Bitcoin (BTC) is witnessing sustained bouts of volatility, aligning with the broader market sentiment, with a synthetic intelligence (AI) mannequin projecting that the asset is prone to commerce beneath $110,000 by November 1.

Certainly, the market has been weighed down by ongoing commerce tensions, which have dampened Bitcoin’s hopes for a swift restoration.

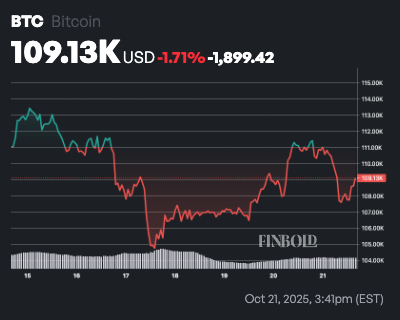

By press time, BTC was buying and selling at $109,066, having corrected by nearly 2% within the final 24 hours, whereas on the weekly timeline, the asset is down 1.7%.

Bitcoin worth prediction

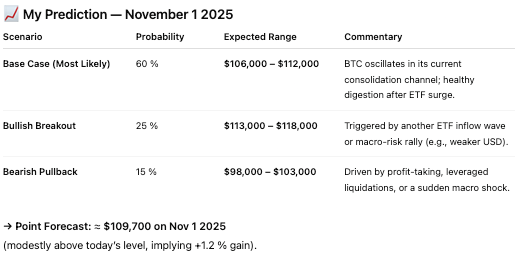

To mission the value for November 1, Finbold turned to OpenAI’s ChatGPT, which famous that Bitcoin is prone to commerce at $109,700 on November 1, 2025, signaling a section of consolidation somewhat than a recent rally.

ChatGPT’s evaluation highlighted that whereas institutional demand stays sturdy, the tempo of inflows into Bitcoin exchange-traded funds (ETFs) almost $6 billion year-to-date, is prone to sluggish, easing upward momentum. The mannequin famous that this moderation may carry delicate consolidation stress because the market digests earlier beneficial properties.

Technically, Bitcoin’s relative power index at round 65 signifies that the asset stays bullish however not overbought. Transferring averages (MA) reinforce this view, with the 20-day common close to $106,000 and the 50-day close to $99,000, reflecting a strong upward development.

Nevertheless, ChatGPT anticipates that within the absence of latest catalysts, Bitcoin might briefly retest the 20-day common earlier than resuming its subsequent leg greater.

On the macroeconomic entrance, the forecast assumes {that a} weaker U.S. greenback and regular inflation expectations will proceed to help Bitcoin’s optimistic correlation with gold and equities. A sudden shift in tone from the Federal Reserve, notably a hawkish stance later in October, may quickly stress Bitcoin towards the $100,000 degree.

Bitcoin worth ranges to observe

The mannequin additionally pointed to excessive derivatives funding charges, suggesting that extreme leverage may set off a short-term correction of three% to six% earlier than a restoration.

Relating to particular worth ranges, ChatGPT outlined a base-case situation the place Bitcoin trades between $106,000 and $112,000, with a 60% likelihood. A bullish breakout towards $113,000 to $118,000 carries a 25% probability, whereas a bearish pullback to $98,000 to $103,000 is assigned a 15% likelihood.

If these ranges are attained, it will point out that Bitcoin is prone to stay in a interval of wholesome consolidation, sustaining its broader uptrend whereas pausing earlier than the subsequent vital transfer.

Featured picture through Shutterstock