Volatility has stormed again as August obtained off to shaky jobs knowledge, aggressive tariffs, and the crypto market coping with the correction. The digital belongings market cap surged marginally on Monday morning to face at $3.37 trillion as its 24-hour buying and selling quantity dipped by 14%, hitting $110 billion.

After a record-setting rally, Bitcoin value noticed a dramatic return with a weekend selloff fueled by the worst spot ETF outflows in months. BTC slid to $114,000 after almost $1 billion in ETF outflows throughout Thursday and Friday.

Ethereum wasn’t spared both because it dropped from the $3,800 degree to the $3,500 zone over the previous 7 days.

Ethereum stays sizzling as Bitcoin cools off

SoSovalue knowledge exhibits that August 1 noticed $812.25 million go away Bitcoin ETFs. July 31 had additionally posted a withdrawal of $114.35 million. The online flows into BTC ETFs reversed to adverse $643 million final week, ending a seven-week optimistic run.

In the meantime, Ethereum ETFs nonetheless recorded $154 million in web inflows, hitting their twelfth consecutive week of printing inexperienced.

Supply: SoSoValue

Bitcoin value is down round 4% within the final 7 days, however nonetheless stays up by 7% over the 30-day timeframe. BTC is buying and selling at a mean value of $114,594 at press time. Ethereum outperformed Bitcoin final month. ETH value jumped by 42% during the last 7 days, hovering across the $3,500 zone.

Arthur Hayes, co-founder of Maelstrom, had warned over the weekend that Bitcoin and Ethereum had been primed for a correction. Pointing to weak job creation, rising tariffs, and sluggish credit score creation globally, Hayes argued that BTC may take a look at $100,000 and ETH $3,000 earlier than resuming any rally. “No main econ is creating sufficient credit score quick sufficient to spice up nominal GDP,” he acknowledged in a X submit.

Nonetheless, his longer-term forecast stays ultra-bullish, anticipating BTC to hit $250K BTC by year-end and $1 million by 2028. Traditionally, August has not been nice for Bitcoin and Ethereum as they closed decrease in every of the previous 4 Augusts.

Price reduce odds surge

However simply as panic set in, a weak US jobs report flipped the script. Solely 73,000 jobs had been added in July, which was properly beneath the anticipated 110,000. The downward revisions from Might and June shaved off 258,000 jobs, the steepest two-month downgrade for the reason that COVID crash. This was sufficient to ship charge reduce odds surging.

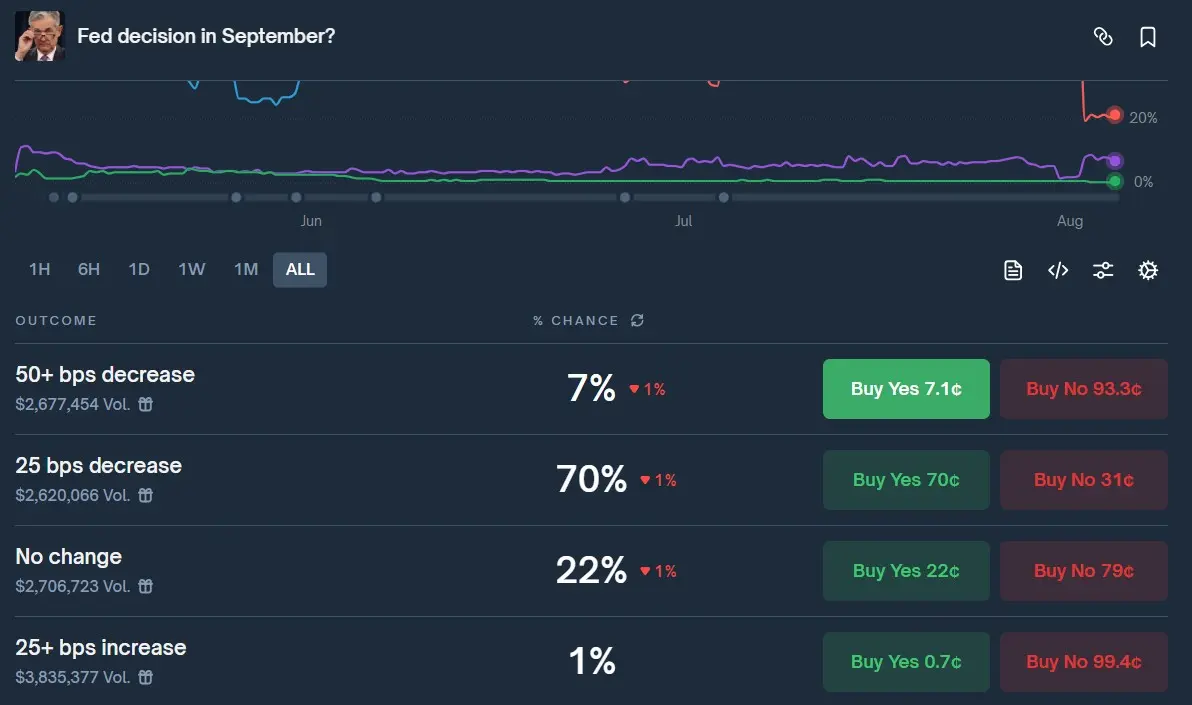

In accordance with Polymarket, there’s now a 70% likelihood the Fed cuts charges by 25bps in September, up from simply 35% every week in the past. The percentages of a deeper 50bps reduce are rising too, however it’s nonetheless below 7%. Amid this, the US greenback dropped, bond yields fell, and threat urge for food reawakened throughout markets.

Supply: Polymarket

The worldwide markets are coping with US President Trump’s newly introduced tariffs concentrating on 69 international locations. However with Fed coverage now firmly again in play, and inflation knowledge nonetheless operating sizzling. The upcoming week could make or break the market as traders will see the July S&P International Providers PMI knowledge on Monday.

Preliminary Jobless claims knowledge shall be out on Thursday, with 5 scheduled Fed audio system this week.