Well-known cryptocurrency analyst Willy Woo shared a exceptional evaluation on Bitcoin’s (BTC) annual compound return charge (CAGR).

Woo famous that traders have unrealistic expectations about BTC and drew consideration to the adjustments which have occurred through the years.

Woo shared on social media, “Individuals see BTC as an asset that rises without end. Nonetheless, the true CAGR chart is apparent.” Woo, who reminded that Bitcoin’s annual returns exceeded 100% in 2017, argued that this era is now behind us.

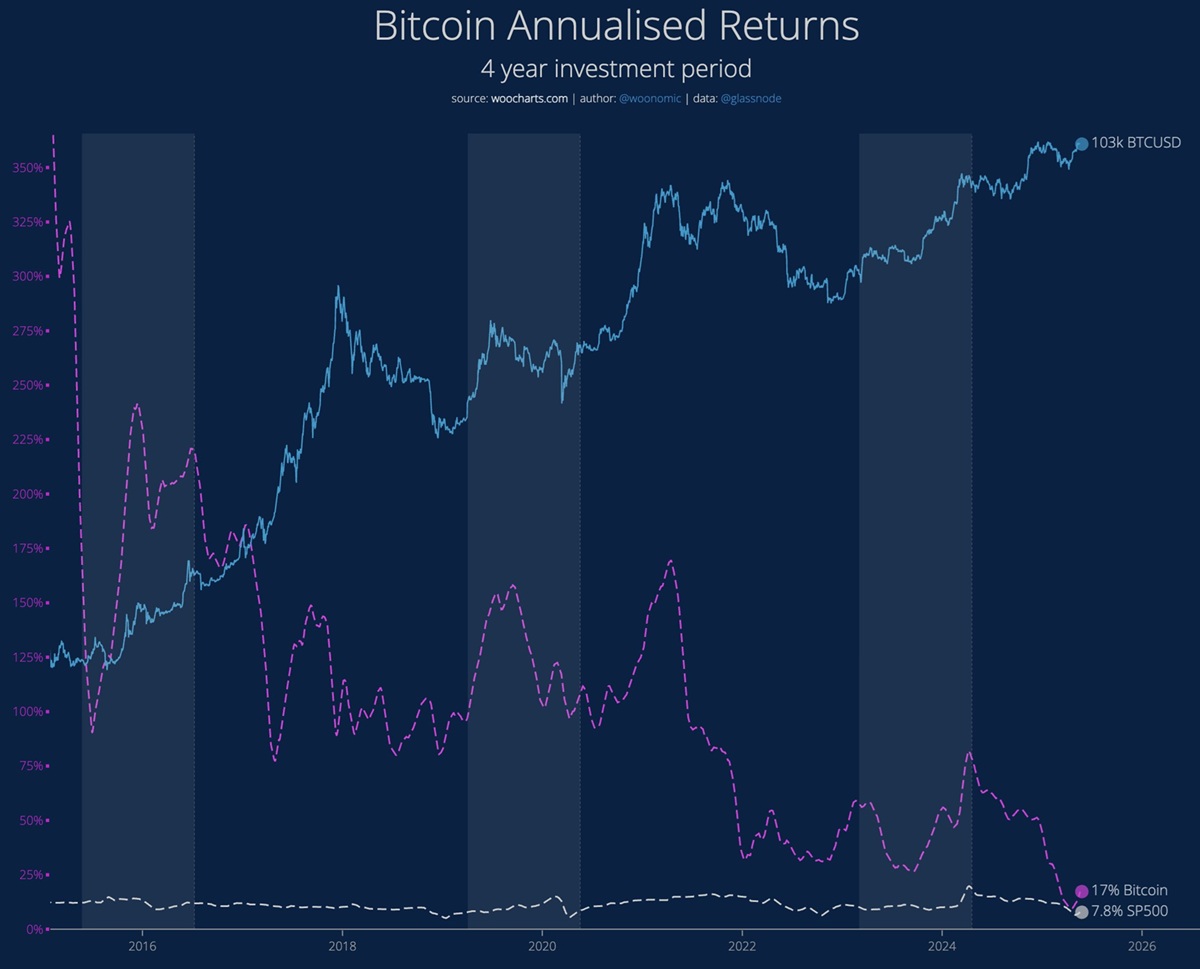

Chart shared by Woo evaluating the annualized charge of return on Bitcoin to the SP500.

The analyst evaluated 2020 as a turning level. Stating that this yr was a interval when Bitcoin was adopted by institutional traders and even some states, Woo said that with this institutionalization, the annual compound return dropped to 30-40% and this charge continued to lower over time.

“Bitcoin is now buying and selling as the latest macro asset of the final 150 years,” Woo stated, including that the community will see decrease charges of return because it shops extra capital. In the long run, the analyst, who famous that cash provide development is round 5% and world GDP development is round 3%, predicts that Bitcoin’s annual compound return will finally stabilize at 8%.

Nonetheless, Woo said that this course of may take 15-20 years, including that BTC’s efficiency would stay unmatched amongst public funding merchandise in the long run till this era.

*This isn’t funding recommendation.