Bitcoin is displaying indicators of exhaustion after reaching a key resistance stage close to $106K. The rally that started in mid-April has pushed costs into overbought territory on increased timeframes, and momentum seems to be slowing.

Whereas the broader development stays bullish, short-term consolidation or perhaps a native pullback wouldn’t be shocking given present technical circumstances and on-chain habits.

The Day by day Chart

On the day by day chart, BTC has surged from the $90K breakout stage, clearing main resistance zones round $98K and approaching a key provide space across the $106K mark. The Relative Power Index (RSI), which was trending at overbought ranges, is now pulling again, reflecting early weak spot.

Furthermore, the value stays properly above the 100- and 200-day transferring averages, each positioned across the $90K zone, suggesting that the macro development is unbroken. Nonetheless, this newest impulsive transfer may have a breather, particularly if patrons fail to push via the $109K area.

The 4-Hour Chart

Zooming into the 4-hour chart, Bitcoin shaped a steep ascending construction earlier than going through resistance slightly below the $109K stage. The RSI has additionally sharply cooled off from above 75 to the low 50s, hinting at a lack of bullish momentum.

For now, the $101K–$102K zone is performing as a short-term help, but when this stage breaks cleanly, the subsequent main help rests close to the $97K–$98K vary. A decisive reclaim of $104K–$105K would invalidate any quick bearish thesis and open the door towards $109K and past.

On-chain Evaluation

Trade Reserve

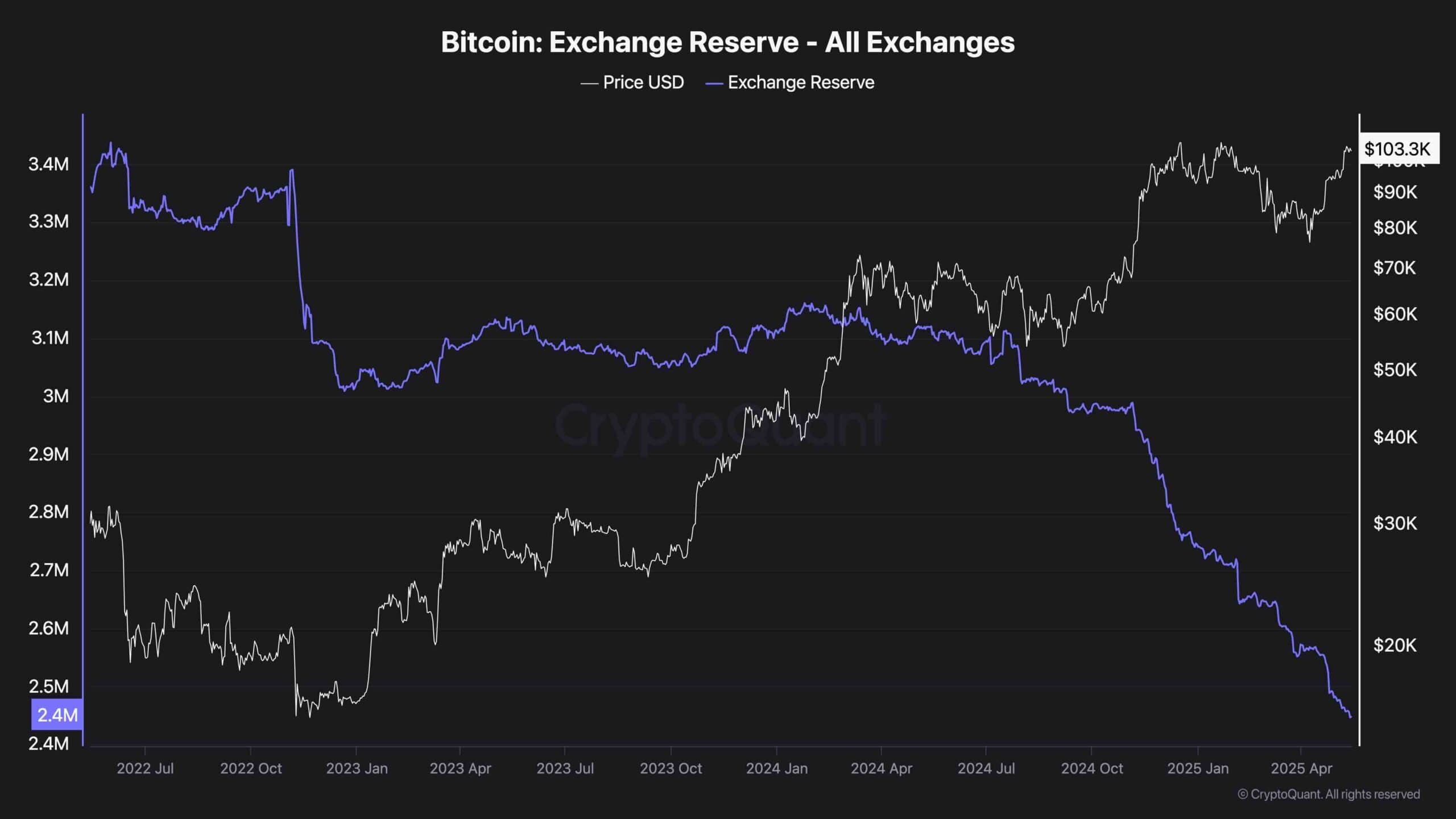

On-chain information helps the cooling sentiment. Bitcoin change reserves proceed to say no, reflecting low sell-side stress from long-term holders, which is a bullish backdrop over time.

Nonetheless, the speed of decline has stabilized in latest weeks, displaying no acceleration regardless of the value surge. Which means though fewer cash are transferring to exchanges, recent inflows of demand might also be really fizzling out for now. The market is probably going ready for brand new catalysts to drive the subsequent leg increased.