The following wave of stablecoin adoption will not be led by individuals in any respect. Paxos Labs’ co-founder says AI brokers might turn out to be the “X-factor,” immediately shifting liquidity to essentially the most environment friendly issuers and turning market fragmentation into a bonus.

With clearer laws round stablecoins passing in the US, the stablecoin market has surged previous $300 billion, changing into one among crypto’s central narratives. Nevertheless, fragmentation throughout issuers and jurisdictions stays a problem.

As new entrants be part of an more and more various discipline — from dollar-backed leaders like Tether and Circle, to artificial belongings like Athena, and PayPal’s PYUSD, which targets shopper funds — questions have arisen over whether or not fragmentation might pose an issue to the business.

Bhau Kotecha, co-founder and head of Paxos Labs, instructed Cointelegraph that “fragmentation is a double-edged sword.” As totally different fashions compete, in addition to subject stablecoins which are aligned with their companies, it dangers “creating liquidity silos and person confusion, which might hinder adoption.”

Nevertheless, he believes that AI brokers — autonomous applications that may make selections and carry out duties like buying and selling or transferring funds with out human enter — might resolve the problem.

AI brokers, he stated, will “change immediately” to whichever stablecoin provides the most effective economics.

“Which means fragmentation isn’t essentially a deterrent; it may well truly turn out to be a market-level optimizer, the place AI ensures liquidity flows to essentially the most environment friendly issuers. Over time, this might compress charges and power issuers to compete on fundamentals.”

The rise of AI brokers in crypto

Kotecha just isn’t the one one highlighting the significance of AI brokers for stablecoin adoption.

In a Sept. 2 Bloomberg interview at Goldman Sachs’ Asia Leaders Convention in Hong Kong, Galaxy Digital CEO Mike Novogratz stated AI brokers are set to turn out to be the first customers of stablecoins, fueling a surge in transaction volumes.

Within the “not-so-distant future,” AI brokers might use stablecoins to deal with on a regular basis purchases, he stated, citing a grocery agent that is aware of your weight loss program, preferences and finances and might routinely fill your cart.

He added that these brokers would probably depend on stablecoins as an alternative of wire transfers or cost apps like Venmo, main him to anticipate “an explosion of stablecoin transactions” within the coming years.

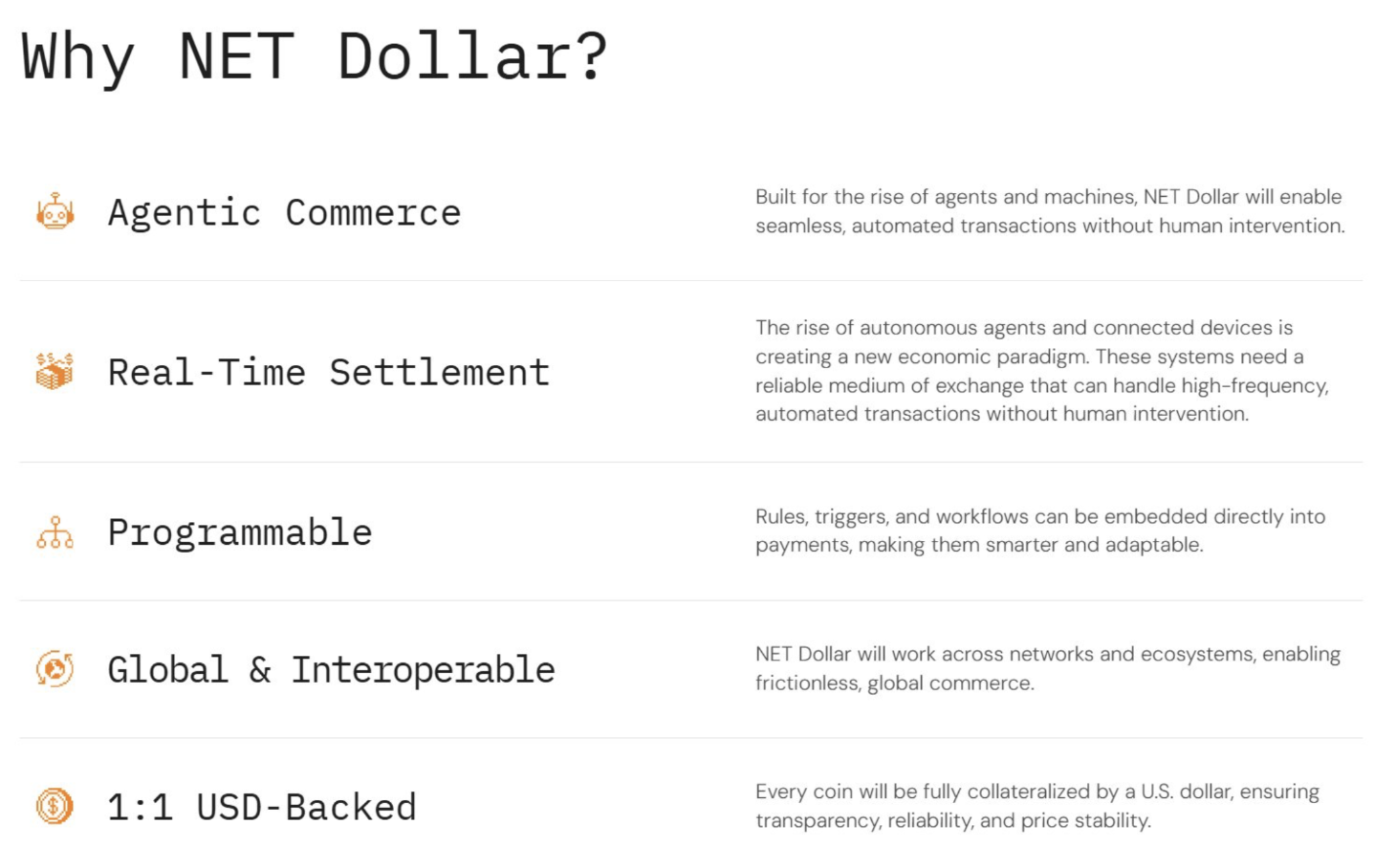

One firm already pursuing this imaginative and prescient is Cloudflare, a worldwide cloud infrastructure firm. On Sept. 25, Cloudflare introduced it was engaged on NET greenback, a stablecoin that helps prompt transactions by AI brokers.

Cloudflare stated its imaginative and prescient for the stablecoin contains private AI brokers that may act immediately, reserving the lowest-priced flight or buying a product the second it goes on sale.

NET Greenback stablecoin traits. Supply: Cloudflare

The information from Cloudflare got here after a number of thought-leaders in crypto expressed their concepts in regards to the significance of AI brokers and their implications for crypto.

On Aug. 13, members of Coinbase’s improvement staff on X wrote that due to a little-used net normal, HTTP 402 “Cost Required,” first launched 30 years in the past, AI brokers are poised to turn out to be “Ethereum’s greatest energy customers.”

Supply: Ethereum Basis

On the finish of August, Adrian Brink, co-founder of Anoma, wrote that the rise of AI agent techniques is inevitable. Nevertheless, they are going to want intent-based blockchain infrastructure to make sure customers have management over their very own knowledge and belongings.