Anthony Pompliano argues that though gold has proven robust efficiency in greenback phrases since January 2020, it has misplaced 84% of its worth when measured in Bitcoin over the identical interval.

Pompliano, the CEO of Skilled Capital Administration (PCM), made the assertion throughout his latest look on FOX Enterprise, the place he framed Bitcoin as a protected haven asset.

Gold and S&P Down Since 2020 in Bitcoin Phrases

The American businessman identified that whereas many buyers have fun nominal beneficial properties in gold or the S&P 500 when priced in {dollars}, the image seems totally completely different when these property are measured towards Bitcoin.

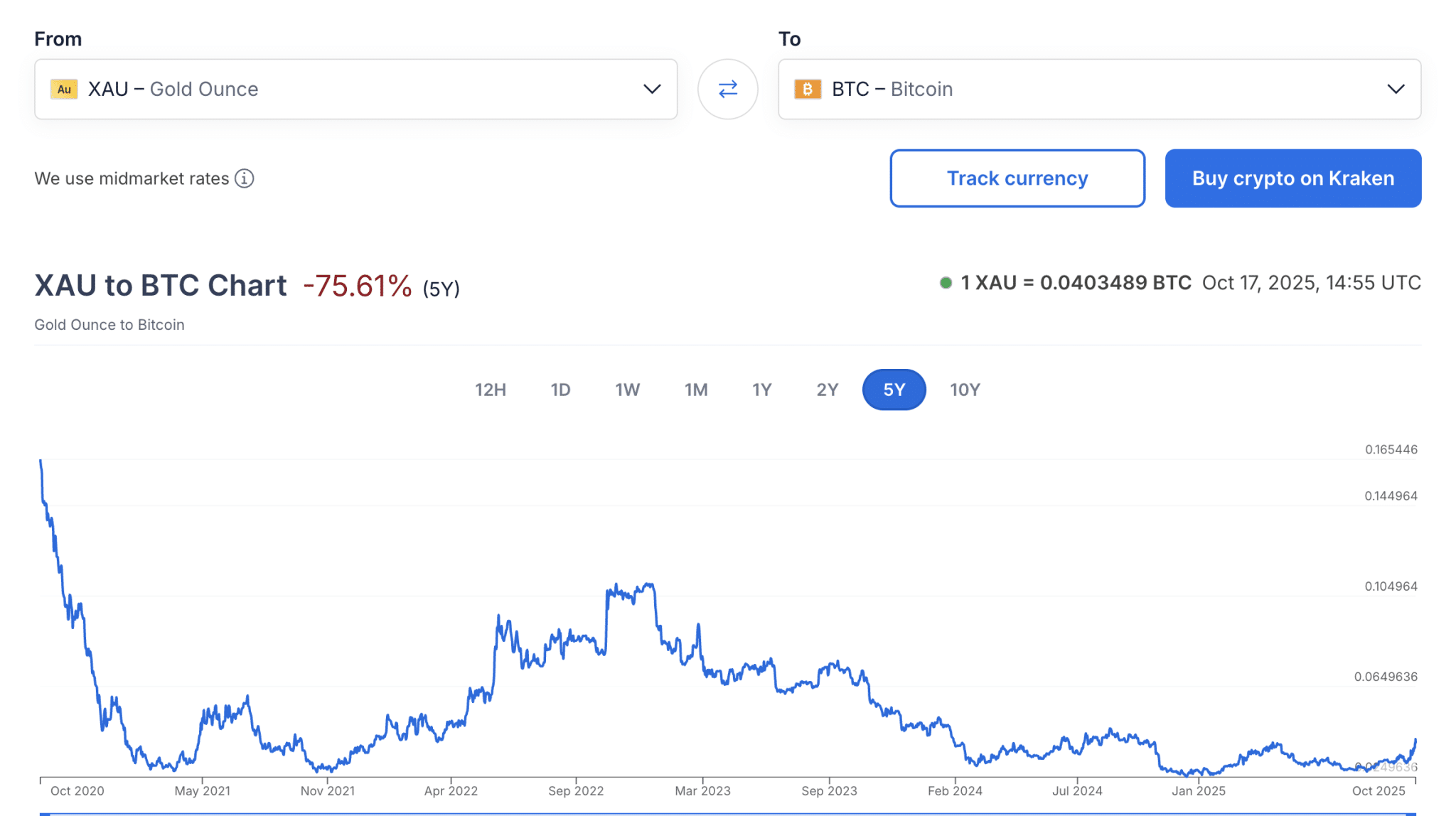

Certainly, this argument holds when analyzing market knowledge from platforms like XE.com. The gold/BTC chart reveals a large lack of 75.55% over the previous 5 years, whereas the BTC/gold chart displays a powerful achieve of 310%.

-

Gold-Bitcoin chart from XE.com

Bitcoin as a Hurdle Fee

Highlighting Bitcoin’s exceptional efficiency throughout the identical interval, Pompliano famous that BTC has surged by roughly 1,500% since January 2020.

His argument positions Bitcoin as a “hurdle charge” for measuring efficiency, reasonably than counting on the greenback. Based on his evaluation, whereas shares and gold might sound to carry out nicely in greenback phrases, they’re truly dropping worth when in comparison with Bitcoin.

Pompliano’s remarks come as gold proponents proceed to criticize Bitcoin amid the valuable steel’s ongoing rally.

Notably, gold reached an all-time excessive of $4,376 as we speak. It has been steadily climbing because of mounting financial uncertainties, significantly escalating commerce tensions between america and China.

Nonetheless, Bitcoin has been reacting negatively to macroeconomic stress. The main cryptocurrency fell under $104,000 as we speak. Amid Bitcoin’s latest correction, Peter Schiff urged buyers to liquidate their BTC holdings and shift to gold.

Schiff additionally claimed that gold is extra more likely to attain a value goal of $1 million than Bitcoin. Regardless of such criticisms, Pompliano maintains that gold, whereas seemingly performing nicely in fiat phrases, is dropping worth when denominated in Bitcoin. He emphasised that anybody who can not beat Bitcoin ought to merely purchase it.