exercise declines and long-term worth metrics reset.

At present, Bitcoin’s MVRV stands close to 1.8, properly under historic overvaluation ranges above 3.0, whereas the SOPR is near 1.02, balancing profit-taking and accumulation.

“All parts level to a structural mid-cycle correction, not a macro prime,” Woominkyu mentioned in his evaluation. “If BCMI rebounds from 0.5 to 0.6, momentum may resume towards a brand new native excessive. But when it breaks under 0.45, prolonged consolidation could observe.”

The market is in disbelief, not sure what to do

Market watcher and CryptoQuant member Darkfost believes the asset may very well be getting into what is named a “disbelief part,” the psychological stage the place costs start to rise once more, however investor confidence is low because of destructive value corrections.

Bitcoin’s funding charges stayed destructive at round -0.004% for six of the previous seven days from persistent bearish positions taken by the market. The prolonged interval of destructive funding signifies that merchants are nonetheless leaning quick regardless of costs stabilizing above $107,000.

That mentioned, change flows present that roughly 18,000 BTC have left exchanges in current days, whereas round 16,000 BTC have flowed in. The delicate internet outflow means that accumulation is reasonable, which additionally means the market is just not assured about the place BTC’s value will go.

Bitcoin bulls struggled to maintain its value above $111,000, going through a pullback from bears which have turned the worth into its new resistance degree. They should maintain the $107,000 help zone, as a sustained break under that degree may tip the promoting stress scale eastwards and extend the consolidation part.